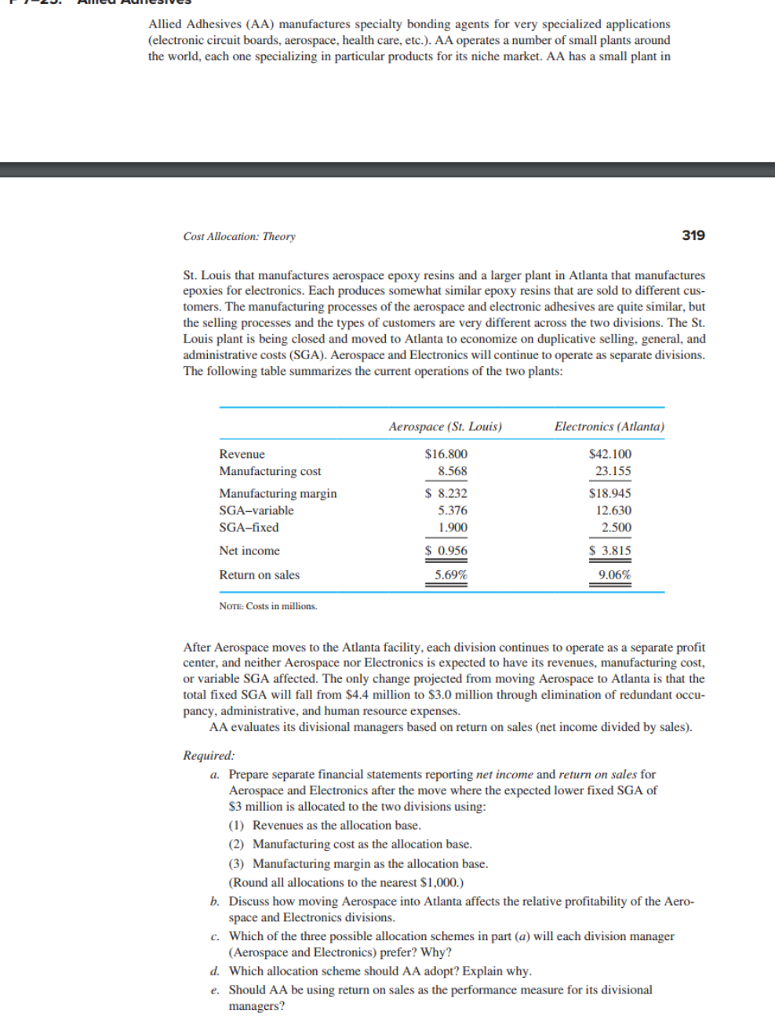

Allied Adhesives (AA) manufactures specialty bonding agents for very specialized applications (electronic circuit boards, aerospace, health care, etc.). AA operates a number of small plants around the world, each one specializing in particular products for its niche market. AA has a small plant in Cost Allocation: Theory 319 St. Louis that manufactures aerospace epoxy resins and a larger plant in Atlanta that manufactures epoxies for electronics. Each produces somewhat similar epoxy resins that are sold to different cus- tomers. The manufacturing processes of the aerospace and electronic adhesives are quite similar, but the selling processes and the types of customers are very different across the two divisions. The St. Louis plant is being closed and moved to Atlanta to economize on duplicative selling, general, and administrative costs (SGA). Aerospace and Electronics will continue to operate as separate divisions. The following table summarizes the current operations of the two plants: Aerospace (St. Louis) Electronics (Atlanta) $16.800 8.568 S 8.232 5.376 1.900 0.956 5.69% Revenue $42.100 23.155 $18.945 12.630 2.500 S 3.815 9.06% g cost Manufacturing margin SGA-variable SGA-fixed Net income Return on sales NoTE: Costs in millions. After Aerospace moves to the Atlanta facility, each division continues to operate as a separate profit center, and neither Aerospace nor Electronics is expected to have its revenues, manufacturing cost, or variable SGA affected. The only change projected from moving Aerospace to Atlanta is that the total fixed SGA will fall from $4.4 million to $3.0 million through elimination of redundant occu- pancy, administrative, and human resource expenses. AA evaluates its divisional managers based on return on sales (net income divided by sales). Required Prepare separate financial statements reporting net income and return on sales for Aerospace and Electronics after the move where the expected lower fixed SGA of S3 million is allocated to the two divisions using: (1) Revenues as the allocation base (2) Manufacturing cost as the allocation base. (3) Manufacturing margin as the allocation base. (Round all allocations to the nearest $1,000.) a. b. Discuss how moving Aerospace into Atlanta affects the relative profitability of the Aero e and Electronics divisions. spac Which of the three possible allocation schemes in part (a) will each division manager (Aerospace and Electronics) prefer? Why? Which allocation scheme should AA adopt? Explain why Should AA be using return on sales as the performance measure for its divisional managers? c. d. e