Answered step by step

Verified Expert Solution

Question

1 Approved Answer

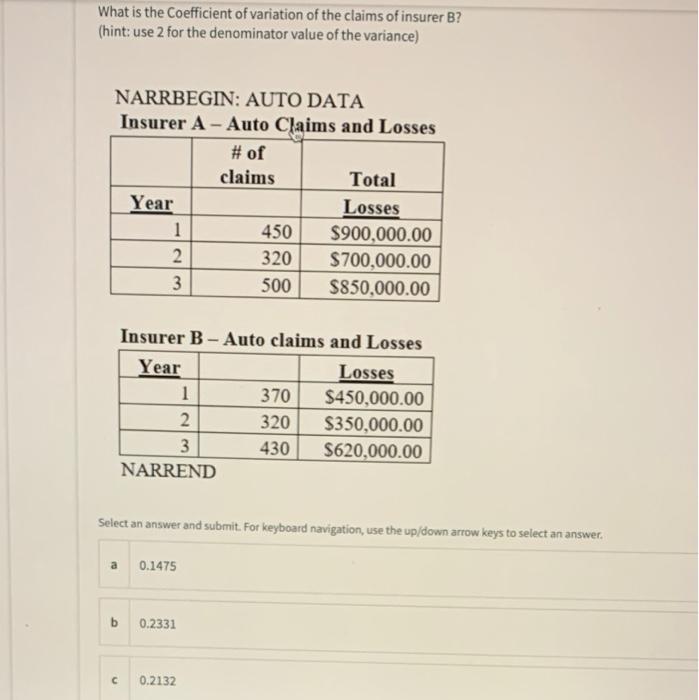

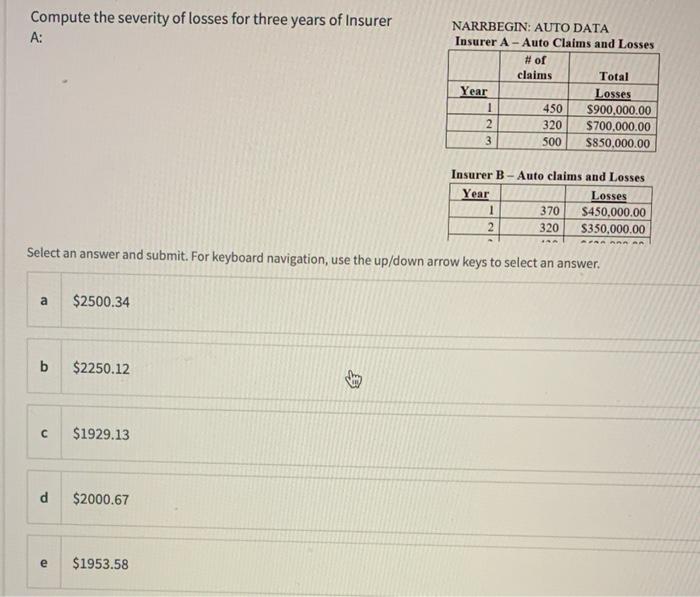

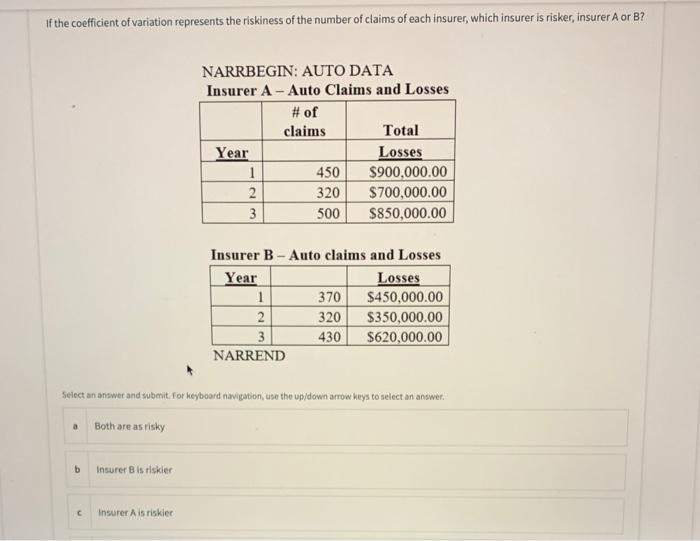

all of the question is related to that one chart What is the Coefficient of variation of the claims of insurer B? (hint: use 2

