Answered step by step

Verified Expert Solution

Question

1 Approved Answer

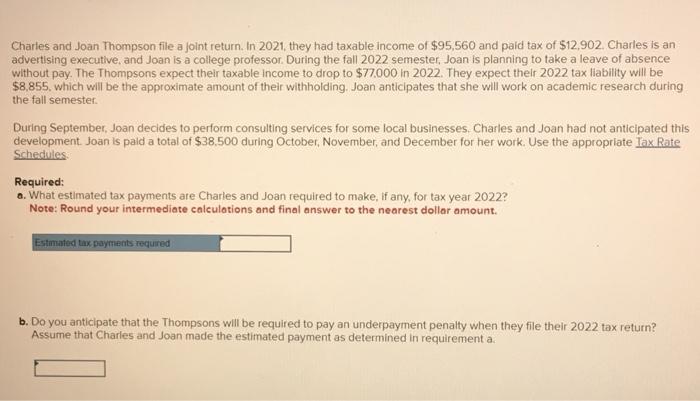

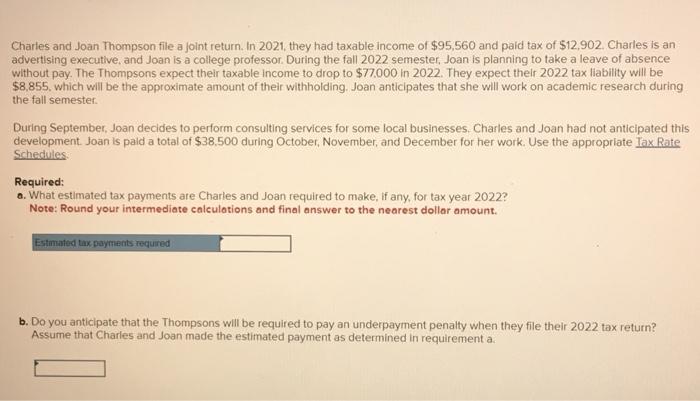

charles and joan thompson file a joint return in 2021 they had a taxable income of 95,560 and paid tax of 12,902. charles is an

charles and joan thompson file a joint return in 2021 they had a taxable income of 95,560 and paid tax of 12,902. charles is an advertising executive and joan is a college professor. during the fall 2022 semester, joan is planning to take a leave of absence witthout pay. the thompsons expect thier taxable income to drop to 77000 in 2022. they expect their 2022 tax liability will be 8,855. which will be the approximate amount of thier withholding. joan anticipates that she will work on academic research during the fall semester.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started