Answered step by step

Verified Expert Solution

Question

1 Approved Answer

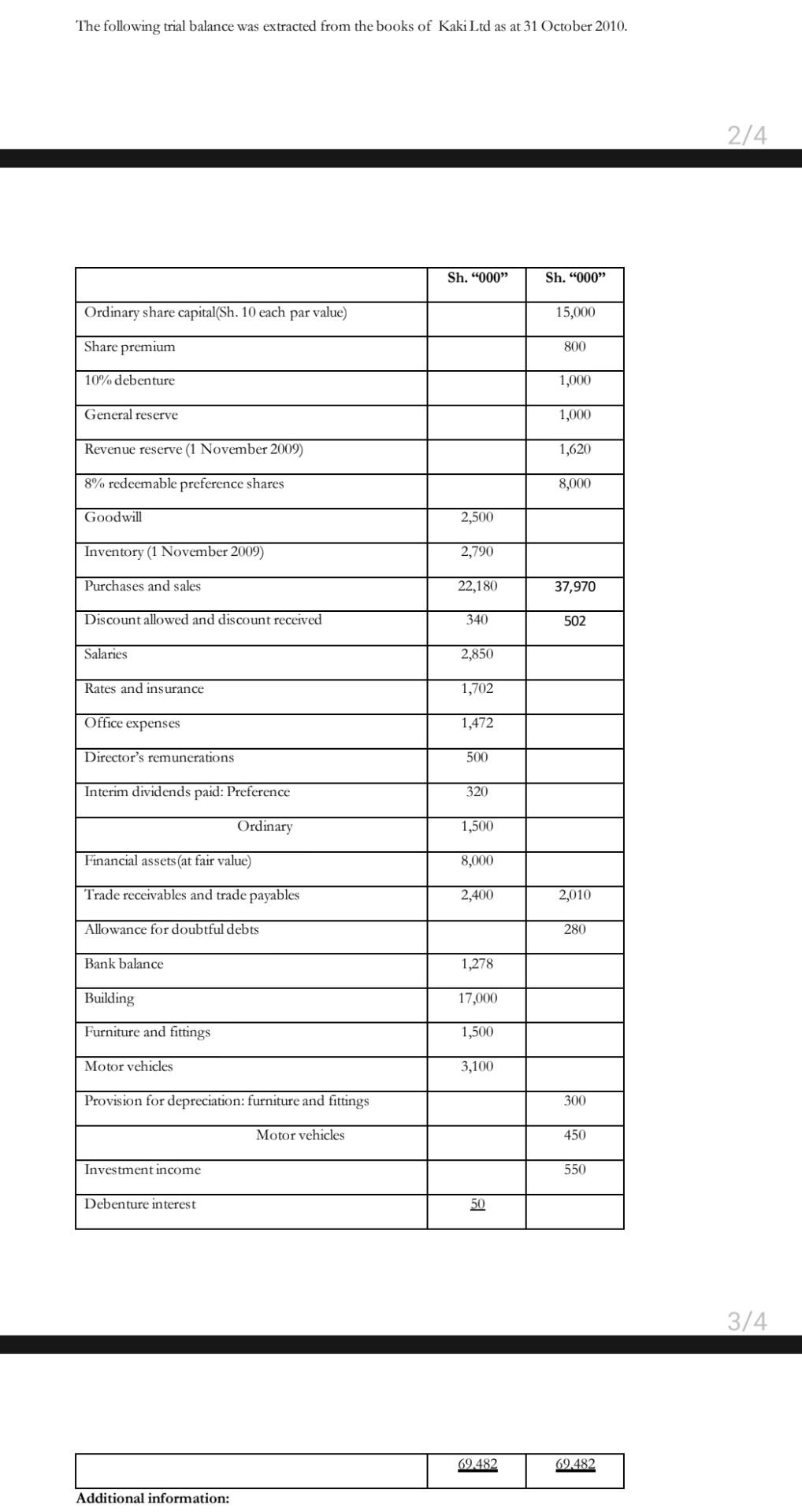

all the information is in the images The following trial balance was extracted from the books of Kaki Ltd as at 31 October 2010. Additional

