- All other factors being constant, decreasing the level of reliability on a particular product will likely have what impact on the contribution margin ratio for that product line.

- Increase

- Decrease

- No change

2. A common stockholders total return is made up of

a. a combination of profit margin and return on equity

b. a combination of contribution margin ratio and return on sales ratio

c. a combination of dividend yield and capital appreciation

d. a combination of dividend payout and profit margin

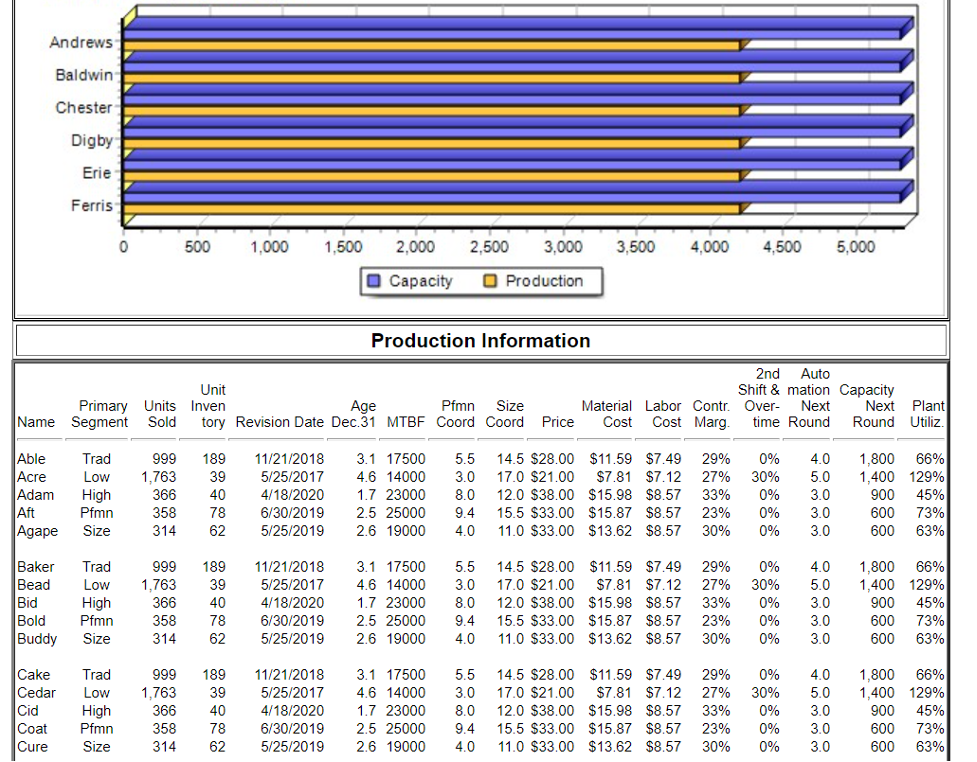

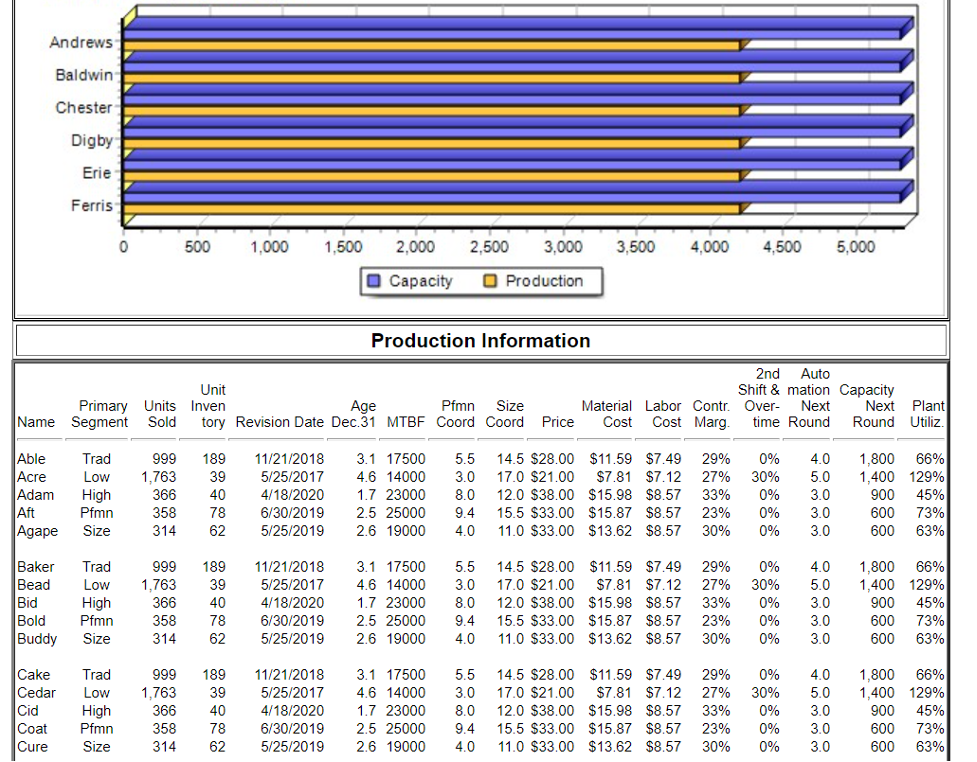

3. At full production output, your firm has the ability to produce at approximately _____________ % of first shift capacity

