all 4 parts please, and in the second part use the provided table to answer. thanks.

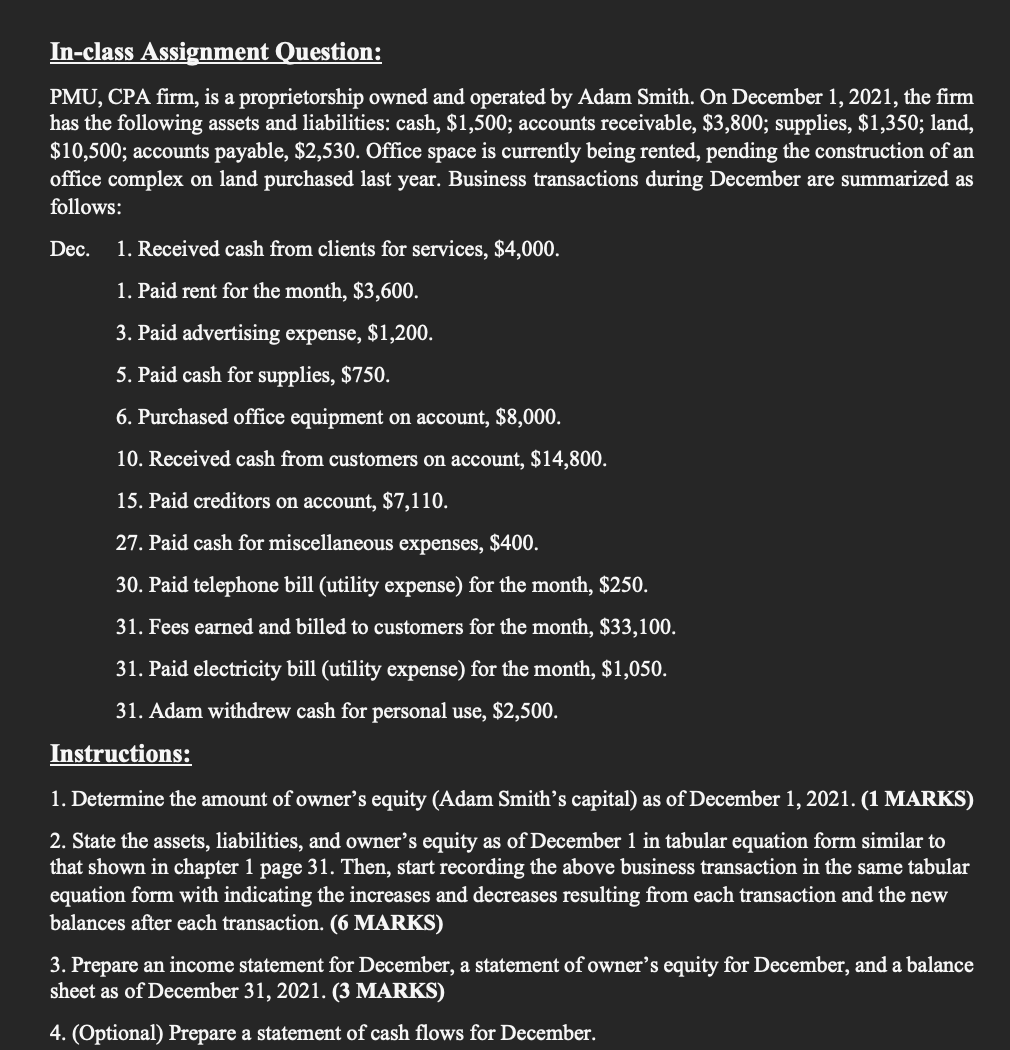

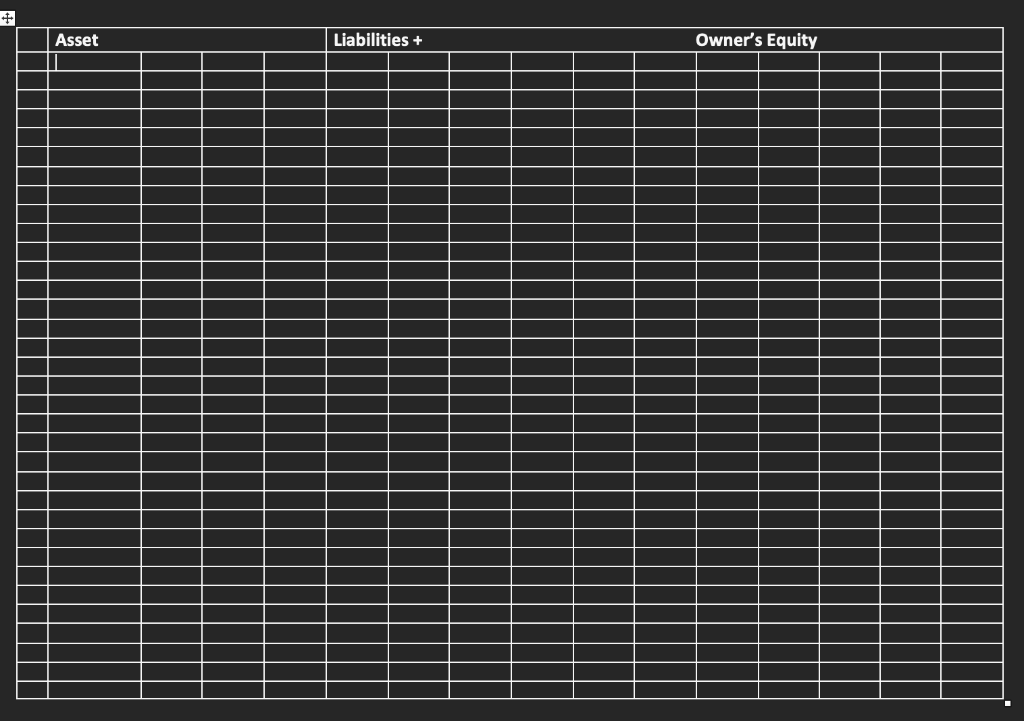

Description of the Homework: The aim of this in-class assignment is to give you the opportunity to demonstrate your level of understanding of: Describing and illustrating how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation. Describing the financial statements of a proprietorship and explain how they interrelate Assignment Instructions: You must submit the possible answers in PDF format via its associated assignment box with this cover page attached. There will be a standard penalty for late submission of Assignment/Homework tasks. The standard penalty is 5% of the marks for that task for each delay in submission of a day or partial day up to a maximum of five (5) working days after the due date; Your submission will not be accepted after the earlier of the following occurrences: o Feedback on the assessment task has been posted/released to any student; or The fifth working day after the due date. o Marking Criteria: Clear and concise discussion and working of the key points of the questions; Presentation format, spelling, vocabulary, readability. In-class Assignment Question: PMU, CPA firm, is a proprietorship owned and operated by Adam Smith. On December 1, 2021, the firm has the following assets and liabilities: cash, $1,500; accounts receivable, $3,800; supplies, $1,350; land, $10,500; accounts