Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All one question, with several steps. Please no handwriting. Budgeting Edwin Company sells beach towels. Unit sales projections for the upcoming two months are as

All one question, with several steps. Please no handwriting.

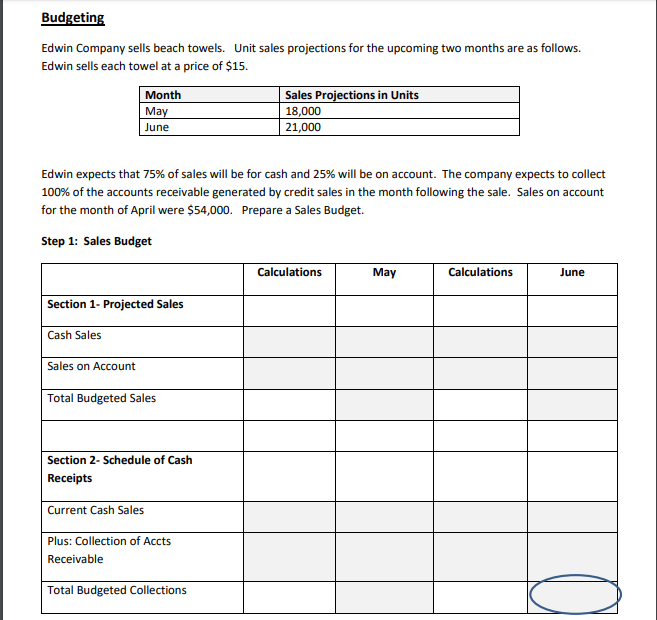

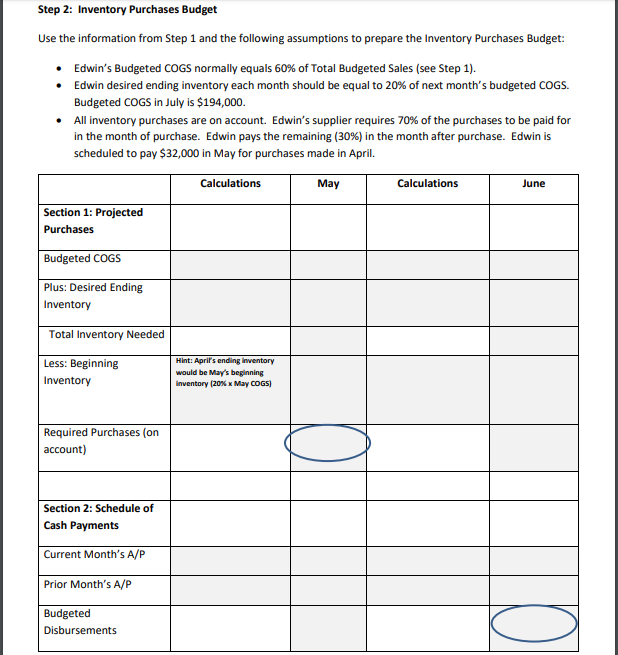

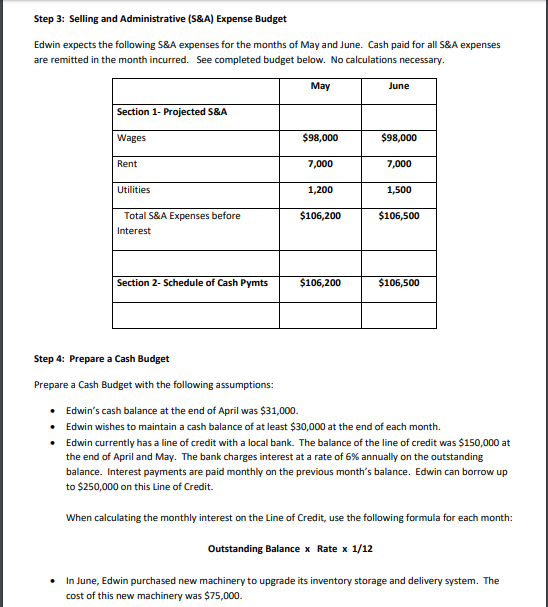

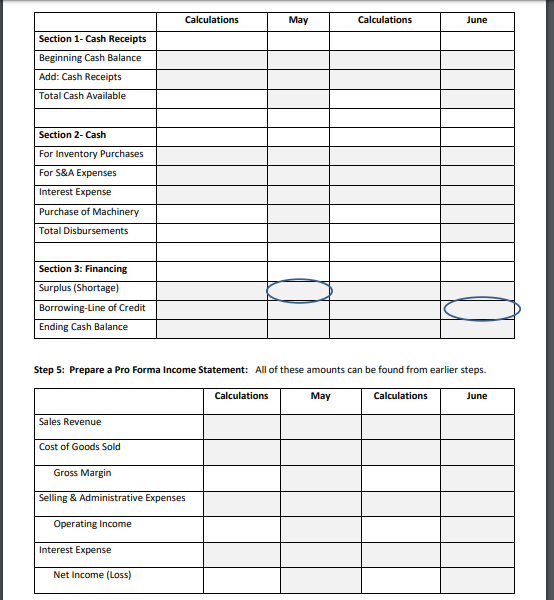

Budgeting Edwin Company sells beach towels. Unit sales projections for the upcoming two months are as follows. Edwin sells each towel at a price of $15. Month Sales Projections in Units 18,000 May June 21,000 Edwin expects that 75% of sales will be for cash and 25% will be on account. The company expects to collect 100% of the accounts receivable generated by credit sales in the month following the sale. Sales on account for the month of April were $54,000. Prepare a Sales Budget. Step 1: Sales Budget Calculations Calculations May June Section 1- Projected Sales Cash Sales Sales on Account Total Budgeted Sales Section 2- Schedule of Cash Receipts Current Cash Sales Plus: Collection of Accts Receivable Total Budgeted Collections Step 2: Inventory Purchases Budget Use the information from Step 1 and the following assumptions to prepare the Inventory Purchases Budget: Edwin's Budgeted COGS normally equals 60% of Total Budgeted Sales (see Step 1) Edwin desired ending inventory each month should be equal to 20% of next month's budgeted COGS. Budgeted COGS in July is $194,000 All inventory purchases are on account. Edwin's supplier requires 70% of the purchases to be paid for in the month of purchase. Edwin pays the remaining (30%) in the month after purchase. Edwin is scheduled to pay $32,000 in May for purchases made in April Calculations Calculations May June Section 1: Projected Purchases Budgeted COGS Plus: Desired Ending Inventory Total Inventory Needed Hint: April's ending inventory Less: Beginning would be May's beginning Inventory inventory (20% x May COGS) Required