- 200

- 150

- 100

- 50

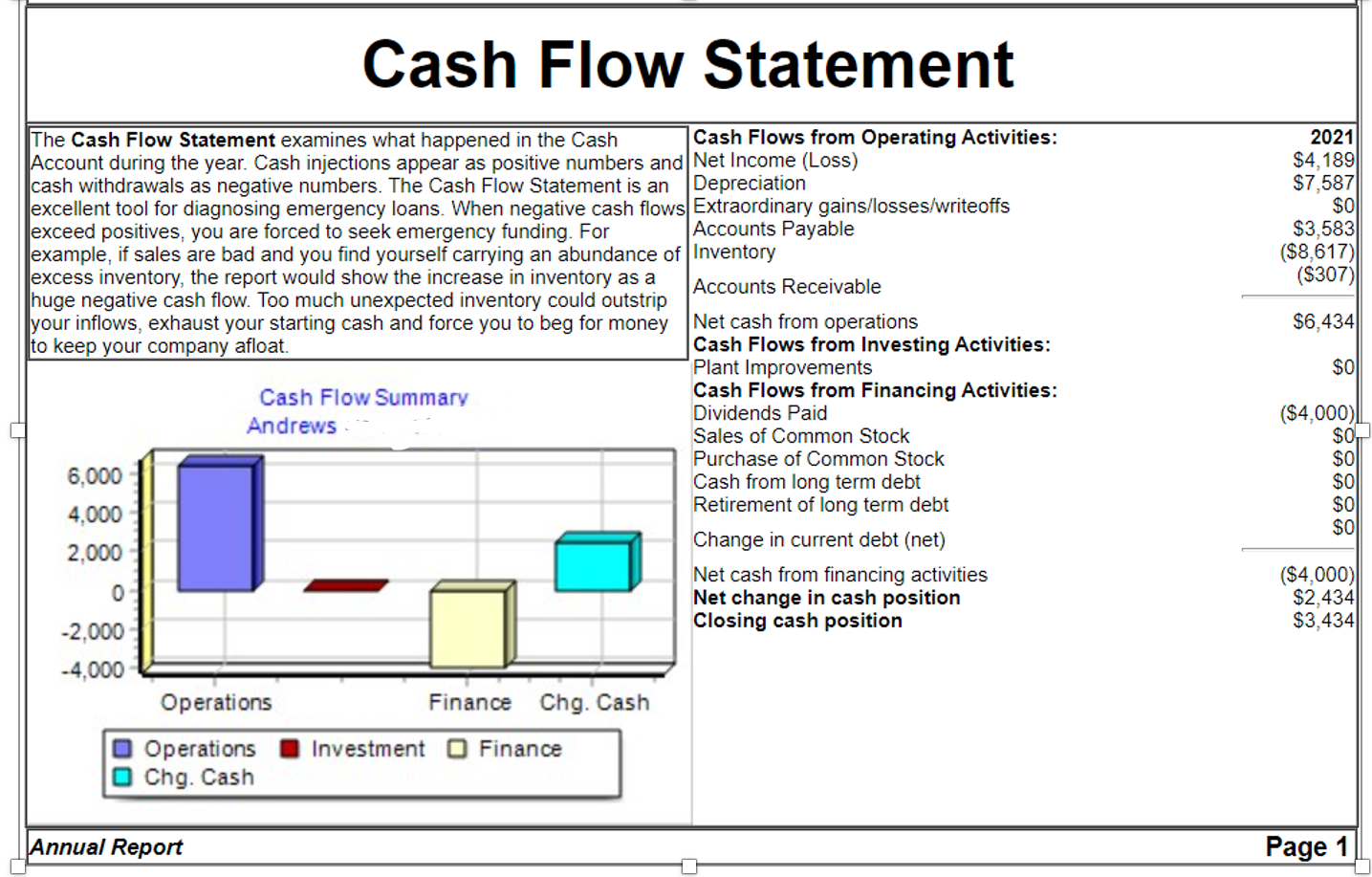

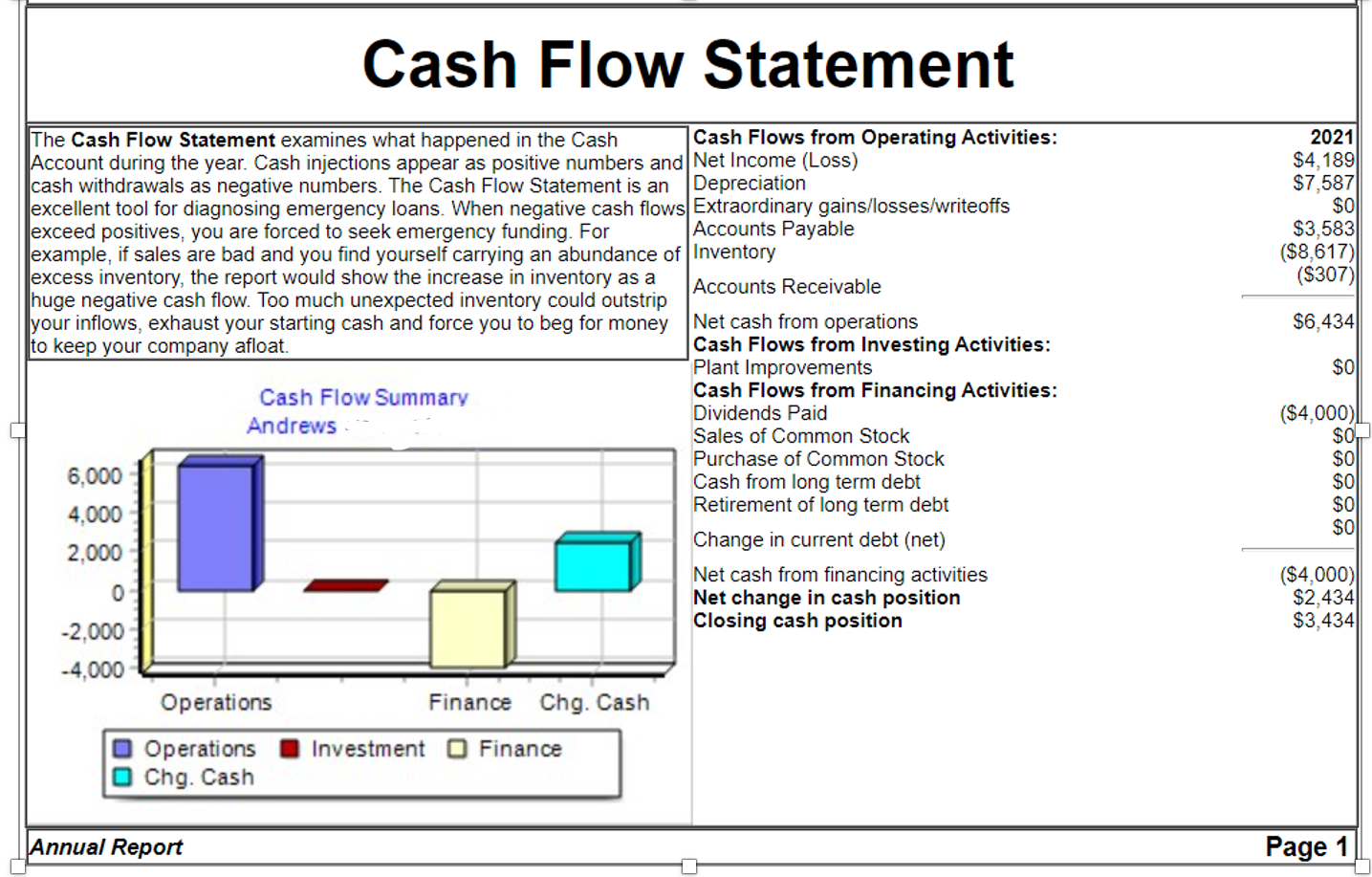

4. For 2021, on the firms statement of cash flows, the primary source (non use) of cash was

- Net income

- Change in inventory

- Depreciation

- Change in accounts receivable

Andrews Baldwin Chester Digby Erie Ferris 0 500 1.000 1,500 2.000 2,500 3,000 3,500 4,000 4,500 5.000 Capacity Production Production Information Unit Primary Units Inven Age Pfmn Size Name Segment Sold tory Revision Date Dec.31 MTBF Coord Coord Price 2nd Auto Shift & mation Capacity Material Labor Contr. Over- Next Next Plant Cost Cost Marg time Round Round Utiliz. Able Acre Adam Aft Agape Trad Low High Pfmn Size 999 1,763 366 358 314 189 39 40 78 62 11/21/2018 5/25/2017 4/18/2020 6/30/2019 5/25/2019 3.1 17500 4.6 14000 1.7 23000 2.5 25000 2.6 19000 5.5 3.0 8.0 9.4 4.0 14.5 $28.00 $11.59 $7.49 17.0 $21.00 $7.81 $7.12 12.0 $38.00 $15.98 $8.57 15.5 $33.00 $15.87 $8.57 11.0 $33.00 $13.62 $8.57 29% 27% 33% 23% 30% 0% 30% 0% 0% 0% 4.0 5.0 3.0 3.0 3.0 1.800 66% 1,400 129% 900 45% 600 73% 600 63% Baker Bead Bid Trad Low High Pfmn Size 