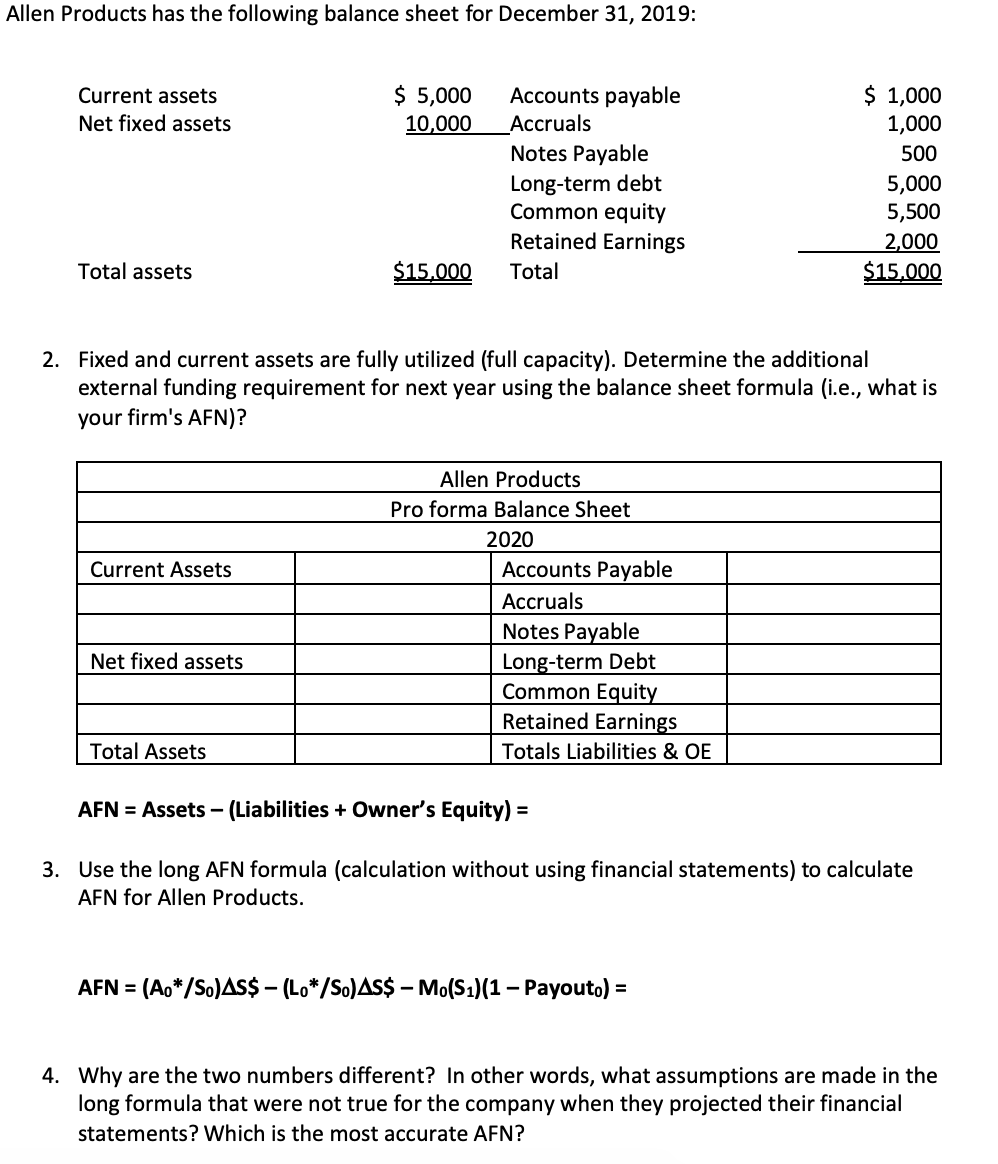

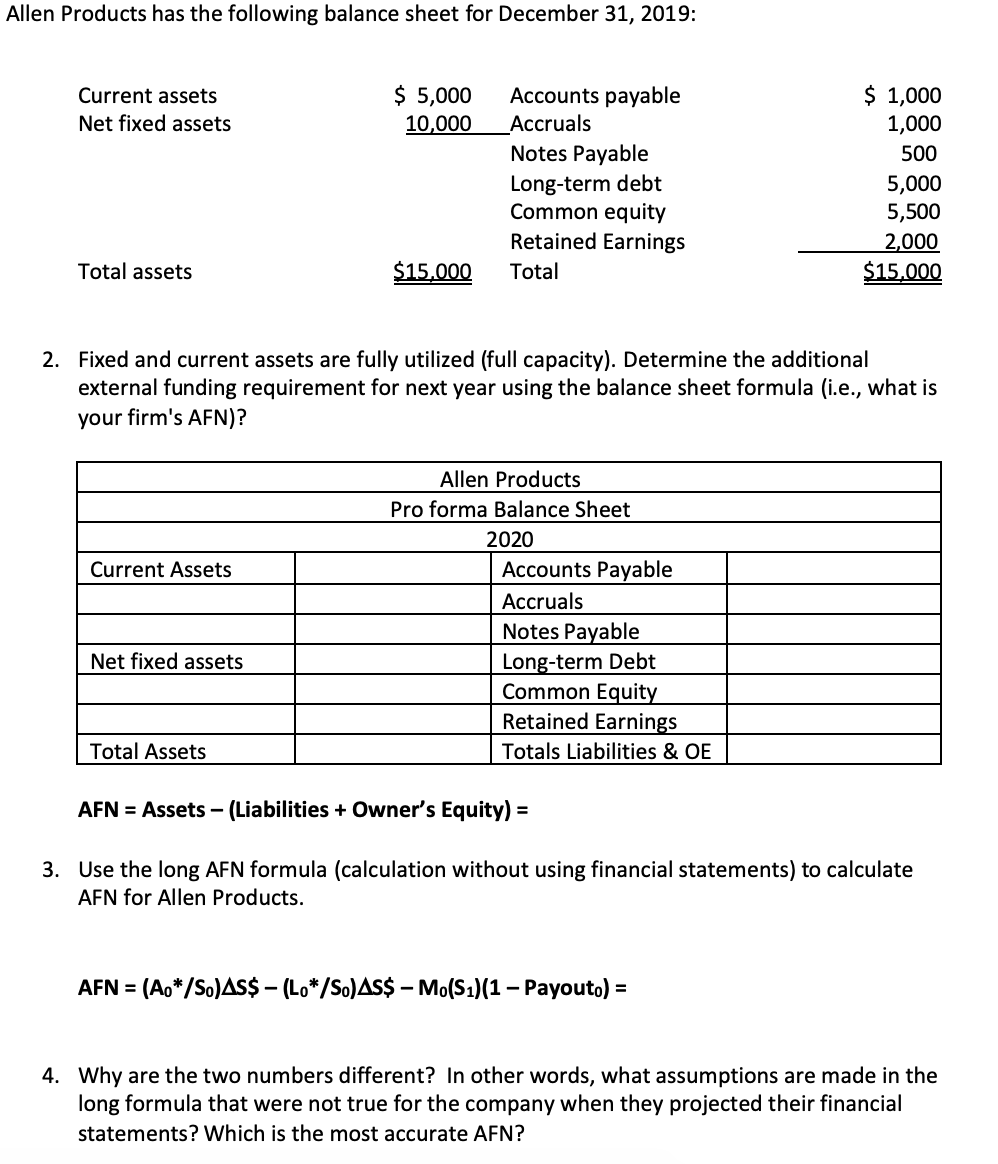

Allen Products has the following balance sheet for December 31, 2019: Current assets Net fixed assets $ 5,000 10,000 Accounts payable Accruals Notes Payable Long-term debt Common equity Retained Earnings Total $ 1,000 1,000 500 5,000 5,500 2,000 $15.000 Total assets $15.000 2. Fixed and current assets are fully utilized (full capacity). Determine the additional external funding requirement for next year using the balance sheet formula (i.e., what is your firm's AFN)? Current Assets Allen Products Pro forma Balance Sheet 2020 Accounts Payable Accruals Notes Payable Long-term Debt Common Equity Retained Earnings Totals Liabilities & OE Net fixed assets Total Assets AFN = Assets (Liabilities + Owner's Equity) = 3. Use the long AFN formula (calculation without using financial statements) to calculate AFN for Allen Products. AFN = (Ao*/S.)AS$ - (L0*/S.)AS$ - M.(S1)(1 - Payouto) = 4. Why are the two numbers different? In other words, what assumptions are made in the long formula that were not true for the company when they projected their financial statements? Which is the most accurate AFN? Allen Products has the following balance sheet for December 31, 2019: Current assets Net fixed assets $ 5,000 10,000 Accounts payable Accruals Notes Payable Long-term debt Common equity Retained Earnings Total $ 1,000 1,000 500 5,000 5,500 2,000 $15.000 Total assets $15.000 2. Fixed and current assets are fully utilized (full capacity). Determine the additional external funding requirement for next year using the balance sheet formula (i.e., what is your firm's AFN)? Current Assets Allen Products Pro forma Balance Sheet 2020 Accounts Payable Accruals Notes Payable Long-term Debt Common Equity Retained Earnings Totals Liabilities & OE Net fixed assets Total Assets AFN = Assets (Liabilities + Owner's Equity) = 3. Use the long AFN formula (calculation without using financial statements) to calculate AFN for Allen Products. AFN = (Ao*/S.)AS$ - (L0*/S.)AS$ - M.(S1)(1 - Payouto) = 4. Why are the two numbers different? In other words, what assumptions are made in the long formula that were not true for the company when they projected their financial statements? Which is the most accurate AFN