Purchases (on account) Section 2: Schedule of Cash Payments Current Month's A/P Prior Month's A/P Budgeted Disbursements Step 3: Selling and Administrative (S&A) Expense Budget Edwin expects the following S&A expenses for the months of May and June. Cash paid for all S&A expenses are remitted in the month incurred. See completed budget below. No calculations necessary. May June Section 1- Projected S&A $98,000 $98,000 Wages Rent 7,000 7,000 Utilities 1,200 1,500 $106,200 $106,500 Total S&A Expenses before Interest $106,200 $106,500 Section 2- Schedule of Cash Pymts Step 4: Prepare a Cash Budget Prepare a Cash Budget with the following assumptions: Edwin's cash balance at the end of April was $31,000. Edwin wishes to maintain a cash balance of at least $30,000 at the end of each month. Edwin currently has a line of credit with a local bank. The balance of the line of credit was $150,000 at the end of April and May. The bank charges interest at a rate of 6 % annually on the outstanding balance. Interest payments are paid monthly on the previous month's balance. Edwin can borrow up to $250,000 on this Line of Credit When calculating the monthly interest on the Line of Credit, use the following formula for each month Outstanding Balance x Rate x 1/12 In June, Edwin purchased new machinery to upgrade its inventory storage and delivery system. The cost of this new machinery was $75,000. May Calculations Calculations June Section 1- Cash Receipts Beginning Cash Balance Add: Cash Receipts Total Cash Available Section 2- Cash For Inventory Purchases For S&A Expenses Interest Expense Purchase of Machinery Total Disbursements Section 3: Financing Surplus (Shortage) Borrowing-Line of Credit Ending Cash Balance Step 5: Prepare a Pro Forma Income Statement: All of these amounts can be found from earlier steps May Calculations Calculations June Sales Revenue Cost of Goods Sold Gross Margin Selling & Administrative Expenses Operating Income Interest Expense Net Income (Loss)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started