payable, $2,530. Office space is currently being rented, pending the construction of an office complex on land purchased last year. Business transactions during December are summarized as follows: Dec. 1. Received cash from clients for services, $4,000. 1. Paid rent for the month, $3,600. 3. Paid advertising expense, $1,200. 5. Paid cash for supplies, $750. 6. Purchased office equipment on account, $8,000. 10. Received cash from customers on account, $14,800. 15. Paid creditors on account, $7,110. 27. Paid cash for miscellaneous expenses, $400. 30. Paid telephone bill (utility expense) for the month, $250. 31. Fees earned and billed to customers for the month, $33,100. 31. Paid electricity bill (utility expense) for the month, $1,050. 31. Adam withdrew cash for personal use, $2,500. Instructions: 1. Determine the amount of owner's equity (Adam Smith's capital) as of December 1, 2021. (1 MARKS) 2. State the assets, liabilities, and owner's equity as of December 1 in tabular equation form similar to that shown in chapter 1 page 31. Then, start recording the above business transaction in the same tabular equation form with indicating the increases and decreases resulting from each transaction and the new balances after each transaction. (6 MARKS) 3. Prepare an income statement for December, a statement of owner's equity for December, and a balance sheet as of December 31, 2021. (3 MARKS) 4. (Optional) Prepare a statement of cash flows for December. Asset Liabilities + Owner's Equity