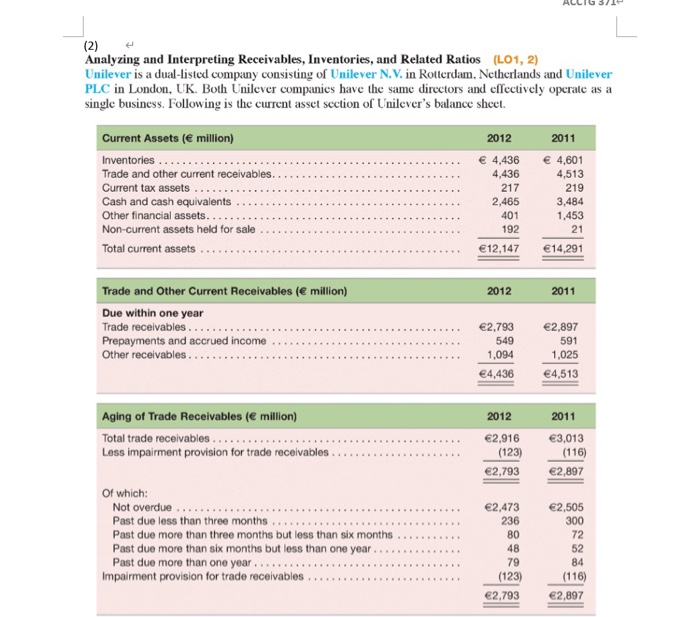

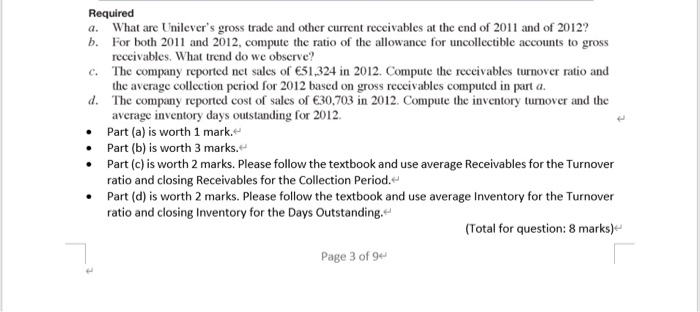

ALLIG 371 (2) e Analyzing and Interpreting Receivables, Inventories, and Related Ratios (L01, 2) Unilever is a dual-Listed company consisting of Unilever N.V. in Rotterdam, Netherlands and Unilever PLC in London, UK. Both Unilever companies have the same directors and effectively operate as a single business. Following is the current asset section of Unilever's balance sheet. 2012 2011 Current Assets ( million) Inventories Trade and other current receivables..... Current tax assets ..... Cash and cash equivalents .... Other financial assets..... Non-current assets held for sale. 4,436 4,436 217 2,465 401 4,601 4,513 219 3,484 1,453 192 Total current assets ...... 12,147 14,291 Trade and Other Current Receivables ( million) 2012 2011 Due within one year Trade receivables.......... Prepayments and accrued income ....... Other receivables. 2,793 549 1,094 2,897 591 1,025 4,436 4,513 Aging of Trade Receivables ( million) Total trade receivables.... Less impairment provision for trade receivables. 2012 2,916 (123) 2,793 2011 3,013 (116) 2,897 Of which: Not overdue ..... Past due less than three months ....... Past due more than three months but less than six months ... Past due more than six months but less than one year ... Past due more than one year Impairment provision for trade receivables........ 2,473 236 80 2,505 300 48 52 84 (123) 2,793 (116) 2,897 Required a. What are Unilever's gross trade and other current receivables at the end of 2011 and of 2012? b. For both 2011 and 2012, compute the ratio of the allowance for uncollectible accounts to gross receivables. What trend do we observe? C. The company reported net sales of 51,324 in 2012. Compute the receivables turnover ratio and the average collection period for 2012 based on gross receivables computed in part a. The company reported cost of sales of 30,703 in 2012. Compute the inventory turnover and the average inventory days outstanding for 2012 Part (a) is worth 1 mark. Part (b) is worth 3 marks. Part (c) is worth 2 marks. Please follow the textbook and use average Receivables for the Turnover ratio and closing Receivables for the Collection Period. Part (d) is worth 2 marks. Please follow the textbook and use average Inventory for the Turnover ratio and closing Inventory for the Days Outstanding. (Total for question: 8 marks) Page 3 of 9