Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All the information needed is provided above. Krystal. Krystal is a U.S.-based company that manufactures, sells, and installs water purification equipment. On April 11, the

All the information needed is provided above.

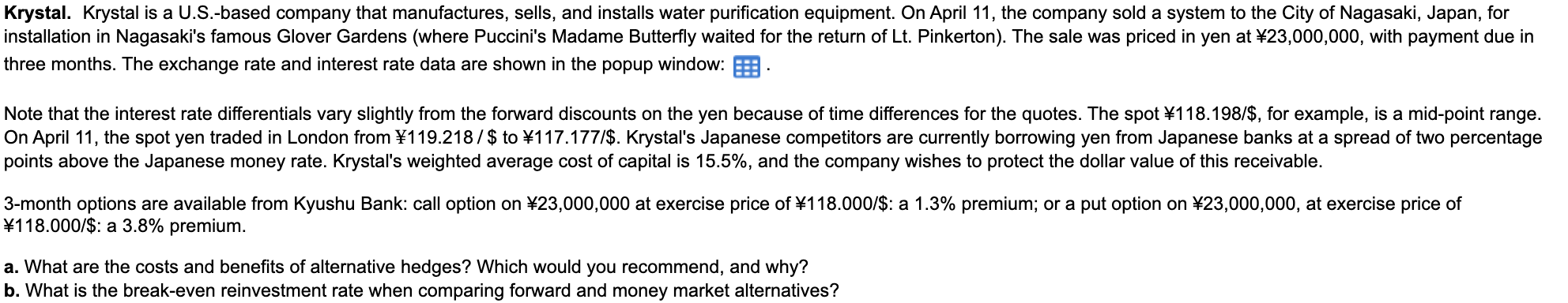

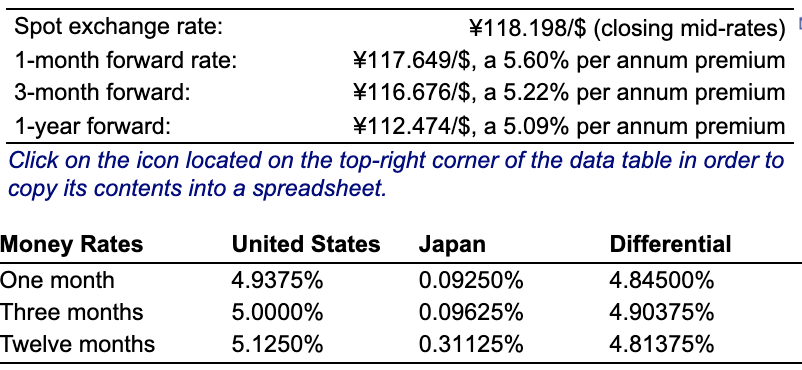

Krystal. Krystal is a U.S.-based company that manufactures, sells, and installs water purification equipment. On April 11, the company sold a system to the City of Nagasaki, Japan, for installation in Nagasaki's famous Glover Gardens (where Puccini's Madame Butterfly waited for the return of Lt. Pinkerton). The sale was priced in yen at 23,000,000, with payment due in three months. The exchange rate and interest rate data are shown in the popup window: Note that the interest rate differentials vary slightly from the forward discounts on the yen because of time differences for the quotes. The spot #118.198/$, for example, is a mid-point range. On April 11, the spot yen traded in London from 119.218/$ to 117.177/$. Krystal's Japanese competitors are currently borrowing yen from Japanese banks at a spread of two percentage points above the Japanese money rate. Krystal's weighted average cost of capital is 15.5%, and the company wishes to protect the dollar value of this receivable. 3-month options are available from Kyushu Bank: call option on 23,000,000 at exercise price of 118.000/$: a 1.3% premium; or a put option on 23,000,000, at exercise price of 118.000/$: a 3.8% premium. a. What are the costs and benefits of alternative hedges? Which would you recommend, and why? b. What is the break-even reinvestment rate when comparing forward and money market alternatives? Spot exchange rate: 118.198/$ (closing mid-rates) 1-month forward rate: 117.649/$, a 5.60% per annum premium 3-month forward: 116.676/$, a 5.22% per annum premium 1-year forward: 112.474/$, a 5.09% per annum premium Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Money Rates One month Three months Twelve months United States 4.9375% 5.0000% 5.1250% Japan 0.09250% 0.09625% 0.31125% Differential 4.84500% 4.90375% 4.81375% Krystal. Krystal is a U.S.-based company that manufactures, sells, and installs water purification equipment. On April 11, the company sold a system to the City of Nagasaki, Japan, for installation in Nagasaki's famous Glover Gardens (where Puccini's Madame Butterfly waited for the return of Lt. Pinkerton). The sale was priced in yen at 23,000,000, with payment due in three months. The exchange rate and interest rate data are shown in the popup window: Note that the interest rate differentials vary slightly from the forward discounts on the yen because of time differences for the quotes. The spot #118.198/$, for example, is a mid-point range. On April 11, the spot yen traded in London from 119.218/$ to 117.177/$. Krystal's Japanese competitors are currently borrowing yen from Japanese banks at a spread of two percentage points above the Japanese money rate. Krystal's weighted average cost of capital is 15.5%, and the company wishes to protect the dollar value of this receivable. 3-month options are available from Kyushu Bank: call option on 23,000,000 at exercise price of 118.000/$: a 1.3% premium; or a put option on 23,000,000, at exercise price of 118.000/$: a 3.8% premium. a. What are the costs and benefits of alternative hedges? Which would you recommend, and why? b. What is the break-even reinvestment rate when comparing forward and money market alternatives? Spot exchange rate: 118.198/$ (closing mid-rates) 1-month forward rate: 117.649/$, a 5.60% per annum premium 3-month forward: 116.676/$, a 5.22% per annum premium 1-year forward: 112.474/$, a 5.09% per annum premium Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Money Rates One month Three months Twelve months United States 4.9375% 5.0000% 5.1250% Japan 0.09250% 0.09625% 0.31125% Differential 4.84500% 4.90375% 4.81375%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started