Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the year ended August 31, 2020, Zefer Ltd., a Canadian-controlled private corporation, reported a net income before income taxes of $526,500. The statement

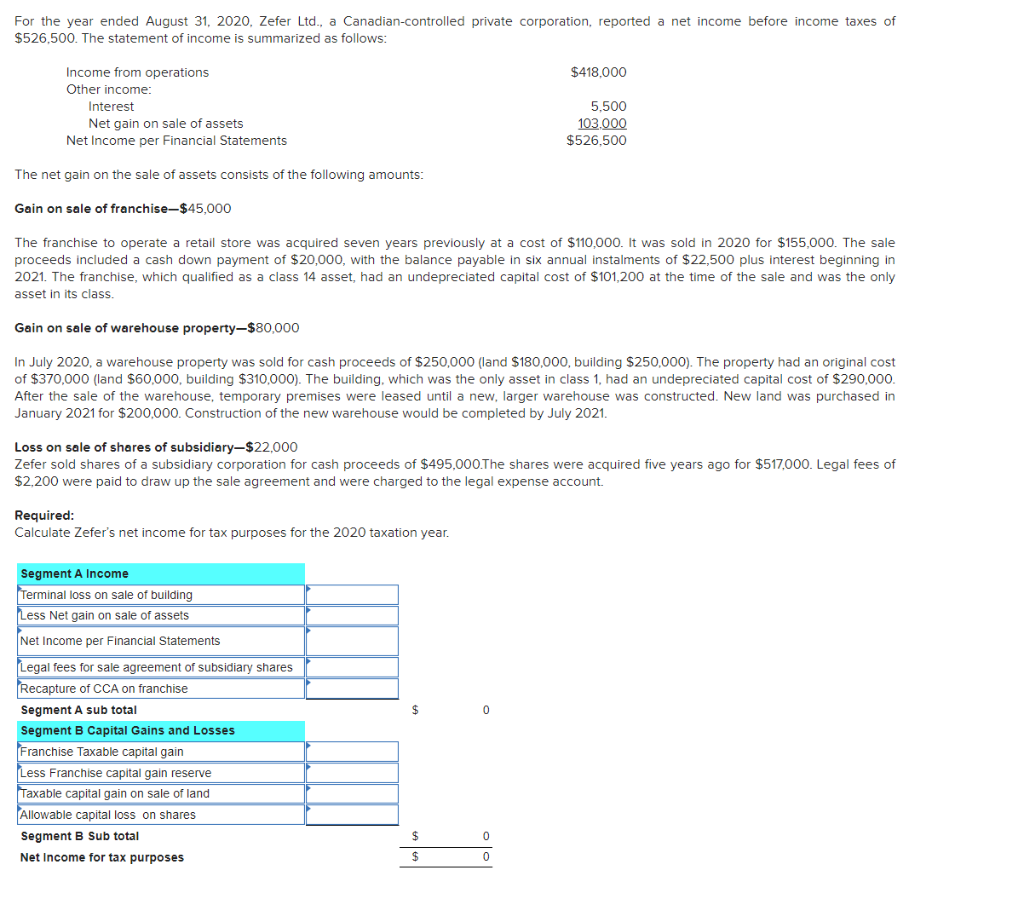

For the year ended August 31, 2020, Zefer Ltd., a Canadian-controlled private corporation, reported a net income before income taxes of $526,500. The statement of income is summarized as follows: Income from operations Other income: Interest Net gain on sale of assets Net Income per Financial Statements The net gain on the sale of assets consists of the following amounts: Gain on sale of franchise-$45,000 $418,000 5,500 103,000 $526,500 The franchise to operate a retail store was acquired seven years previously at a cost of $110,000. It was sold in 2020 for $155,000. The sale proceeds included a cash down payment of $20,000, with the balance payable in six annual instalments of $22,500 plus interest beginning in 2021. The franchise, which qualified as a class 14 asset, had an undepreciated capital cost of $101,200 at the time of the sale and was the only asset in its class. Gain on sale of warehouse property-$80,000 In July 2020, a warehouse property was sold for cash proceeds of $250,000 (land $180,000, building $250,000). The property had an original cost of $370,000 (land $60,000, building $310,000). The building, which was the only asset in class 1, had an undepreciated capital cost of $290,000. After the sale of the warehouse, temporary premises were leased until a new, larger warehouse was constructed. New land was purchased in January 2021 for $200,000. Construction of the new warehouse would be completed by July 2021. Loss on sale of shares of subsidiary-$22,000 Zefer sold shares of a subsidiary corporation for cash proceeds of $495,000.The shares were acquired five years ago for $517,000. Legal fees of $2,200 were paid to draw up the sale agreement and were charged to the legal expense account. Required: Calculate Zefer's net income for tax purposes for the 2020 taxation year. Segment A Income Terminal loss on sale of building Less Net gain on sale of assets Net Income per Financial Statements Legal fees for sale agreement of subsidiary shares Recapture of CCA on franchise Segment A sub total Segment B Capital Gains and Losses Franchise Taxable capital gain Less Franchise capital gain reserve Taxable capital gain on sale of land Allowable capital loss on shares Segment B Sub total Net Income for tax purposes $ $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Zefers net income for tax purposes for the 2020 taxation year we need to adjust the financial statement income for tax purposes The proce...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started