All four you guys answered was wrong.

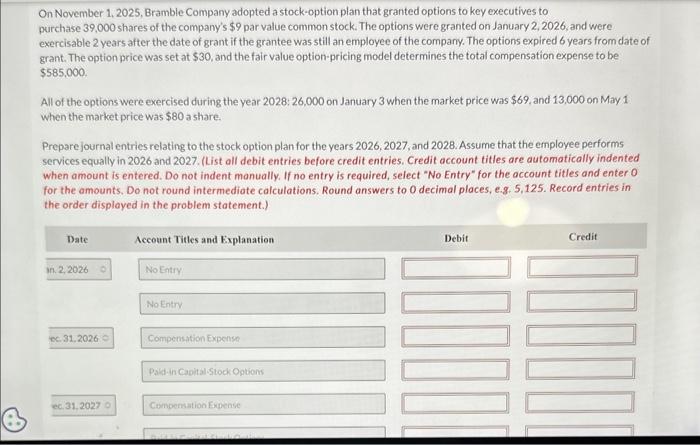

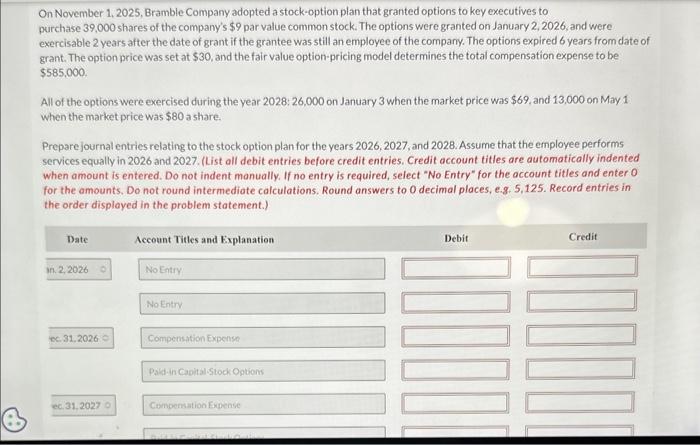

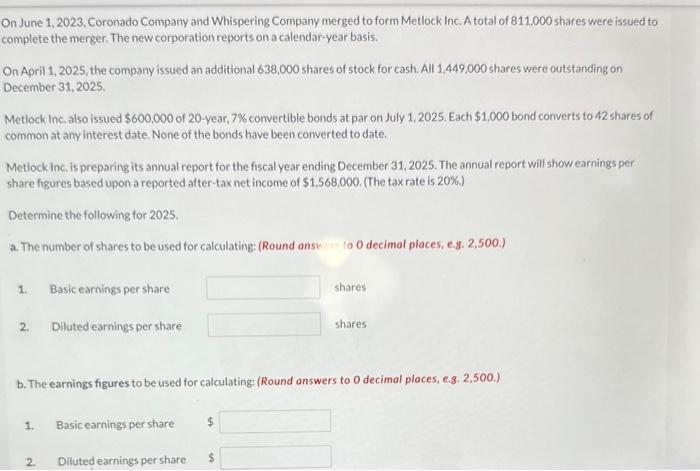

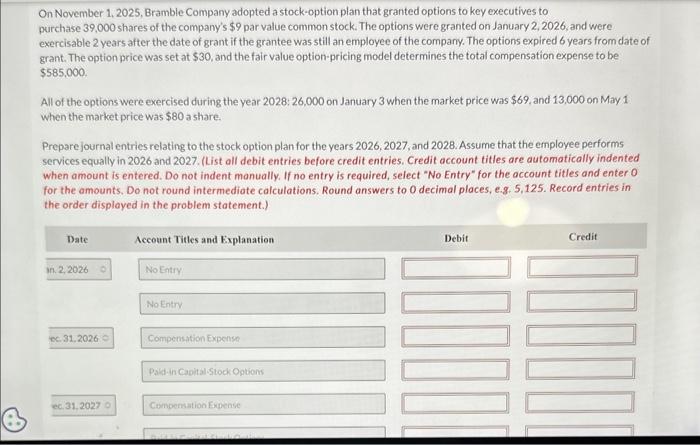

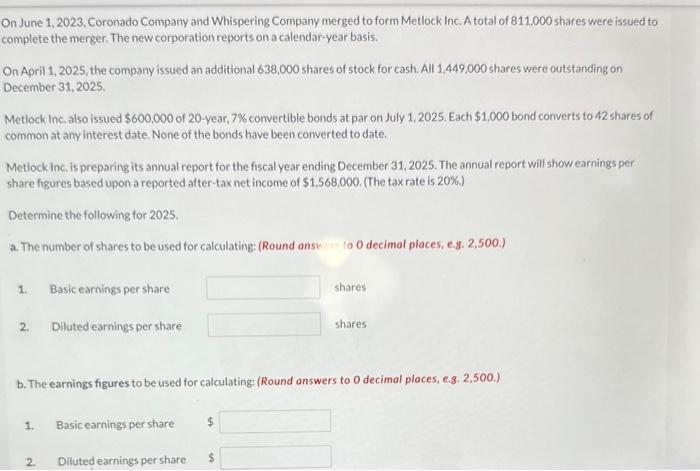

On November 1, 2025, Bramble Company adopted a stock-option plan that granted options to key executives to purchase 39,000 shares of the company's $9 par value common stock. The options were granted on January 2, 2026, and were exercisable 2 years after the date of grant if the grantee was still an employee of the company. The options expired 6 years from date of grant. The option price was set at $30, and the fair value option-pricing model determines the total compensation expense to be $585,000. All of the options were exercised during the year 2028:26,000 on January 3 when the market price was $69, and 13,000 on May 1 when the market price was $80 a share. Prepare journal entries relating to the stock option plan for the years 2026, 2027, and 2028. Assume that the employee performs services equally in 2026 and 2027. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Do not round intermediate calculations. Round answers to 0 decimal places, e.g. 5,125. Record entries in the order displayed in the problem statement.) On June 1, 2023, Coronado Company and Whispering Company merged to form Metlock Inc. A total of 811,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis. On April 1, 2025, the company issued an additional 638,000 shares of stock for cash. All 1,449,000 shares were outstanding on December 31,2025. Metlock Inc. also issued $600,000 of 20 -year. 7% convertible bonds at par on July 1, 2025, Each $1,000 bond converts to 42 shares of common at any interest date. None of the bonds have been converted to date. Metlock Inc. is preparing its annual report for the fiscal year ending December 31,2025 . The annual report will show earnings per share figures based upon a reported after-tax net income of $1,568,000. (The tax rate is 20% ) Determine the following for 2025. a. The number of shares to be used for calculating: (Round answ w to 0 decimal places, e.g. 2, 500.) 1. Basic earnings per share shares 2. Diluted earnings per share shares b. The earnings figures to be used for calculating: (Round answers to 0 decimal places, e.g. 2,500.) 1. Basic earnings per share 2. Diluted earnings per share $