Question

All-Star Automotive Company experienced the following accounting events during 2018: Performed services for $25,000 cash. Purchased land for $6,000 cash. Hired an accountant to keep

All-Star Automotive Company experienced the following accounting events during 2018:

Performed services for $25,000 cash.

Purchased land for $6,000 cash.

Hired an accountant to keep the books.

Received $50,000 cash from the issue of common stock.

Borrowed $5,000 cash from State Bank.

Paid $14,000 cash for salary expense.

Sold land for $9,000 cash.

Paid $10,000 cash on the loan from State Bank.

Paid $2,800 cash for utilities expense.

Paid a cash dividend of $5,000 to the stockholders.

Required

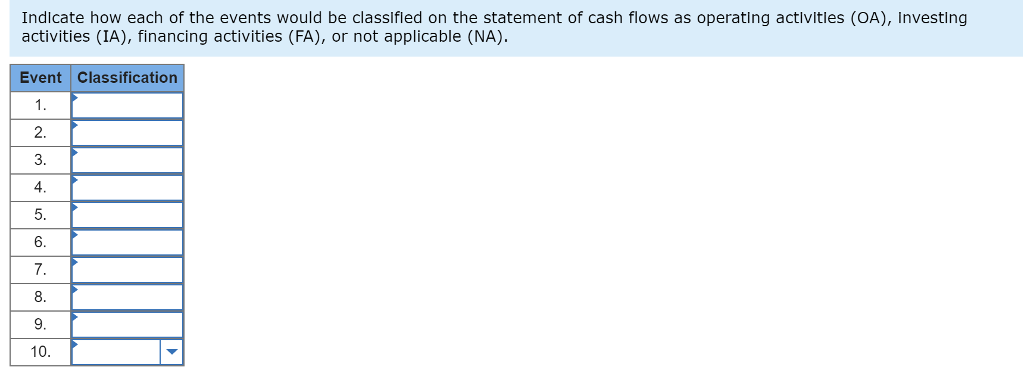

Indicate how each of the events would be classified on the statement of cash flows as operating activities (OA), investing activities (IA), financing activities (FA), or not applicable (NA).

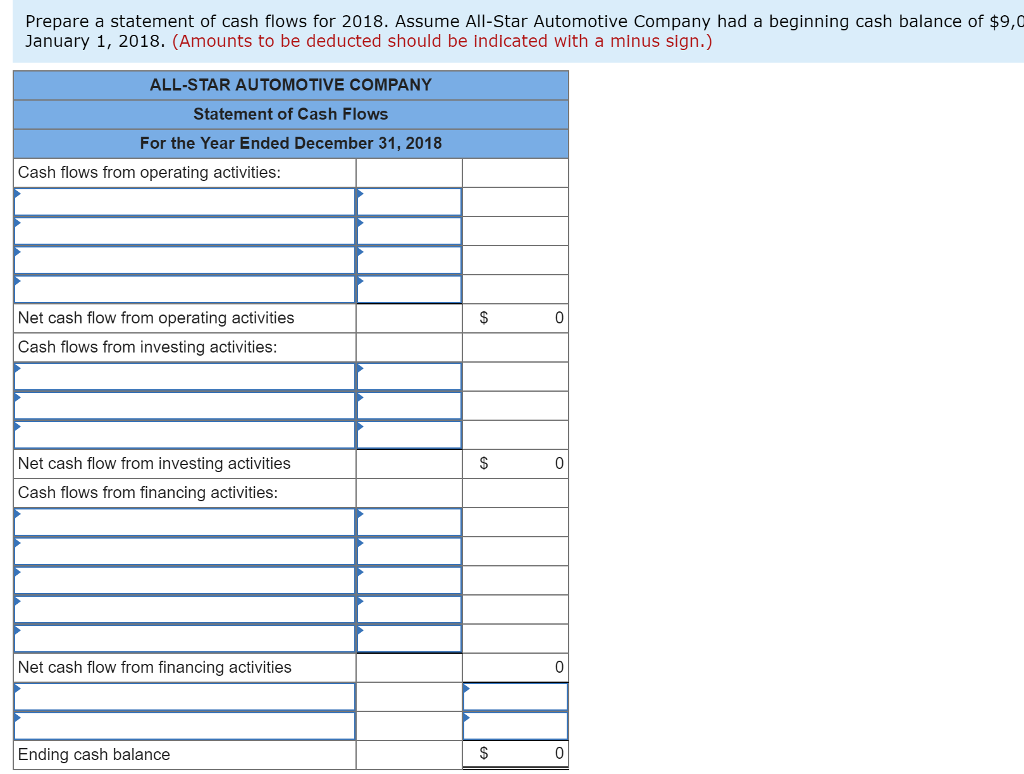

Prepare a statement of cash flows for 2018. Assume All-Star Automotive Company had a beginning cash balance of $9,000 on January 1, 2018.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started