Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ALL PARTS TO ONE QUESTION PLEASE ANSWER ALL THANK YOU Fletcher Industries has $1,000 par value bonds with a coupon rate of 8% per year

ALL PARTS TO ONE QUESTION PLEASE ANSWER ALL THANK YOU

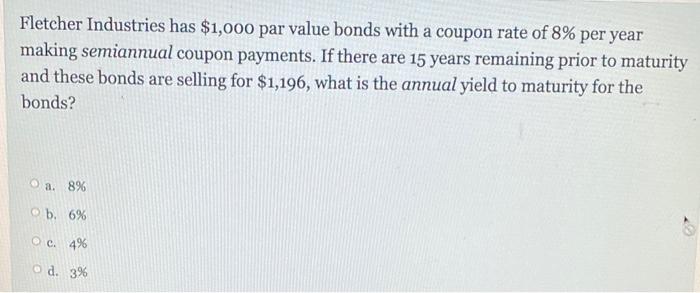

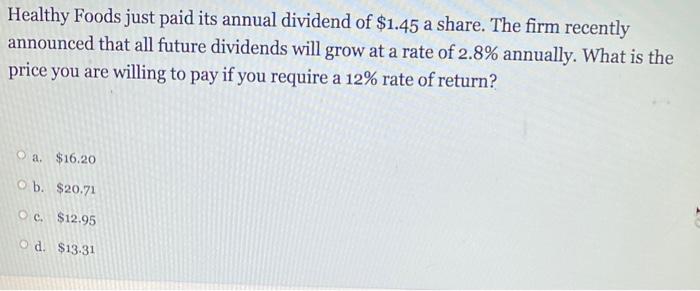

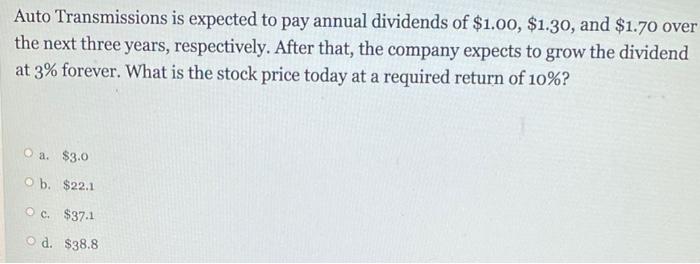

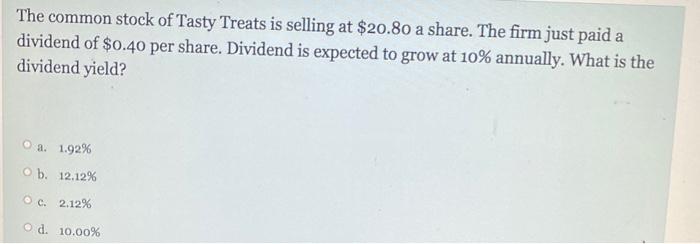

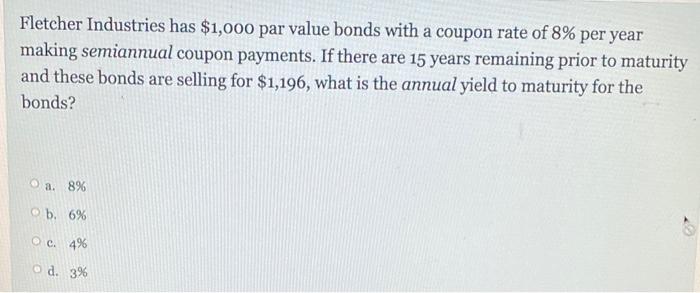

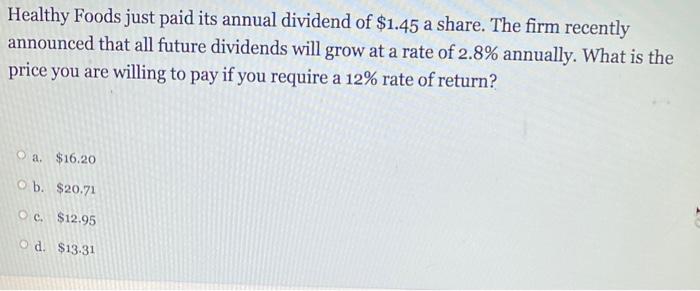

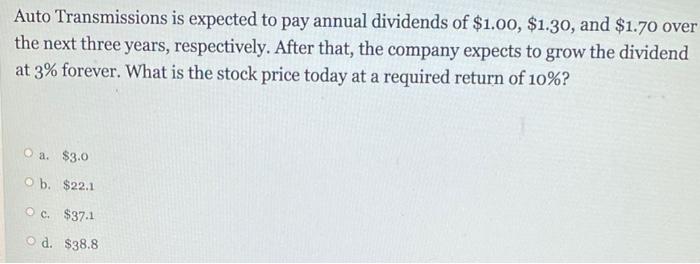

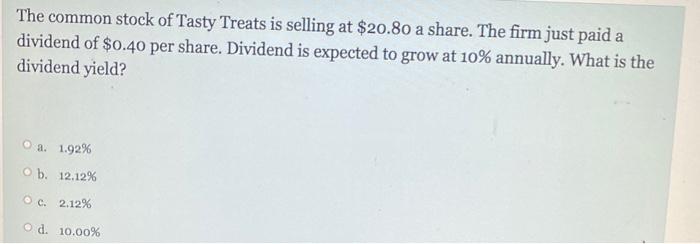

Fletcher Industries has $1,000 par value bonds with a coupon rate of 8% per year making semiannual coupon payments. If there are 15 years remaining prior to maturity and these bonds are selling for $1,196, what is the annual yield to maturity for the bonds? a. 8% b. 6% Oc.4% d. 3% Healthy Foods just paid its annual dividend of $1.45 a share. The firm recently announced that all future dividends will grow at a rate of 2.8% annually. What is the price you are willing to pay if you require a 12% rate of return? a. $16.20 b. $20.71 c. $12.95 Od $13.31 Auto Transmissions is expected to pay annual dividends of $1.00, $1.30, and $1.70 over the next three years, respectively. After that, the company expects to grow the dividend at 3% forever. What is the stock price today at a required return of 10%? a. $3.0 Ob $22.1 c. $37.1 d. $38.8 a The common stock of Tasty Treats is selling at $20.80 a share. The firm just paid a dividend of $0.40 per share. Dividend is expected to grow at 10% annually. What is the dividend yield? a. 1.92% ob 12.12% c. 2.12% od 10.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started