all multiple choice

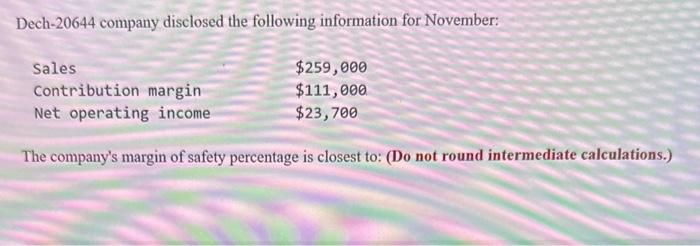

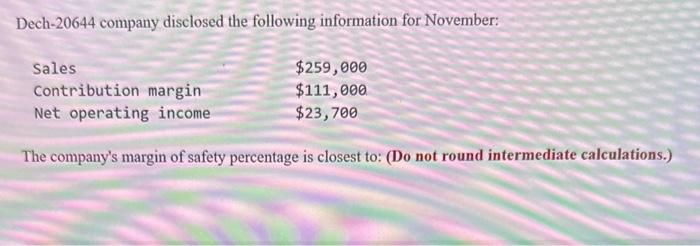

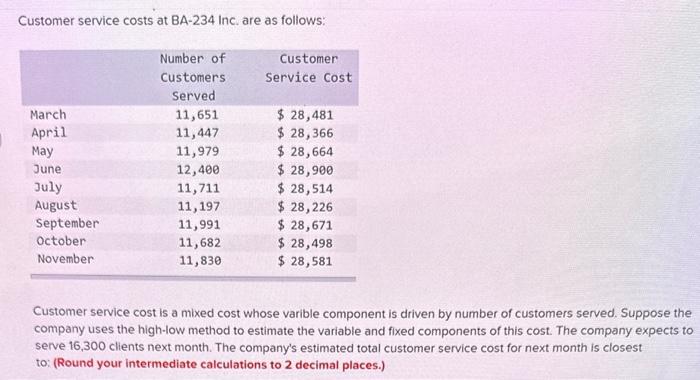

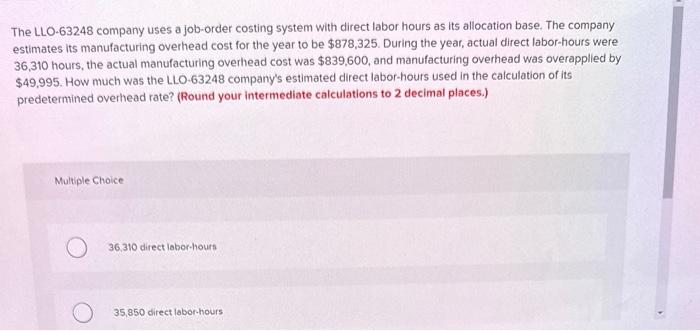

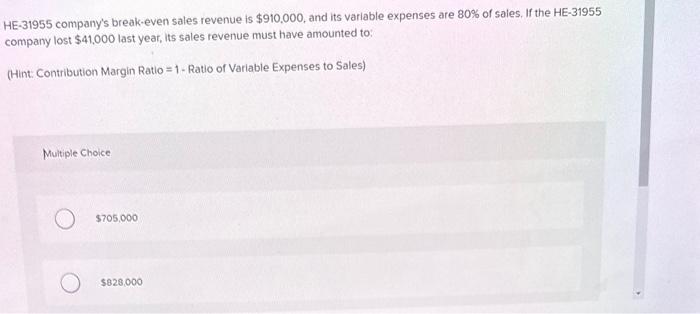

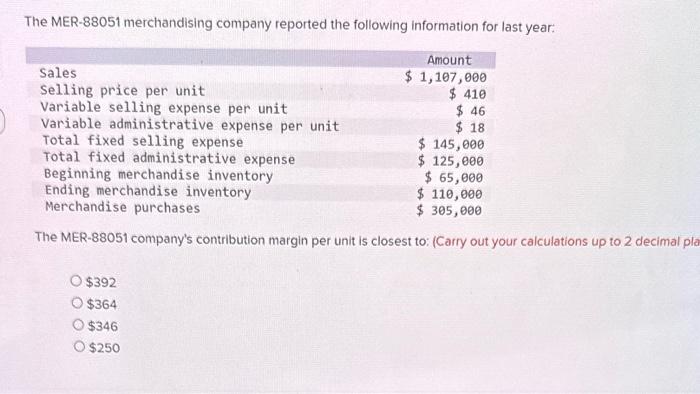

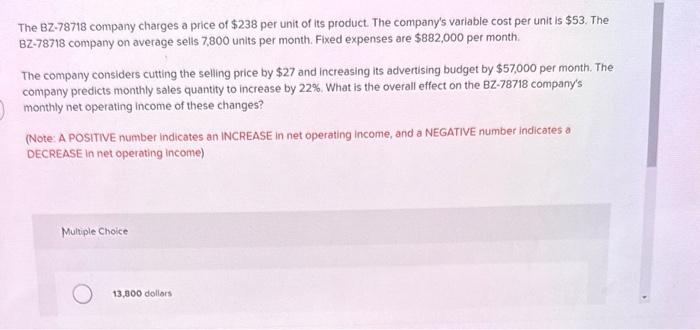

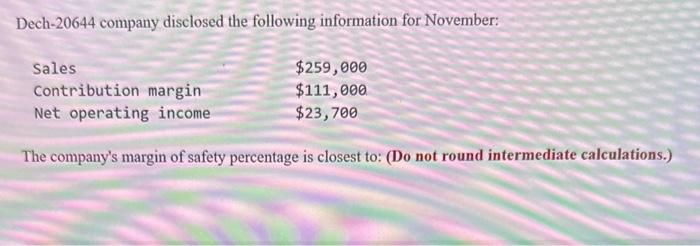

Dech-20644 company disclosed the following information for November: The company's margin of safety percentage is closest to: (Do not round intermediate calculations.) Customer service costs at BA-234 Inc. are as follows: Customer service cost is a mixed cost whose varible component is driven by number of customers served. Suppose the company uses the high-low method to estimate the variable and fixed components of this cost. The company expects to serve 16,300 clients next month. The company's estimated total customer service cost for next month is closest to: (Round your intermediate calculations to 2 decimal places.) CAR-28944 company purchases battery powered bikes from a manufacturer for $1,511 per unit and then sells them to its customers for $2,500 each. The company's monthly selling and administrative costs are the following: Last month CAR-28944 sold 58 units. How much was the company's total contribution margin for the month? $57,362$47,270$87,638$97,730 The LLO-63248 company uses a job-order costing system with direct labor hours as its allocation base. The company estimates its manufacturing overhead cost for the year to be $878,325. During the year, actual direct labor-hours