Answered step by step

Verified Expert Solution

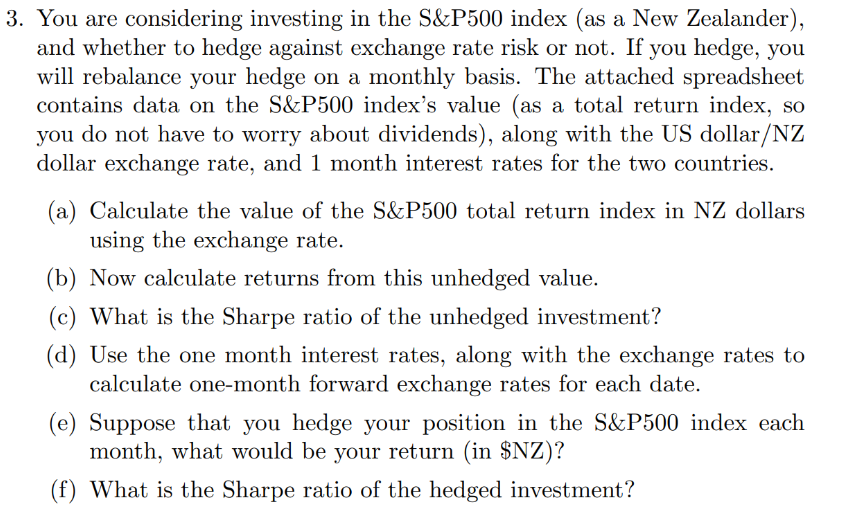

Question

1 Approved Answer

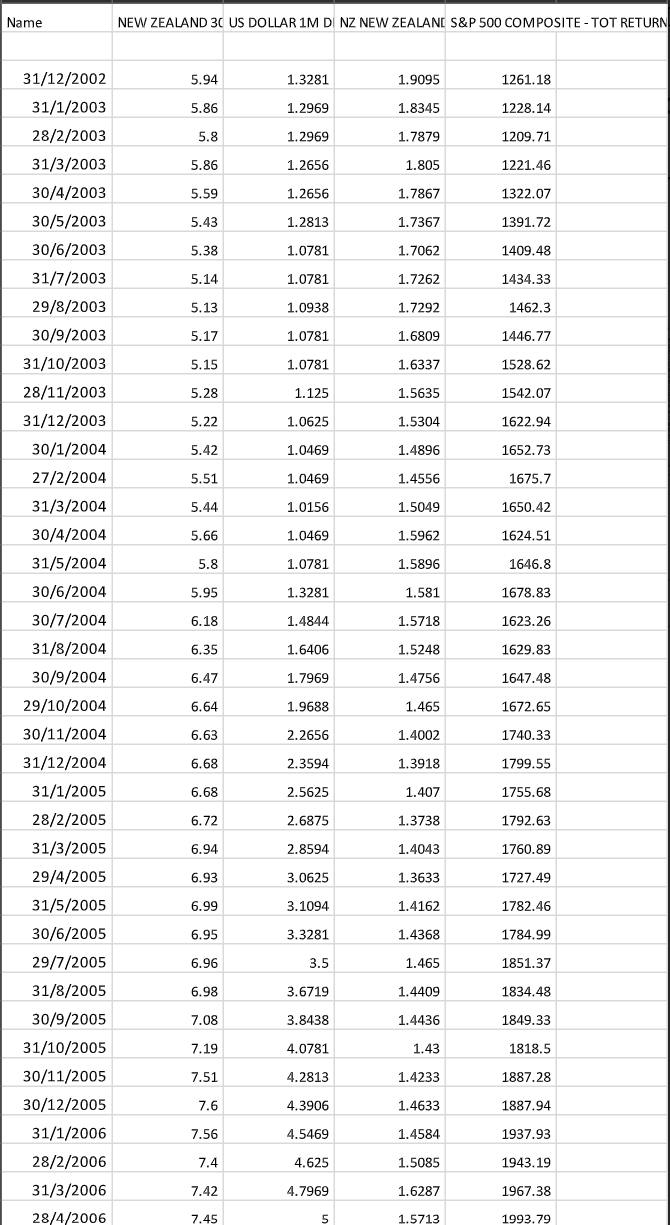

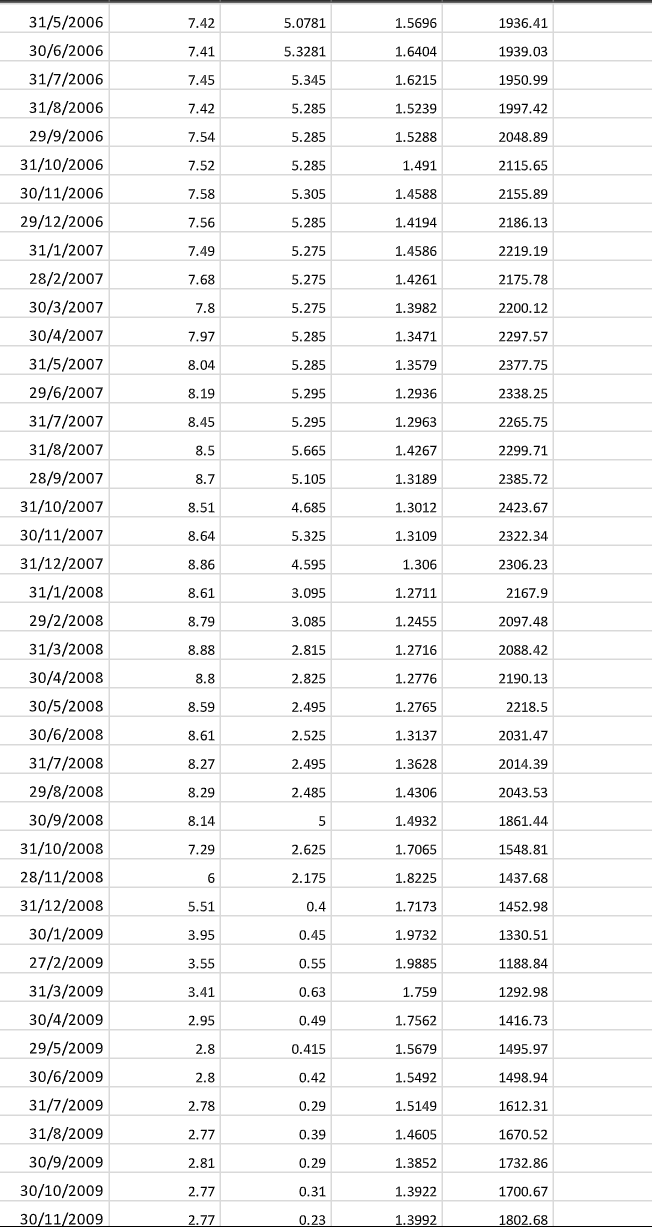

