Answered step by step

Verified Expert Solution

Question

1 Approved Answer

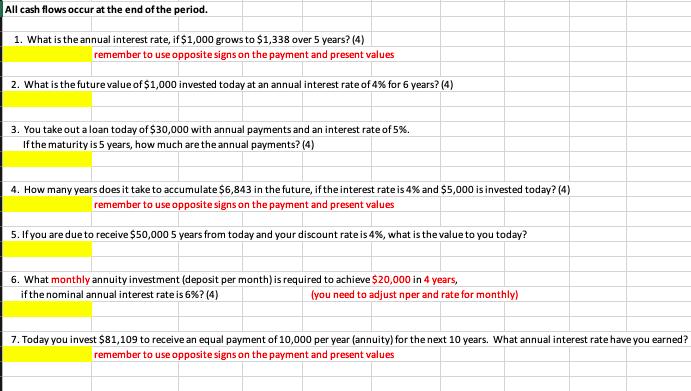

All cash flows occur at the end of the period. 1. What is the annual interest rate, if $1,000 grows to $1,338 over 5

All cash flows occur at the end of the period. 1. What is the annual interest rate, if $1,000 grows to $1,338 over 5 years? (4) remember to use opposite signs on the payment and present values 2. What is the future value of $1,000 invested today at an annual interest rate of 4% for 6 years? (4) 3. You take out a loan today of $30,000 with annual payments and an interest rate of 5%. If the maturity is 5 years, how much are the annual payments? (4) 4. How many years does it take to accumulate $6,843 in the future, if the interest rate is 4% and $5,000 is invested today? (4) remember to use opposite signs on the payment and present values 5. If you are due to receive $50,000 5 years from today and your discount rate is 4%, what is the value to you today? 6. What monthly annuity investment (deposit per month) is required to achieve $20,000 in 4 years, if the nominal annual interest rate is 6 % ? (4) (you need to adjust nper and rate for monthly) 7. Today you invest $81,109 to receive an equal payment of 10,000 per year (annuity) for the next 10 years. What annual interest rate have you earned? remember to use opposite signs on the payment and present values

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 To calculate the annual interest rate we can use the formula for future value FV PV x 1 rn where FV is the future value PV is the present v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started