all the information is in the images

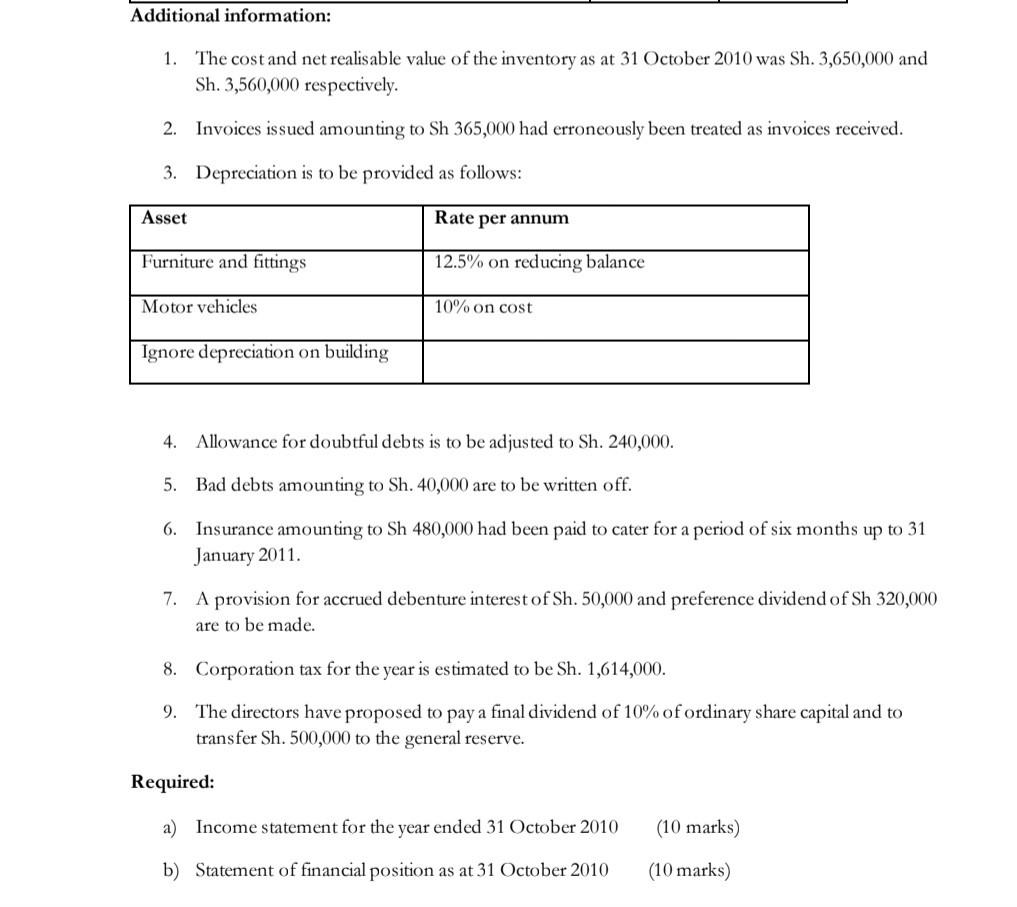

The following trial balance was extracted from the books of Kaki Ltd as at 31 October 2010. Additional information: 1. The cost and net realisable value of the inventory as at 31 October 2010 was Sh. 3,650,000 and Sh. 3,560,000 respectively. 2. Invoices issued amounting to Sh365,000 had erroneously been treated as invoices received. 3. Depreciation is to be provided as follows: 4. Allowance for doubtful debts is to be adjusted to Sh. 240,000 . 5. Bad debts amounting to Sh. 40,000 are to be written off. 6. Insurance amounting to Sh 480,000 had been paid to cater for a period of six months up to 31 January 2011. 7. A provision for accrued debenture interest of Sh. 50,000 and preference dividend of Sh 320,000 are to be made. 8. Corporation tax for the year is estimated to be Sh. 1,614,000. 9. The directors have proposed to pay a final dividend of 10% of ordinary share capital and to transfer Sh. 500,000 to the general reserve. Required: a) Income statement for the year ended 31 October 2010 (10 marks) b) Statement of financial position as at 31 October 2010 (10 marks) The following trial balance was extracted from the books of Kaki Ltd as at 31 October 2010. Additional information: 1. The cost and net realisable value of the inventory as at 31 October 2010 was Sh. 3,650,000 and Sh. 3,560,000 respectively. 2. Invoices issued amounting to Sh365,000 had erroneously been treated as invoices received. 3. Depreciation is to be provided as follows: 4. Allowance for doubtful debts is to be adjusted to Sh. 240,000 . 5. Bad debts amounting to Sh. 40,000 are to be written off. 6. Insurance amounting to Sh 480,000 had been paid to cater for a period of six months up to 31 January 2011. 7. A provision for accrued debenture interest of Sh. 50,000 and preference dividend of Sh 320,000 are to be made. 8. Corporation tax for the year is estimated to be Sh. 1,614,000. 9. The directors have proposed to pay a final dividend of 10% of ordinary share capital and to transfer Sh. 500,000 to the general reserve. Required: a) Income statement for the year ended 31 October 2010 (10 marks) b) Statement of financial position as at 31 October 2010 (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started