were 36,310 hours, the actual manufacturing overhead cost was $839,600, and manufacturing overhead was overapplied by $49,995. How much was the LLO-63248 company's estimated direct labor-hours used in the calculation of its predetermined overhead rate? (Round your intermediate calculations to 2 decimal places.) Multiple Choice 36.310 direct labor-hours 35,850 direct labor-hours HE-31955 company's break-even sales revenue is $910.000, and its varlable expenses are 80% of sales. If the HE-31955 company lost $41,000 last year, its sales revenue must have amounted to: (Hint: Contribution Margin Ratio = 1 - Ratio of Variable Expenses to Sales) Muitiple Choice $705,000 $828,000 The MER-88051 merchandising company reported the following information for last year: The MER-88051 company's contribution margin per unit is closest to: (Carry out your calculations up to 2 decimal ple $392$364$346$250 The Bz-78718 company charges a price of $238 per unit of its product. The company's variable cost per unit is $53. The. BZ-78718 company on average sells 7,800 units per month. Fixed expenses are $882,000 per month. The company considers cutting the selling price by $27 and increasing its advertising budget by $57,000 per month. The company predicts monthly sales quantity to increase by 22%. What is the overall effect on the BZ-78718 company's monthly net operating income of these changes? (Note: A POSITIVE number indicates an INCREASE in net operating income, and a NEGATIVE number indicates a. DECREASE In net operating income) Multiple Choice 13,800 dollors