999 1.763 366 358 314 189 39 40 78 62 11/21/2018 5/25/2017 4/18/2020 6/30/2019 5/25/2019 3.1 17500 4.6 14000 1.7 23000 2.5 25000 2.6 19000 5.5 3.0 8.0 9.4 4.0 14.5 $28.00 $11.59 $7.49 17.0 $21.00 $7.81 $7.12 12.0 $38.00 $15.98 $8.57 15.5 $33.00 $15.87 $8.57 11.0 $33.00 $13.62 $8.57 29% 27% 33% 23% 30% 0% 30% 0% 0% 0% 4.0 5.0 3.0 3.0 3.0 1.800 66% 1,400 129% 900 45% 600 73% 600 63% Bold Buddy Cake Cedar Cid Coat Cure Trad Low High Pfmn Size 999 1,763 366 358 314 189 39 40 78 62 11/21/2018 5/25/2017 4/18/2020 6/30/2019 5/25/2019 3.1 17500 4.6 14000 1.7 23000 2.5 25000 2.6 19000 5.5 3.0 8,0 9.4 4.0 14.5 $28.00 $11.59 $7.49 17,0 $21.00 $7.81 $7.12 12.0 $38.00 $15.99 $8.57 15.5 $33.00 $15.87 $8.57 11.0 $33.00 $13.62 $8.57 29% 27% 33% 23% 30% 0% 30% 0% 0% 0% 4.0 5.0 3.0 3.0 3.0 1,800 66% 1,400 129% 900 45% 600 73% 600 63% Cash Flow Statement 2021 $4,189 $7,587 $0 $3,583 ($8,617) ($307) $6,434 $0 The Cash Flow Statement examines what happened in the Cash Cash Flows from Operating Activities: Account during the year. Cash injections appear as positive numbers and Net Income (Loss) cash withdrawals as negative numbers. The Cash Flow Statement is an Depreciation excellent tool for diagnosing emergency loans. When negative cash flows Extraordinary gains/losses/writeoffs exceed positives, you are forced to seek emergency funding. For Accounts Payable example, if sales are bad and you find yourself carrying an abundance of Inventory excess inventory, the report would show the increase in inventory as a Accounts Receivable huge negative cash flow. Too much unexpected inventory could outstrip your inflows, exhaust your starting cash and force you to beg for money Net cash from operations to keep your company afloat. Cash Flows from Investing Activities: Plant Improvements Cash Flow Summary Cash Flows from Financing Activities: Dividends Paid Andrews Sales of Common Stock Purchase of Common Stock 6,000 Cash from long term debt 4,000 Retirement of long term debt Change in current debt (net) 2,000 Net cash from financing activities 0 Net change in cash position Closing cash position -2,000 -4,000 Operations Finance Chg. Cash ($4,000) $0, $0 $0 $0 $0 ($4,000) $2,434 $3,434 Investment Finance Operations Chg. Cash Annual Report Page 1