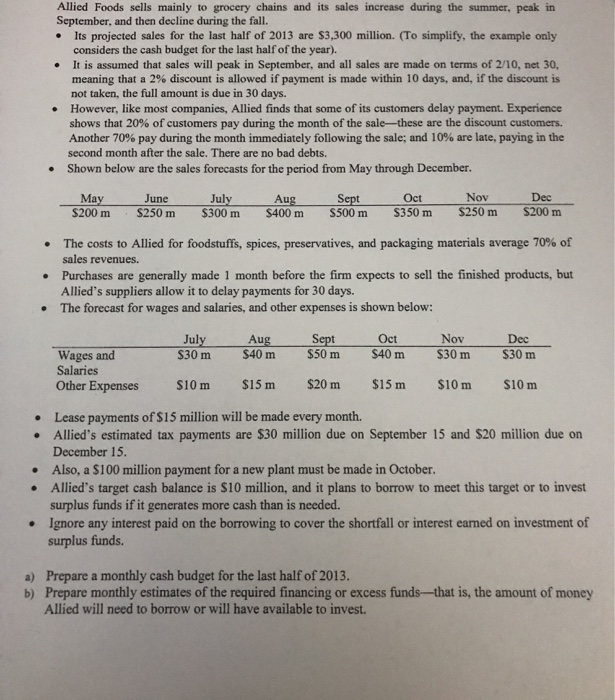

Allied Foods sells mainly to grocery chains and its sales increase during the summer, peak in September, and then decline during the fall. Its projected sales for the last half of 2013 are $3,300 million. (To simplify, the example only considers the cash budget for the last half of the year). It is assumed that sales will peak in September, and all sales are made on terms of 2/10, net 30. meaning that a 2% discount is allowed if payment is made within 10 days, and, if the discount is not taken, the full amount is due in 30 days. However, like most companies, Allied finds that some of its customers delay payment. Experience shows that 20% of customers pay during the month of the salethese are the discount customers. Another 70% pay during the month immediately following the sale; and 10% are late, paying in the second month after the sale. There are no bad debts. Shown below are the sales forecasts for the period from May through December. . Aug May June July Sept Oct Nov Dec S200 m $250 m $300 m $400 m S500 m S350 m $250 m $200 m The costs to Allied for foodstuffs, spices, preservatives, and packaging materials average 70% of sales revenues. Purchases are generally made 1 month before the firm expects to sell the finished products, but Allied's suppliers allow it to delay payments for 30 days. The forecast for wages and salaries, and other expenses is shown below: July Aug Sept Oct Nov Dec Wages and S30 m $40 m $50 m $40 m $30 m $30 m Salaries Other Expenses $10 m $15 m $20 m $15 m $10 m $10 m Lease payments of $15 million will be made every month. Allied's estimated tax payments are $30 million due on September 15 and $20 million due on December 15. Also, a $100 million payment for a new plant must be made in October. Allied's target cash balance is $10 million, and it plans to borrow to meet this target or to invest surplus funds if it generates more cash than is needed. Ignore any interest paid on the borrowing to cover the shortfall or interest earned on investment of surplus funds. a) Prepare a monthly cash budget for the last half of 2013. b) Prepare monthly estimates of the required financing or excess funds--that is, the amount of money Allied will need to borrow or will have available to invest