Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Allied Pigments and Dyes, Inc. (APD) has received notification from the New Jersey Environment Protection Agency (NJEPA) that their Bound Brook manufacturing facility is

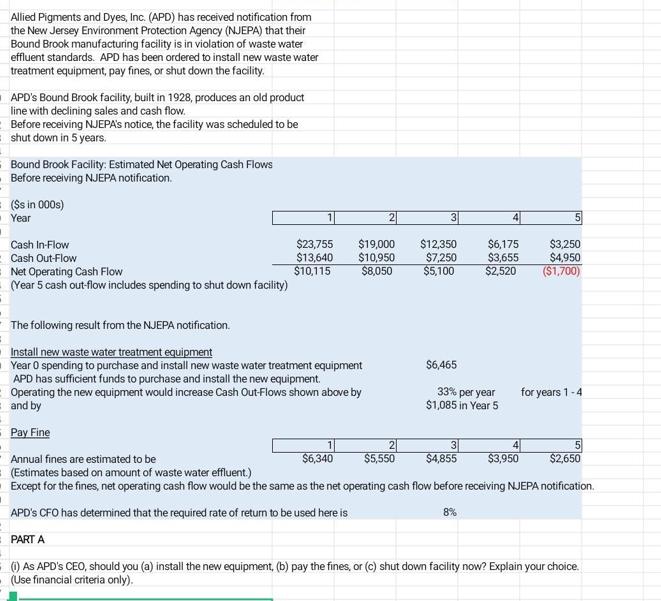

Allied Pigments and Dyes, Inc. (APD) has received notification from the New Jersey Environment Protection Agency (NJEPA) that their Bound Brook manufacturing facility is in violation of waste water effluent standards. APD has been ordered to install new waste water treatment equipment, pay fines, or shut down the facility. APD's Bound Brook facility, built in 1928, produces an old product line with declining sales and cash flow. Before receiving NJEPA's notice, the facility was scheduled to be shut down in 5 years. Bound Brook Facility: Estimated Net Operating Cash Flows Before receiving NJEPA notification. = ($s in 000s) Year Cash In-Flow Cash Out-Flow Net Operating Cash Flow (Year 5 cash out-flow includes spending to shut down facility) The following result from the NJEPA notification. 3 2 $19,000 $23,755 $13,640 $10,950 $10,115 $8,050 Install new waste water treatment equipment Year 0 spending to purchase and install new waste water treatment equipment APD has sufficient funds to purchase and install the new equipment. Operating the new equipment would increase Cash Out-Flows shown above by and by Pay Fine 2 $5,550 3 $12,350 $7,250 $5,100 $6,465 33% per year $1,085 in Year 5 3 $4,855 $6,175 $3,655 $2,520 ($1,700) 5 $3,950 $3,250 $4,950 for years 1-4 5 $2,650 Annual fines are estimated to be $6,340 (Estimates based on amount of waste water effluent.) Except for the fines, net operating cash flow would be the same as the net operating cash flow before receiving NJEPA notification. 1 APD's CFO has determined that the required rate of return to be used here is 8% =PART A (1) As APD's CEO, should you (a) install the new equipment, (b) pay the fines, or (c) shut down facility now? Explain your choice. (Use financial criteria only). (ii) What other (non-financial) issues should enter into your decision? Part B You have also looked into selling the product line and shutting down the Bound Brook faciltiy now. Global Colors has expressed interest in acquiring the product line - brand names, product formulations, inventories, etc. - produced in your Bound Brook Brook facility. Global Colors would manufacture the acquired products in their own facility. The decision to sell to Global Colors would require ADP to shut down their Bound Brook facilty now. Spending to do so (in Year 0) would be: What is the minimum price ADP should accept to sell the product line.

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION PART A 1 As APDs CEO my decision would depend on the financial criteria only To make this decision we need to compare the present value of th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started