Answered step by step

Verified Expert Solution

Question

1 Approved Answer

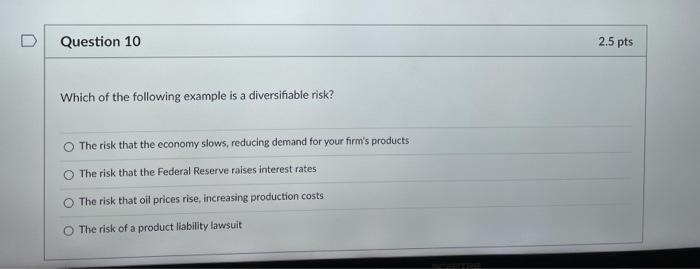

all please D Question 10 2.5 pts Which of the following example is a diversifiable risk? The risk that the economy slows, reducing demand for

all please

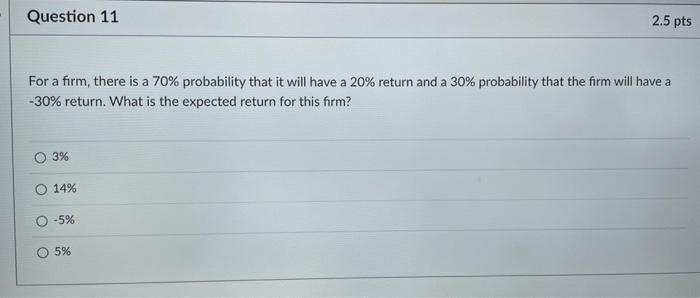

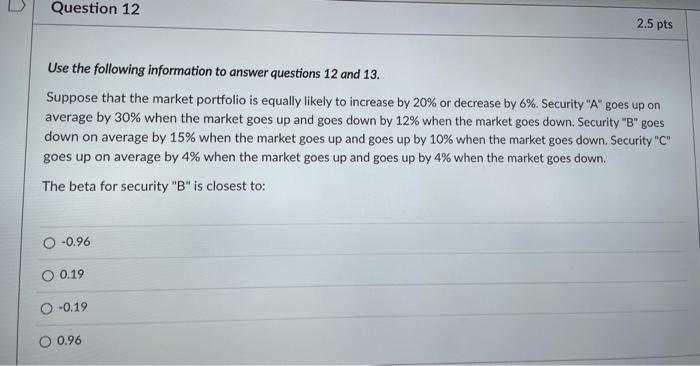

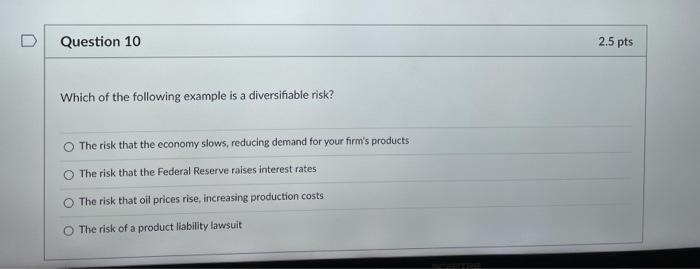

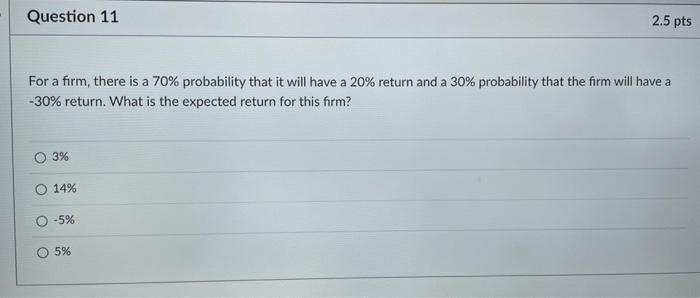

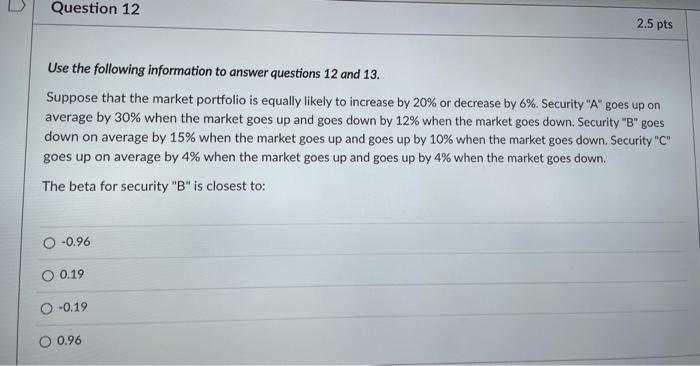

D Question 10 2.5 pts Which of the following example is a diversifiable risk? The risk that the economy slows, reducing demand for your firm's products The risk that the Federal Reserve raises interest rates The risk that oil prices rise, increasing production costs The risk of a product liability lawsuit Question 11 2.5 pts For a firm, there is a 70% probability that it will have a 20% return and a 30% probability that the firm will have a -30% return. What is the expected return for this firm? 3% 14% -5% 5% Question 12 2.5 pts Use the following information to answer questions 12 and 13. Suppose that the market portfolio is equally likely to increase by 20% or decrease by 6%. Security "A" goes up on average by 30% when the market goes up and goes down by 12% when the market goes down. Security "B" goes down on average by 15% when the market goes up and goes up by 10% when the market goes down. Security "C" goes up on average by 4% when the market goes up and goes up by 4% when the market goes down. The beta for security "B" is closest to: -0.96 O 0.19 0 -0.19 0.96

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started