Question

Allan and Hardyare in partnership. The following are the additional information and extracts from the Trail Balance at 31 December 2020and after the Gross profit

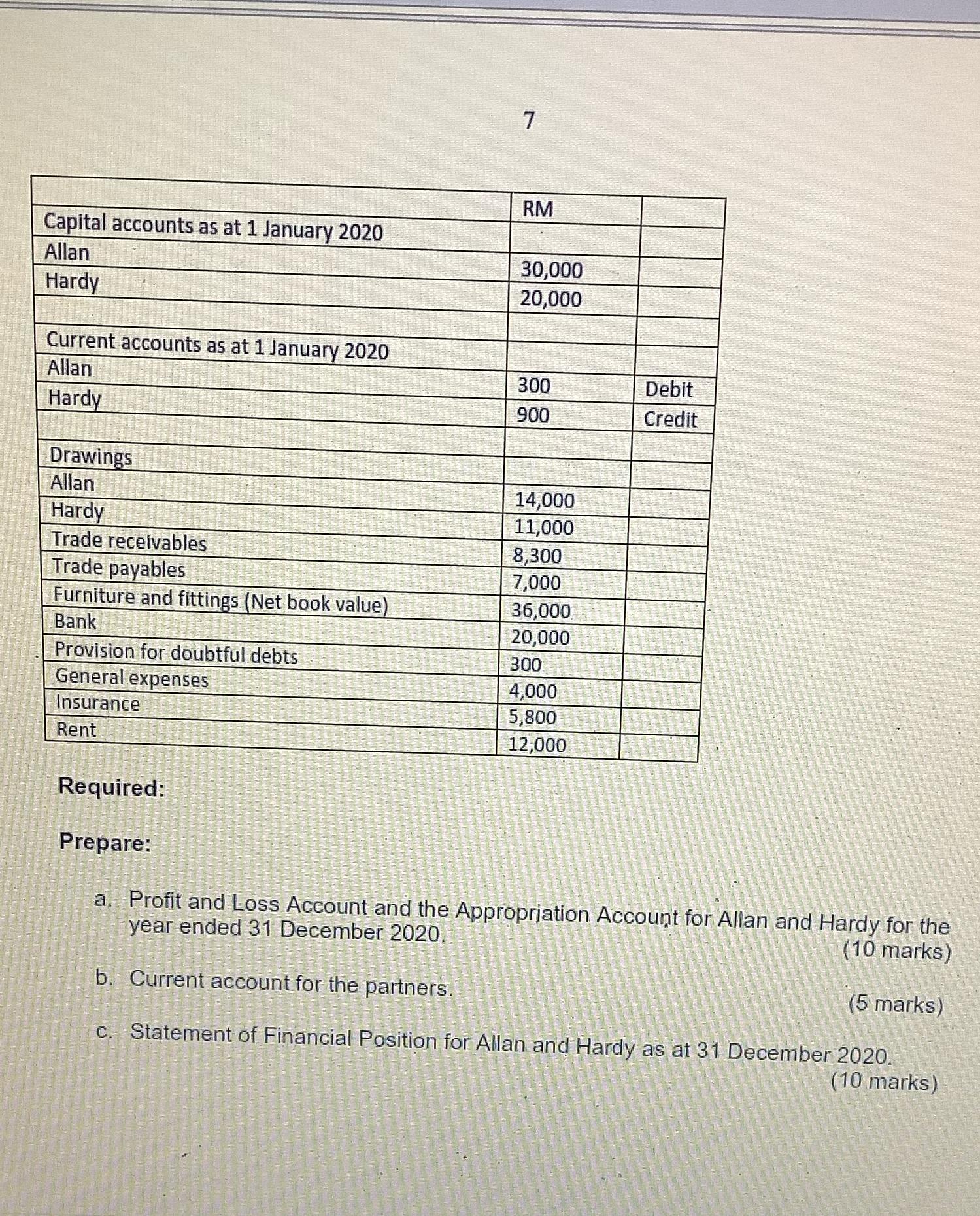

Allan and Hardyare in partnership. The following are the additional information and extracts from the Trail Balance at 31 December 2020and after the Gross profit had been calculated. Additional information •Gross profit for the year ended 31 December 2020was shown in the Trading Account at RM68,200. •The insurancepremium included RM1,000paid in advance for the year 2021. •A debt of RM300 which was included in the trade debtors is to be written off as bad debts. •Rent of RM200 was still unpaid on 31 December 2020. *A provision for doubtful debts is to be maintained at 5% of trade receivable. •Depreciation of furniture and fittings is to be provided at 5% on book value. •Inventory held at 31 December 2020was RM15,000. •Allan and Hardywill share their profits (or losses) in the ratio of 3:2 respectively.Interest on capital at 5% is to be provided for each partner and Hardyis entitled to a salary of RM8,000

7 RM Capital accounts as at 1 January 2020 Allan 30,000 Hardy 20,000 Current accounts as at 1 January 2020 Allan 300 Debit Hardy 900 Credit Drawings Allan 14,000 Hardy 11,000 Trade receivables 8,300 Trade payables 7,000 Furniture and fittings (Net book value) 36,000 Bank 20,000 Provision for doubtful debts 300 General expenses 4,000 Insurance Rent 5,800 12,000 Required: Prepare: a. Profit and Loss Account and the Appropriation Account for Allan and Hardy for the year ended 31 December 2020. (10 marks) b. Current account for the partners. (5 marks) c. Statement of Financial Position for Allan and Hardy as at 31 December 2020. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Allan and Hardy Profit and Loss Account for the year ended 31 December 2020 To Gross Profit given RM ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started