Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All of the following items/transactions are off-balance sheet items for a bank, except: I A documentary letter of credit provided by the bank to a

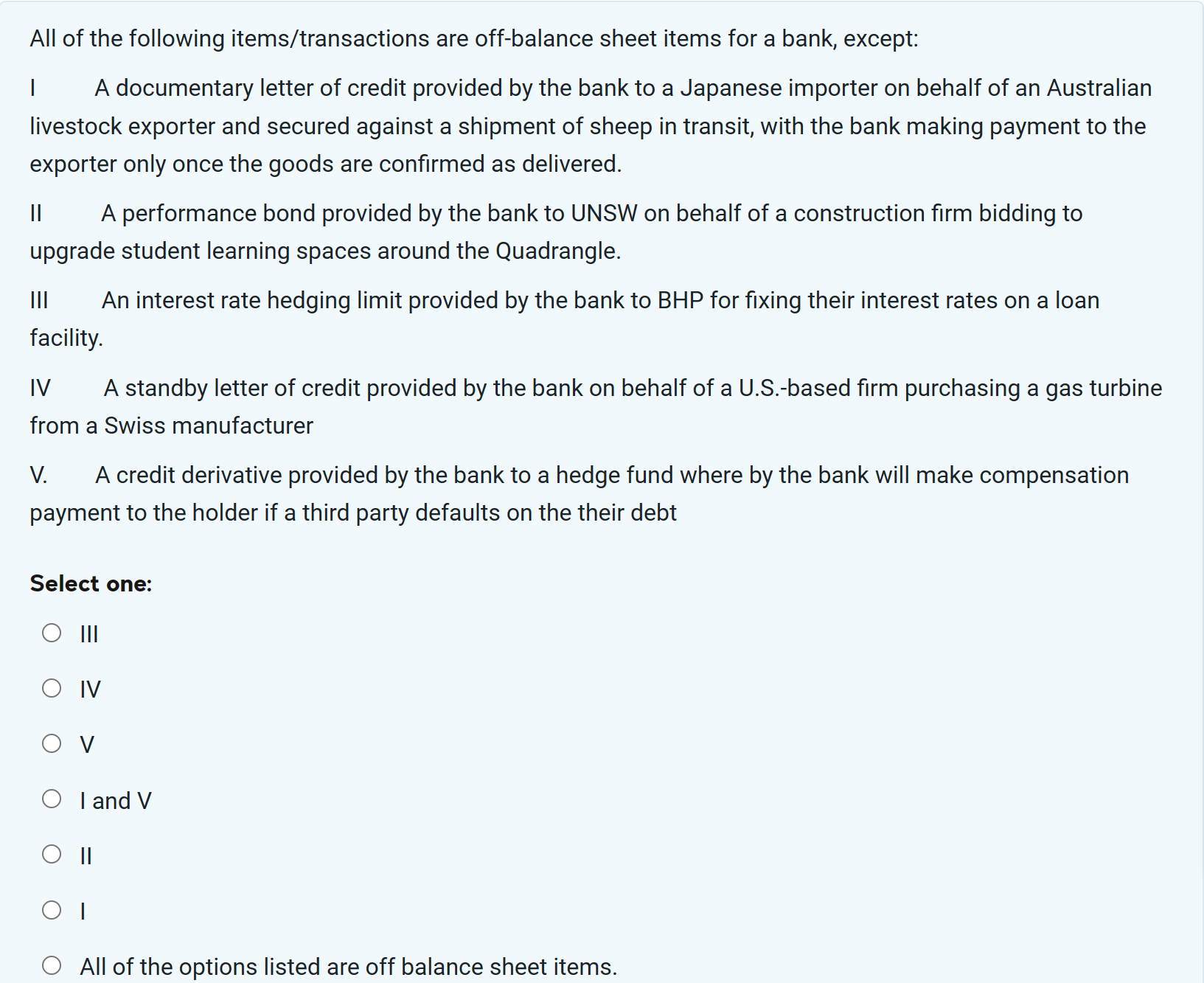

All of the following items/transactions are off-balance sheet items for a bank, except: I A documentary letter of credit provided by the bank to a Japanese importer on behalf of an Australian livestock exporter and secured against a shipment of sheep in transit, with the bank making payment to the exporter only once the goods are confirmed as delivered. II A performance bond provided by the bank to UNSW on behalf of a construction firm bidding to upgrade student learning spaces around the Quadrangle. III An interest rate hedging limit provided by the bank to BHP for fixing their interest rates on a loan facility. IV A standby letter of credit provided by the bank on behalf of a U.S.-based firm purchasing a gas turbine from a Swiss manufacturer V. A credit derivative provided by the bank to a hedge fund where by the bank will make compensation payment to the holder if a third party defaults on the their debt Select one: III IV V I and V II I All of the options listed are off balance sheet items

All of the following items/transactions are off-balance sheet items for a bank, except: I A documentary letter of credit provided by the bank to a Japanese importer on behalf of an Australian livestock exporter and secured against a shipment of sheep in transit, with the bank making payment to the exporter only once the goods are confirmed as delivered. II A performance bond provided by the bank to UNSW on behalf of a construction firm bidding to upgrade student learning spaces around the Quadrangle. III An interest rate hedging limit provided by the bank to BHP for fixing their interest rates on a loan facility. IV A standby letter of credit provided by the bank on behalf of a U.S.-based firm purchasing a gas turbine from a Swiss manufacturer V. A credit derivative provided by the bank to a hedge fund where by the bank will make compensation payment to the holder if a third party defaults on the their debt Select one: III IV V I and V II I All of the options listed are off balance sheet items Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started