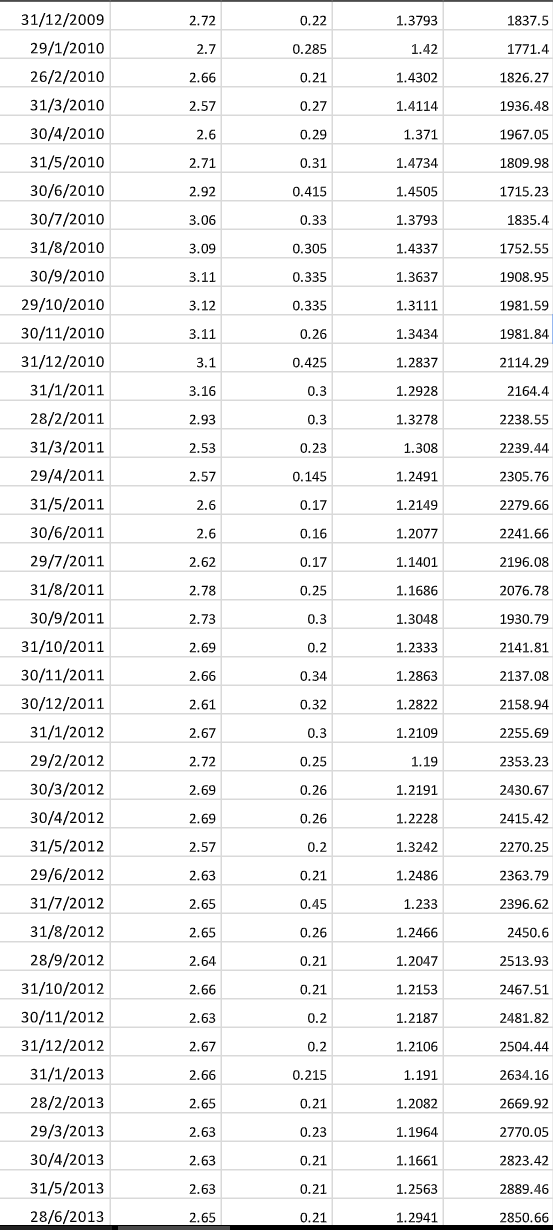

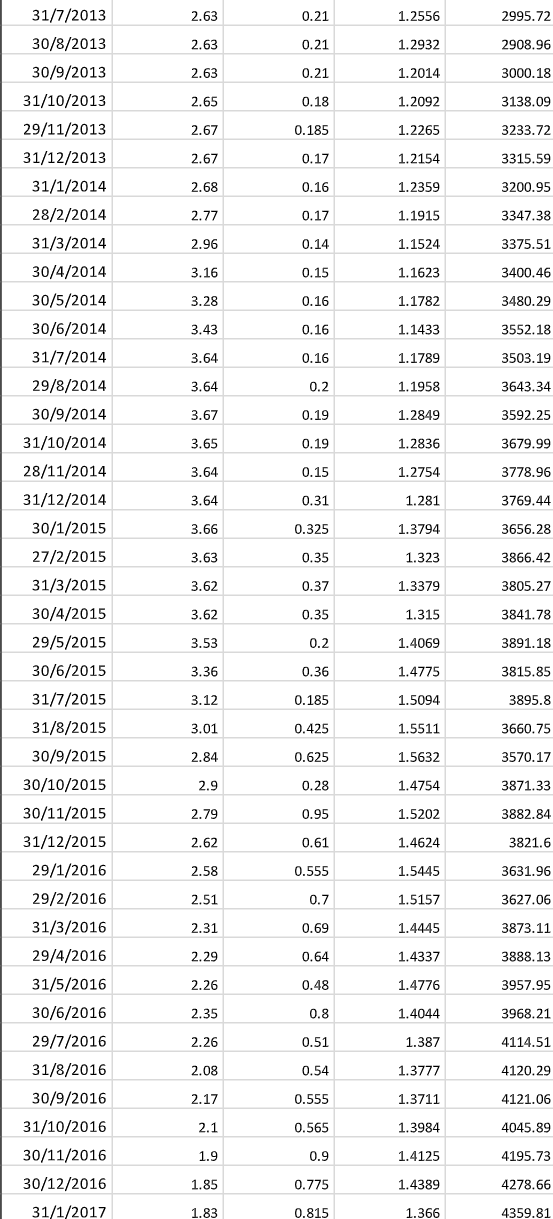

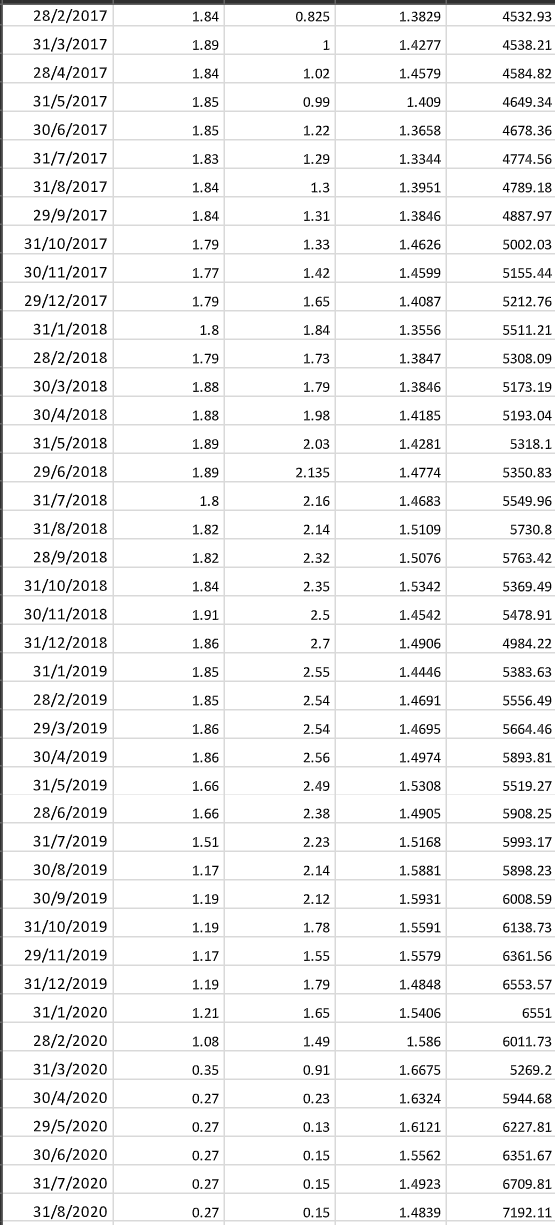

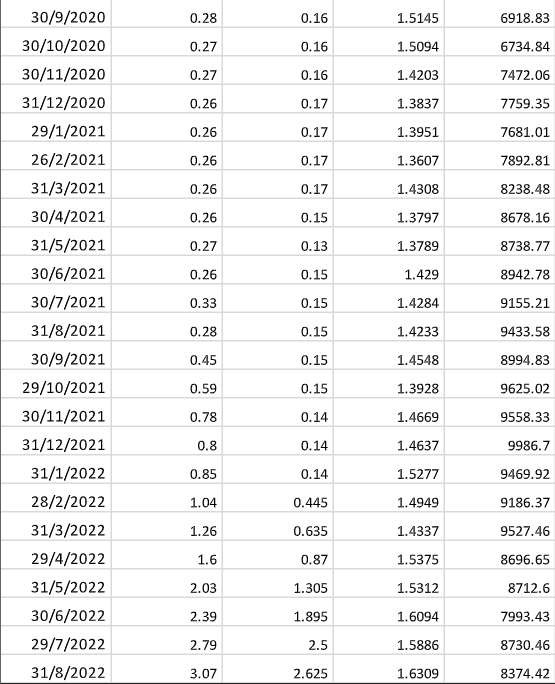

All the table pics are all one table there was no way to post the spreadsheet Name NEW ZEALAND 3C US DOLLAR 1M D NZ

All the table pics are all one table there was no way to post the spreadsheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started