Answered step by step

Verified Expert Solution

Question

1 Approved Answer

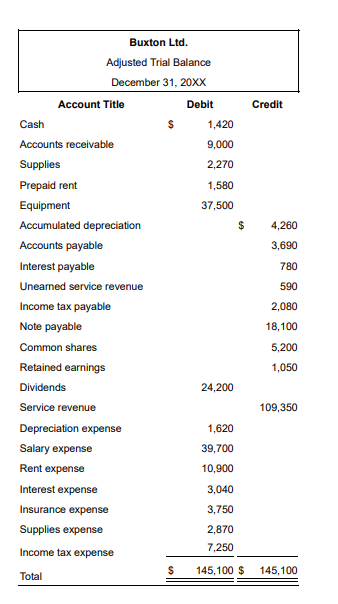

begin{tabular}{|c|c|c|c|} hline multicolumn{4}{|c|}{BuxtonLtd.AdjustedTrialBalanceDecember31,20XX} hline Account Title & & Debit & Credit hline Cash & $ & 1,420 & hline Accounts receivable &

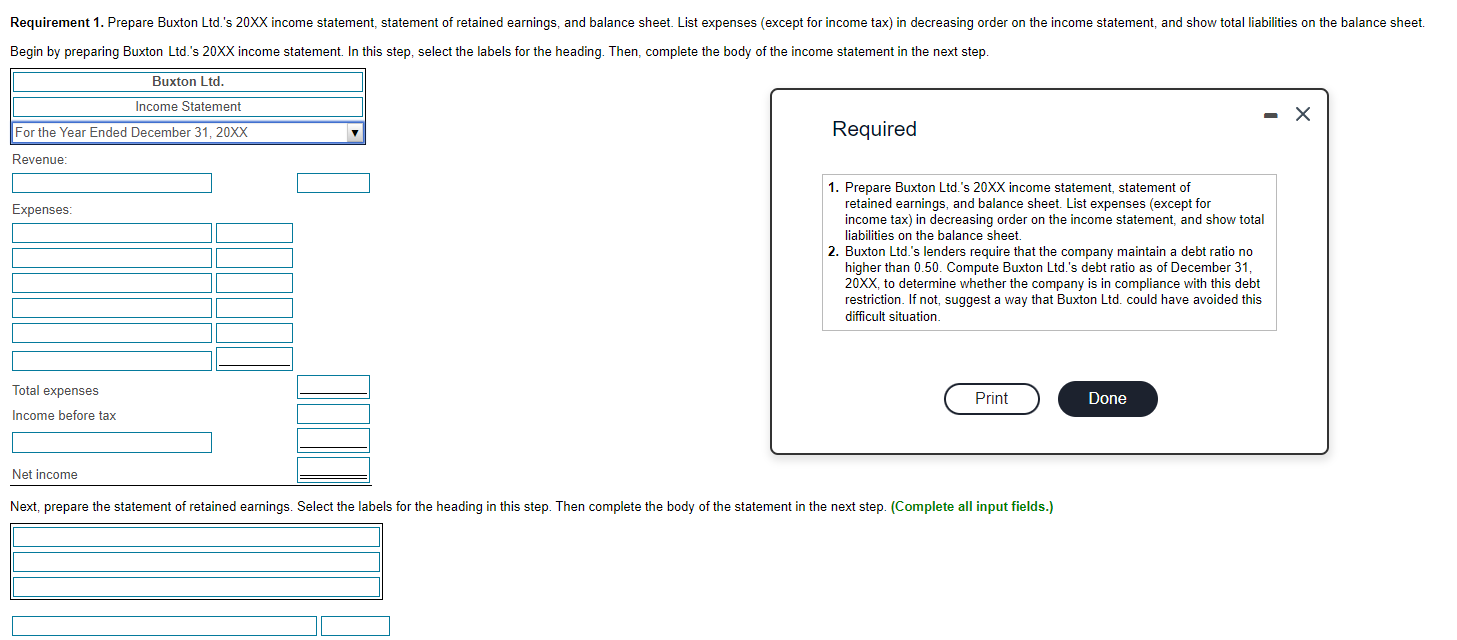

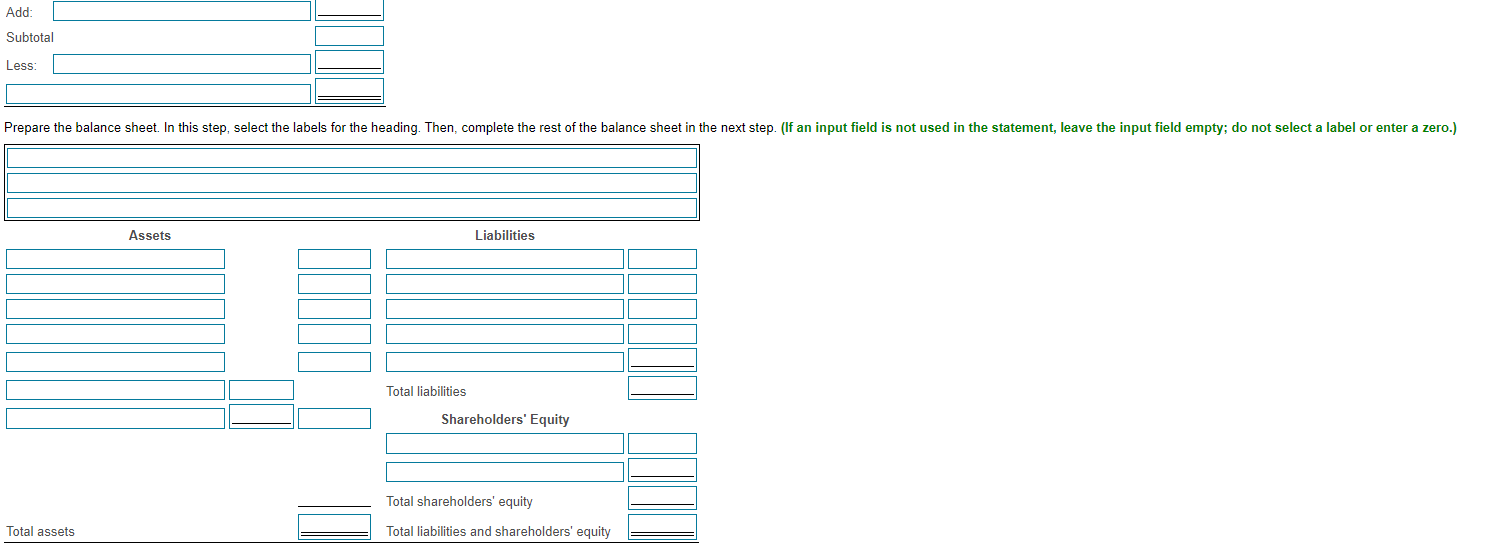

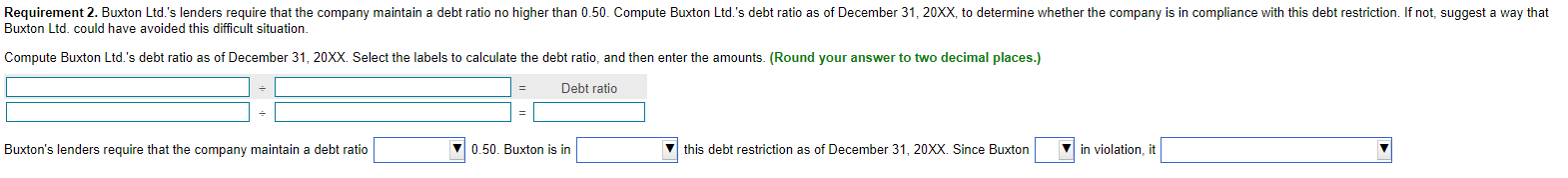

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{BuxtonLtd.AdjustedTrialBalanceDecember31,20XX} \\ \hline Account Title & & Debit & Credit \\ \hline Cash & $ & 1,420 & \\ \hline Accounts receivable & & 9,000 & \\ \hline Supplies & & 2,270 & \\ \hline Prepaid rent & & 1,580 & \\ \hline Equipment & & 37,500 & \\ \hline Accumulated depreciation & & $ & 4,260 \\ \hline Accounts payable & & & 3,690 \\ \hline Interest payable & & & 780 \\ \hline Unearned service revenue & & & 590 \\ \hline Income tax payable & & & 2,080 \\ \hline Note payable & & & 18,100 \\ \hline Common shares & & & 5,200 \\ \hline Retained earnings & & & 1,050 \\ \hline Dividends & & 24,200 & \\ \hline Service revenue & & & 109,350 \\ \hline Depreciation expense & & 1,620 & \\ \hline Salary expense & & 39,700 & \\ \hline Rent expense & & 10,900 & \\ \hline Interest expense & & 3,040 & \\ \hline Insurance expense & & 3,750 & \\ \hline Supplies expense & & 2,870 & \\ \hline Income tax expense & & 7,250 & \\ \hline Total & $ & 145,100$ & 145,100 \\ \hline \end{tabular} \begin{tabular}{ll|l|} \hline Add: & \\ Subtotal \\ Less: \end{tabular} Prepare the balance sheet. In this step, select the labels for the heading. Then, complete the rest of the balance sheet in the next step. (If an input field is not used in the statement, leave the input field empty; do not select a label or enter a zero.) Buxton Ltd. could have avoided this difficult situation. Compute Buxton Ltd.'s debt ratio as of December 31, 20XX. Select the labels to calculate the debt ratio, and then enter the amounts. (Round your answer to two decimal places.) Buxton's lenders require that the company maintain a debt ratio 0.50 . Buxton is in this debt restriction as of December 31, 20XX. Since Buxton in violation, it Begin by preparing Buxton Ltd.'s 20XX income statement. In this step, select the labels for the heading. Then, complete the body of the income statement in the next step. Required 1. Prepare Buxton Ltd.'s 20XX income statement, statement of retained earnings, and balance sheet. List expenses (except for income tax) in decreasing order on the income statement, and show total liabilities on the balance sheet. 2. Buxton Ltd.'s lenders require that the company maintain a debt ratio no higher than 0.50. Compute Buxton Ltd.'s debt ratio as of December 31, 20XX, to determine whether the company is in compliance with this debt restriction. If not, suggest a way that Buxton Ltd. could have avoided this difficult situation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started