Answered step by step

Verified Expert Solution

Question

1 Approved Answer

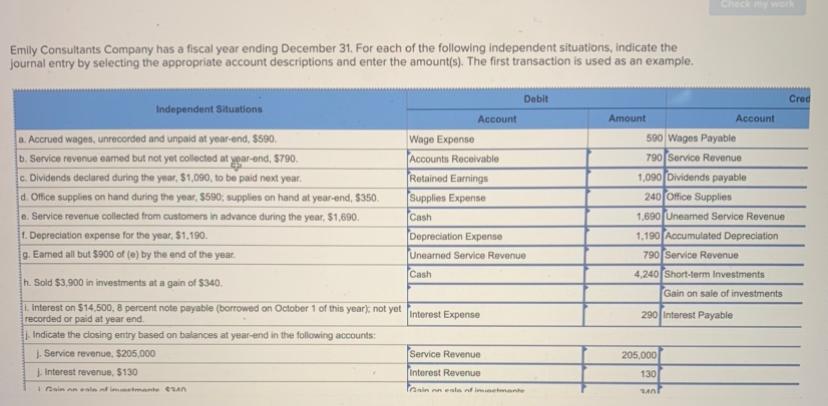

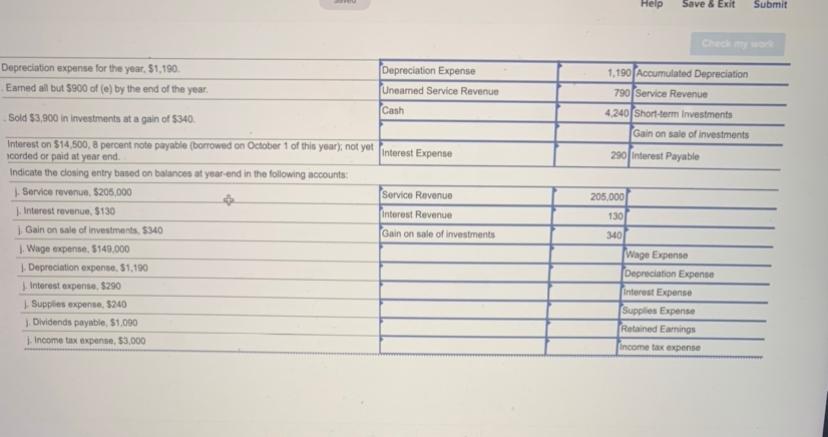

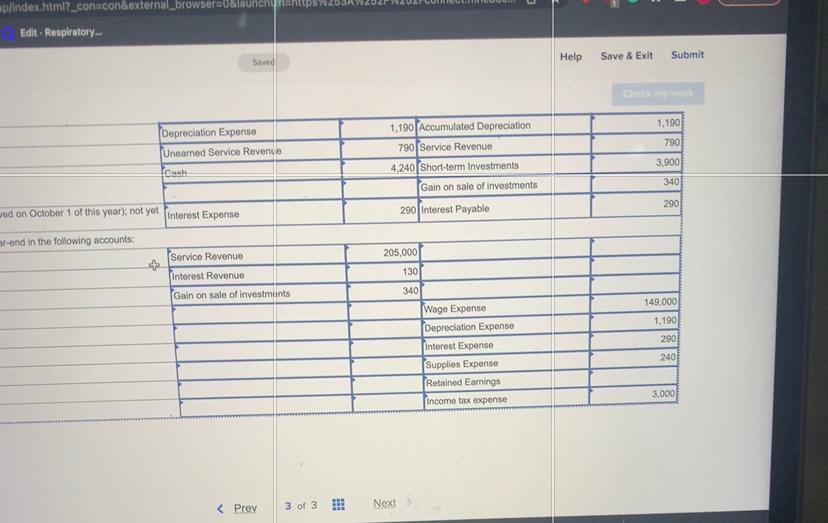

please solve for J Emily Consultants Company has a fiscal year ending December 31. For each of the following independent situations, indicate the journal entry

please solve for J

Emily Consultants Company has a fiscal year ending December 31. For each of the following independent situations, indicate the journal entry by selecting the appropriate account descriptions and enter the amount(s). The first transaction is used as an example. Depreciation expense for the year, $1,190. Eamed all but 5900 of (e) by the end of the year. Sold $3,900 in investments at a gain of $340 Interest on $14,500,8 percent note payable (borrowed on Octaber 1 of this year), not yet lcorded or paid at year end. Indicate the dosing entry based on balances at year-end in the following accounts: 1. Service revenus, 5206,000 I. Intarest rovenue, 5130 1. Gain on sale of imvestments. $40 1. Wape expense, 5149,000 1. Deprociation expense. 51,190 1. Interest expense. $290 L Supples expense, $240 I. Oividends payable, $1,090 I income tax uxpente, 53,000 Edit - Resplratory... Emily Consultants Company has a fiscal year ending December 31. For each of the following independent situations, indicate the journal entry by selecting the appropriate account descriptions and enter the amount(s). The first transaction is used as an example. Depreciation expense for the year, $1,190. Eamed all but 5900 of (e) by the end of the year. Sold $3,900 in investments at a gain of $340 Interest on $14,500,8 percent note payable (borrowed on Octaber 1 of this year), not yet lcorded or paid at year end. Indicate the dosing entry based on balances at year-end in the following accounts: 1. Service revenus, 5206,000 I. Intarest rovenue, 5130 1. Gain on sale of imvestments. $40 1. Wape expense, 5149,000 1. Deprociation expense. 51,190 1. Interest expense. $290 L Supples expense, $240 I. Oividends payable, $1,090 I income tax uxpente, 53,000 Edit - ResplratoryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started