Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All the answers are shown. Can you explain with using excel with showing the formulas? Thank you. The wireless phone manufacturing division of a consumer

All the answers are shown. Can you explain with using excel with showing the formulas? Thank you.

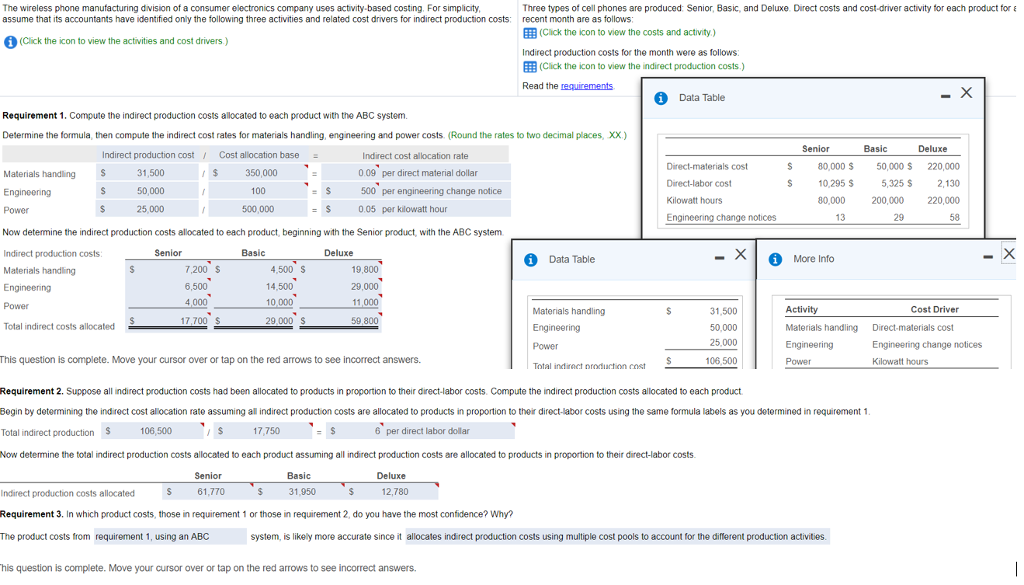

The wireless phone manufacturing division of a consumer electronics company uses activity-based costing, For simplicity assume that its accountants have identified only the following three activities and related cost drivers for indirect production costs: Three types of cell phones are produced Senior, Basic, and Deluxe Direct costs and cost-driver activity tor each product for ? recent month are as follows ?(Click the icon to view the costs and activity) Indirect production costs for the month were as follows ?(Click the icon to view the indirect production costs ) Read the requirements (Click the icon to view the activities and cost drivers) Data Table Requirement 1. Compute the indirect production costs allocated to each product with the ABC system Determine the formula, then compute the indirect cost rates for materials handling, engineering and power costs (Round the rates to two decimal places, xx) Basic Deluxe Indirect production costCost allocation base 31,500 50,000 25,000 350,000 100 500,000 Indirect cost allocation rate 009 per direct material dollar 500 per engineering change notice 0.05 per klowatt hour 80,000 S 50,000 S 220,000 5,325 s 2,130 80,000 200,000 220,000 58 Materials handling S Engineering Power Now detemine the indirect production costs allocated to each product, beginning with the Senior product, with the ABC system Indirect production costs Materials handling Engineering Power Total indirect costs allocated 10,295 S Kilowatt hours Engineering change notices 29 Senior Basic Deluxe Data Table More Info 7,200 S 6,500 4,000 4,500 S 14,500 10,000 29,000 S 19,800 29,000 11,000 Materials handling Cost Driver 31,500 50,000 25.000 06,500 17,700 $ Materials handling Engineering Direct-materials cost Engineering change notices Kilowatt hours Power This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. Total indiect oodiuction cost Requirement 2. Suppose all indirect production costs had been allocated to products in proportion to their direct-labor costs. Compute the indirect production costs allocated to each product Begin by determining the indi rect cost allocation rate assuming al indirect production costs are allocated to products in proportion to their direct-labor costs using the same tormula labels as you determined in requirement 1 Total indirect production S Now determine the total indirect production costs allocated to each product assuming all indirect production costs are allocated to products in proportion to their direct-labor costs. 106,500 17,750 6 per direct labor dollar Basic Deluxe 61,770 31950 12,780 Indirect production costs allocated Requirement 3. In which product costs, those in requirement 1 or those in requirement 2, do you have the most confidence? Why? The product costs from requirement 1, using an ABC system, is likely more accurate since it allocates indi rect production costs using multiple cost pools to account for the dilerent production activities his question is complete. Move your cursor over or tap on the red arrows to see incorrect answersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started