Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All information are provided in the pictures if you don't know the answer please leave it to someone who would like to help. Chapter 5

All information are provided in the pictures if you don't know the answer please leave it to someone who would like to help.

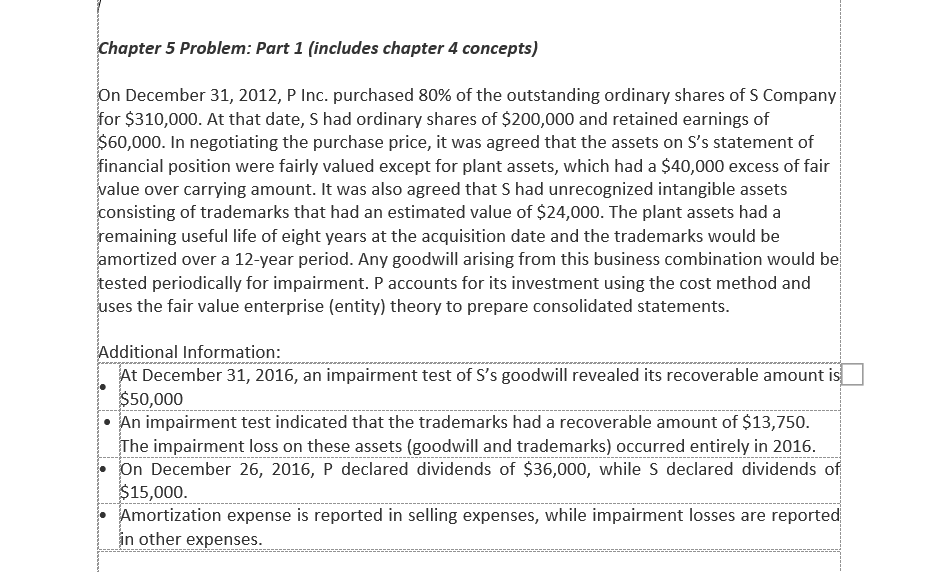

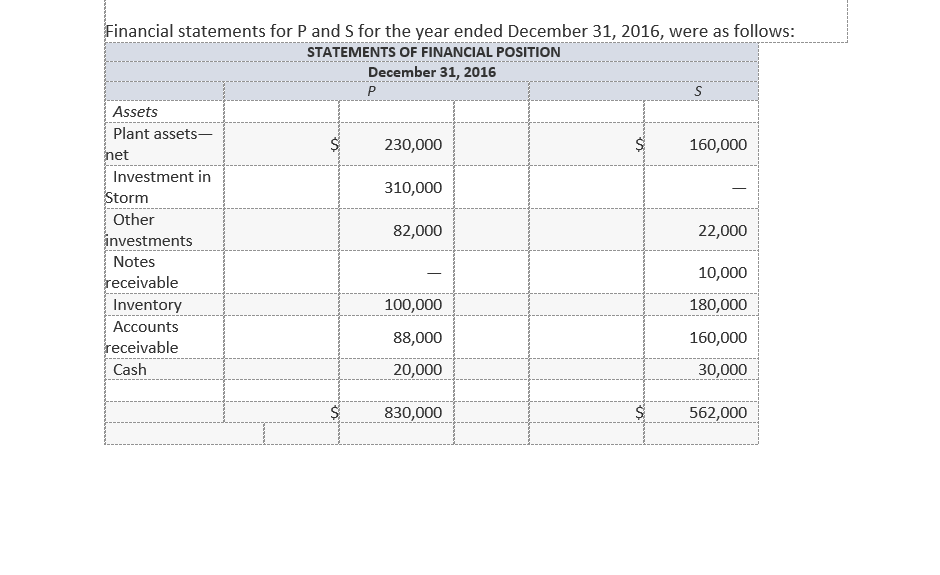

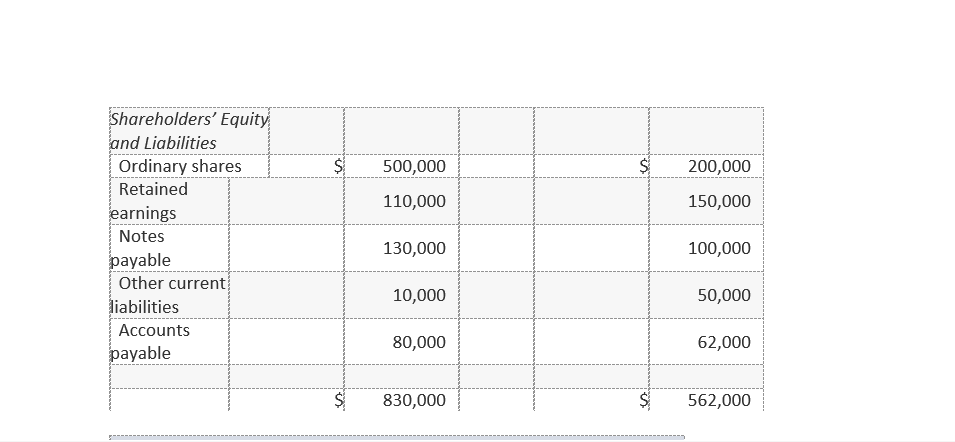

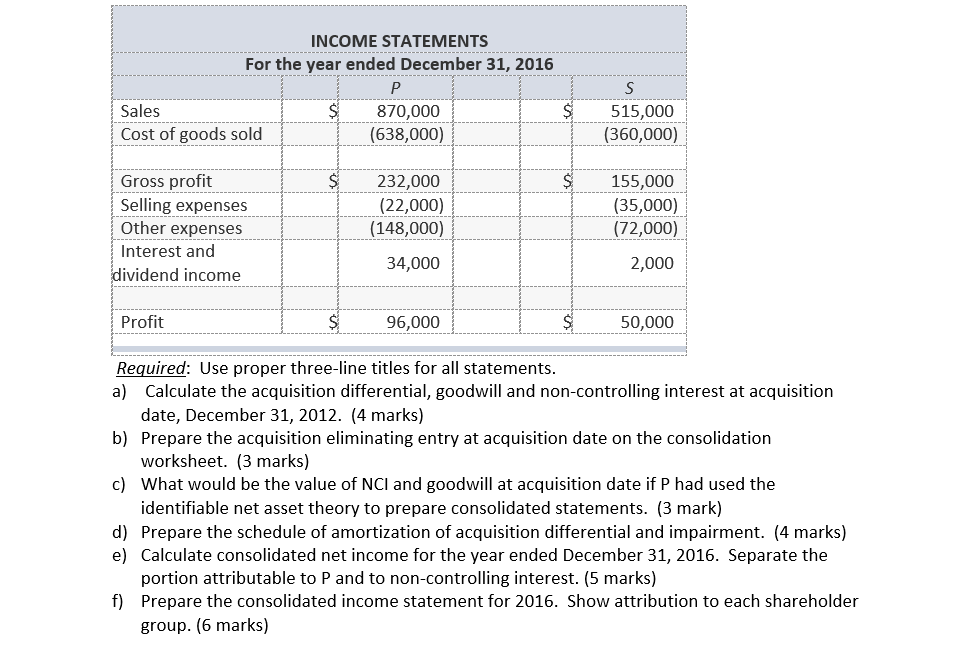

Chapter 5 Problem: Part 1 (includes chapter 4 concepts) On December 31, 2012, P Inc. purchased 80% of the outstanding ordinary shares of S Company for $310,000. At that date, S had ordinary shares of $200,000 and retained earnings of $60,000. In negotiating the purchase price, it was agreed that the assets on S s statement of financial position were fairly valued except for plant assets, which had a $40,000 excess of fair value over carrying amount. It was also agreed that S had unrecognized intangible assets consisting of trademarks that had an estimated value of $24,000. The plant assets had a remaining useful life of eight years at the acquisition date and the trademarks would be amortized over a 12-year period. Any goodwill arising from this business combination would be tested periodically for impairment. P accounts for its investment using the cost method and uses the fair value enterprise (entity) theory to prepare consolidated statements. Additional Information: At December 31, 2016, an impairment test of S's goodwill revealed its recoverable amount is $50,000 - An impairment test indicated that the trademarks had a recoverable amount of $13,750. The impairment loss on these assets (goodwill and trademarks) occurred entirely in 2016. - On December 26, 2016, P declared dividends of $36,000, while S declared dividends of $15,000. - Amortization expense is reported in selling expenses, while impairment losses are reported in other expenses. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{\begin{tabular}{l} Shareholders' Equity \\ and Liabilities \end{tabular}} \\ \hline Ordinary shares & $ & 500,000 & $ & 200,000 \\ \hline \begin{tabular}{l} Retained \\ earnings \end{tabular} & & 110,000 & & 150,000 \\ \hline \begin{tabular}{l} Notes \\ payable \end{tabular} & & 130,000 & & 100,000 \\ \hline \begin{tabular}{l} Other current \\ iabilities \end{tabular} & & 10,000 & & 50,000 \\ \hline \begin{tabular}{l} Accounts \\ payable \end{tabular} & & 80,000 & & 62,000 \\ \hline & & & & \\ \hline & $ & 830,000 & $ & 562,000 \\ \hline \end{tabular} Financial statements for P and S for the year ended December 31,2016 , were as follows: Required: Use proper three-line titles for all statements. a) Calculate the acquisition differential, goodwill and non-controlling interest at acquisition date, December 31, 2012. (4 marks) b) Prepare the acquisition eliminating entry at acquisition date on the consolidation worksheet. (3 marks) c) What would be the value of NCl and goodwill at acquisition date if P had used the identifiable net asset theory to prepare consolidated statements. (3 mark) d) Prepare the schedule of amortization of acquisition differential and impairment. (4 marks) e) Calculate consolidated net income for the year ended December 31, 2016. Separate the portion attributable to P and to non-controlling interest. (5 marks) f) Prepare the consolidated income statement for 2016. Show attribution to each shareholder group. (6 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started