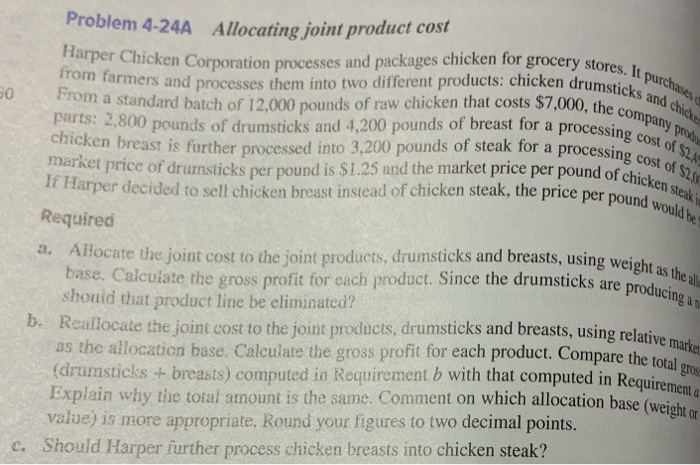

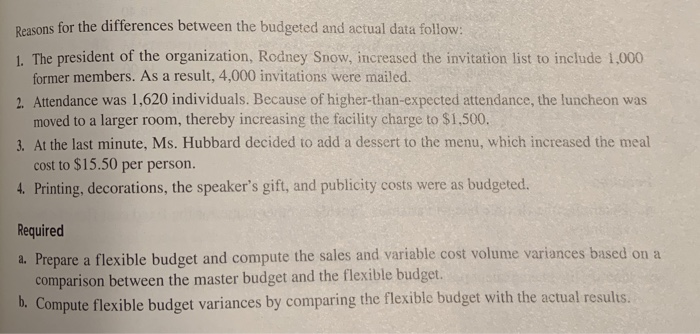

Allocating joint product cost arerChicken Corporation processes and packages chicken for grocery stores. t Harper Chicken C om farmers and processes them into two different products: chicken drums From a standard Problem 4-24A es. It purchases rom a standard batch of 12,000 pounds of raw chicken that costs $7,000, the c parts; 2,800 pounds of drumsticks and 4,200 pounds of breast for a procescompany chicken breast is further processed into 3,200 pounds of steak for a processin market price of drumsticks per pound is $1.25 and the market price per pound of chcof 2 If Harper decided to sell chicken breast instead of chicken steak, the price per po Required essing cost of $2.A 0 icken steak i und would be weight as the all producing a n base. Calcuiate the gross profit for each product. Since the drumsticks are shouid that product line be eliminated Realocate the joint cost to the joint products, drumsticks and breasts, using relative as the allocation base. Calculate the gross profit for each product. Compare the (drumsticks + breasts) computed in Requirement b with that computed in Requi Explain why thc total smount is the same. Comment on which allocation base (weight value) is more appropriate. Round your figures to two decimal points. Should Harper further process chicken breasts into chicken steak? , Allocate the joint cost to the joint products, drumsticks and breasts, using wei ative market total b. gros c. Reasons for the differences between the budgeted and actual data follow: 1. The president of the organization, Rodney Snow, increased the invitation list to include 1,000 former members. As a result, 4,000 invitations were mailed. 2. Attendance was 1,620 individuals. Because of higher-than-expected attendance, the luncheon was moved to a larger room, thereby increasing the facility charge to $1.500. 3. At the last minute, Ms. Hubbard decided to add a dessert to the menu, which increased the meal cost to $15.50 per person. 4. Printing, decorations, the speaker's gift, and publicity costs were as budgeted. Required a. Prepare a flexible budget and compute the sales and variable cost volume variances based on a comparison between the master budget and the flexible budget. b. Compute flexible budget variances by comparing the flexible budget with the actual results