Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all calculation question You are an experienced property analyst. Your client has identified an income producing property in the Laucala Beach Industrial precinct and would

all calculation

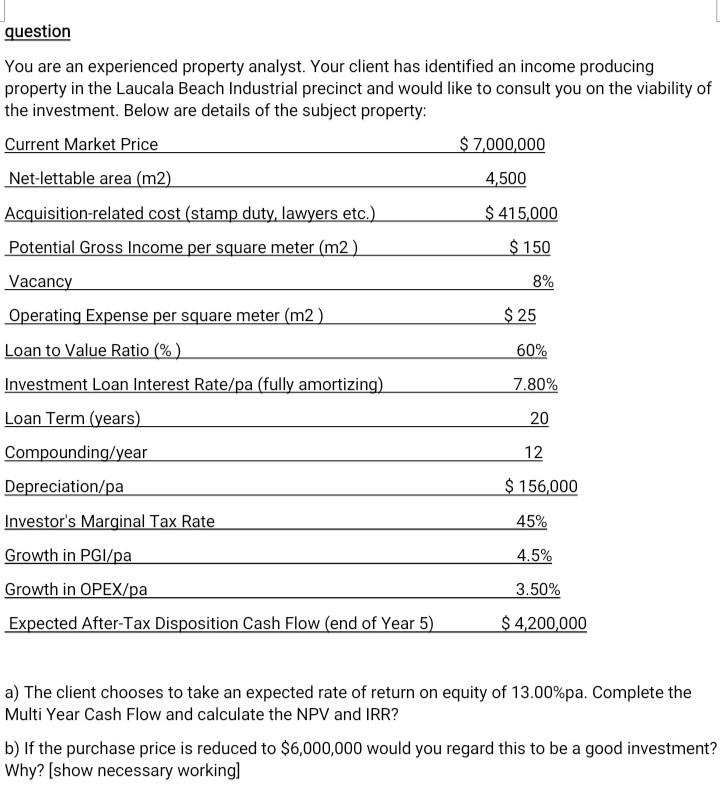

question You are an experienced property analyst. Your client has identified an income producing property in the Laucala Beach Industrial precinct and would like to consult you on the viability of the investment. Below are details of the subject property: Current Market Price $ 7,000,000 Net-lettable area (m2) 4,500 Acquisition-related cost (stamp duty, lawyers etc.) $ 415,000 Potential Gross Income per square meter (m2) $ 150 Vacancy 8% Operating Expense per square meter (m2) $ 25 Loan to Value Ratio (%) 60% Investment Loan Interest Rate/pa (fully amortizing) 7.80% Loan Term (years) 20 Compounding/year 12 Depreciation/pa $ 156,000 Investor's Marginal Tax Rate 45% Growth in PGI/pa 4.5% Growth in OPEX/pa 3.50% Expected After-Tax Disposition Cash Flow (end of Year 5) $4,200,000 a) The client chooses to take an expected rate of return on equity of 13.00%pa. Complete the Multi Year Cash Flow and calculate the NPV and IRR? b) If the purchase price is reduced to $6,000,000 would you regard this to be a good investment? Why? (show necessary workingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started