all of the question is related to that one chart

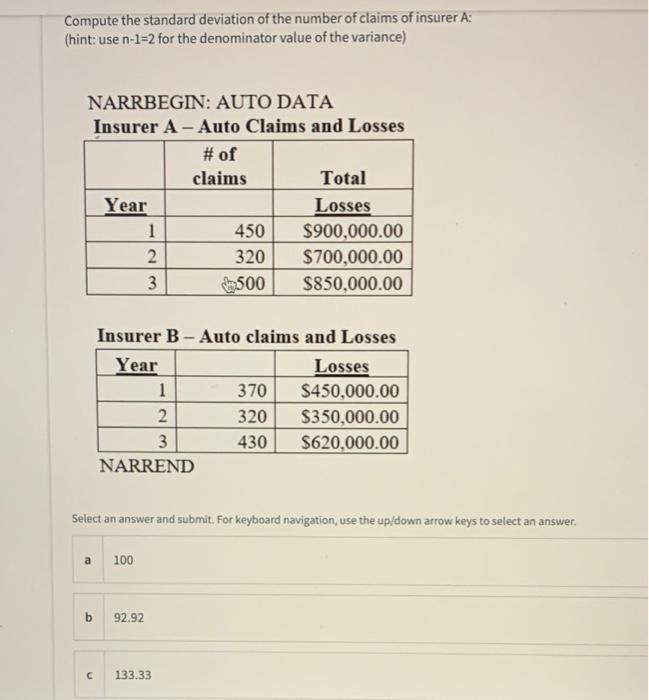

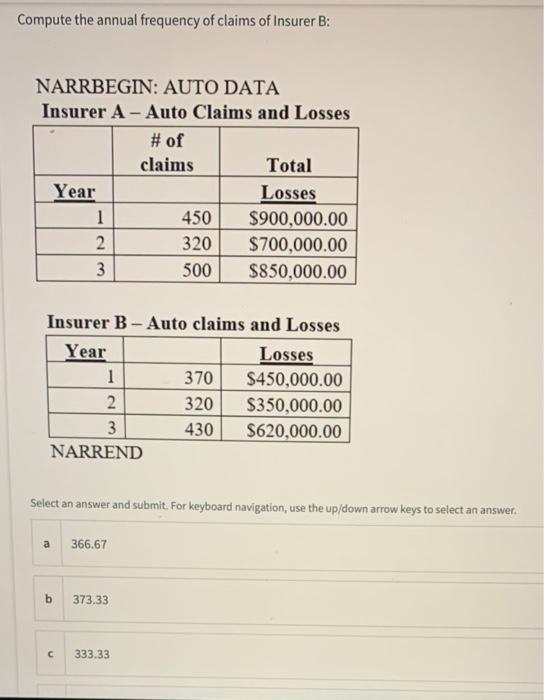

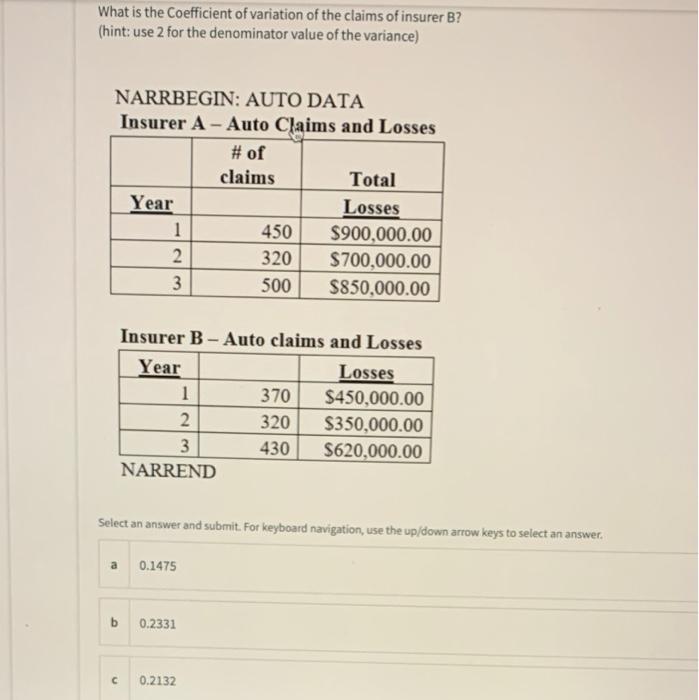

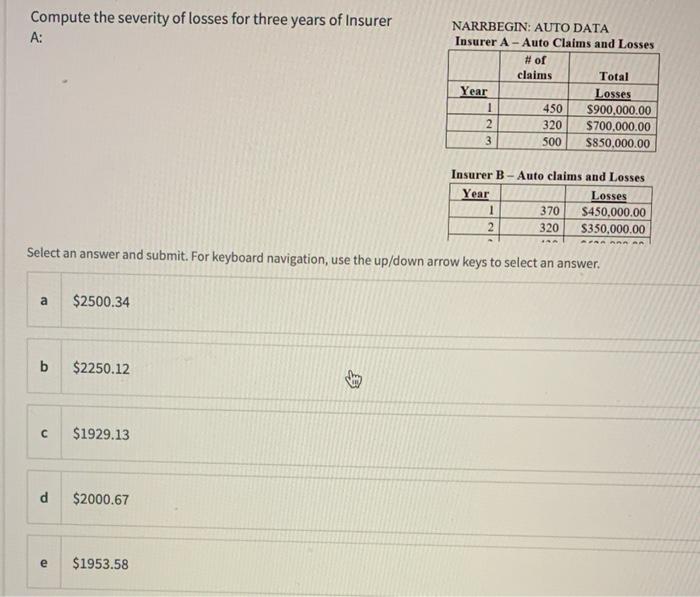

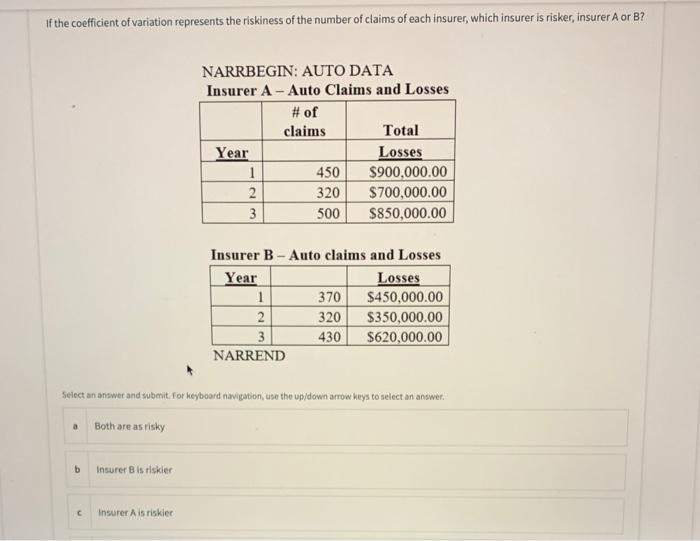

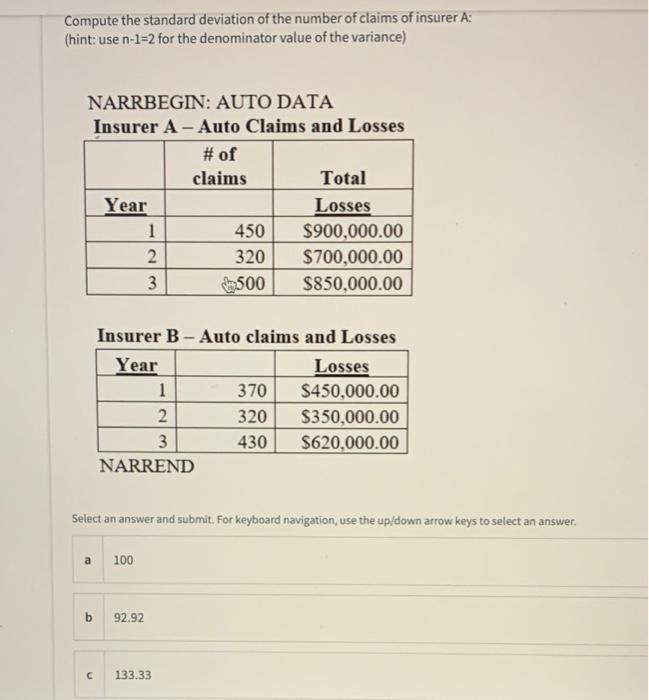

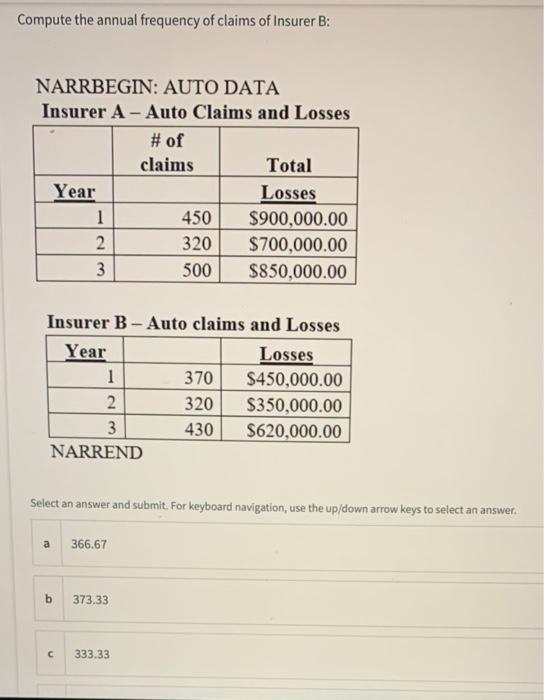

What is the Coefficient of variation of the claims of insurer B? (hint: use 2 for the denominator value of the variance) NARRBEGIN: AUTO DATA Insurer A - Auto Claims and Losses # of claims Total Year Losses 1 450 $900,000.00 2 320 $700,000.00 3 500 $850,000.00 2 3 Insurer B - Auto claims and Losses Year Losses 1 370 $450,000.00 2 320 $350,000.00 3 430 $620,000.00 NARREND Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a 0.1475 b 0.2331 C 0.2132 Compute the severity of losses for three years of Insurer A: NARRBEGIN: AUTO DATA Insurer A - Auto Claims and Losses # of claims Total Year Losses 1 450 $900,000.00 2 320 $700,000.00 3 500 $850,000.00 Insurer B - Auto claims and Losses Year Losses 1 370 $450,000.00 2 320 S350,000.00 Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a $2500.34 b $2250.12 $1929.13 d $2000.67 e $1953.58 of the coefficient of variation represents the riskiness of the number of claims of each insurer, which insurer is risker, insurer A or B? NARRBEGIN: AUTO DATA Insurer A - Auto Claims and Losses # of claims Total Year Losses 1 450 $900,000.00 2 320 $700,000.00 3 500 $850,000.00 Insurer B - Auto claims and Losses Year Losses 1 370 $450,000.00 2 320 $350,000.00 3 430 $620,000.00 NARREND Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Both are as risky b Insurer Bis riskler C Insurer A is riskier Compute the standard deviation of the number of claims of insurer A: (hint: use n-1=2 for the denominator value of the variance) NARRBEGIN: AUTO DATA Insurer A - Auto Claims and Losses # of claims Total Year Losses 1 450 $900,000.00 2 320 $700,000.00 3 2500 $850,000.00 WIN Insurer B-Auto claims and Losses Year Losses 1 370 $450,000.00 2 320 $350,000.00 3 430 $620,000.00 NARREND Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a 100 b 92.92 C 133.33 Compute the annual frequency of claims of Insurer B: NARRBEGIN: AUTO DATA Insurer A - Auto Claims and Losses # of claims Total Year Losses 1 450 $900,000.00 2. 320 $700,000.00 3 500 $850,000.00 . 3 Insurer B - Auto claims and Losses Year Losses 1 370 $450,000.00 2 320 $350,000.00 3 430 $620,000.00 NARREND Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer, a 366.67 b 373.33 333.33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started