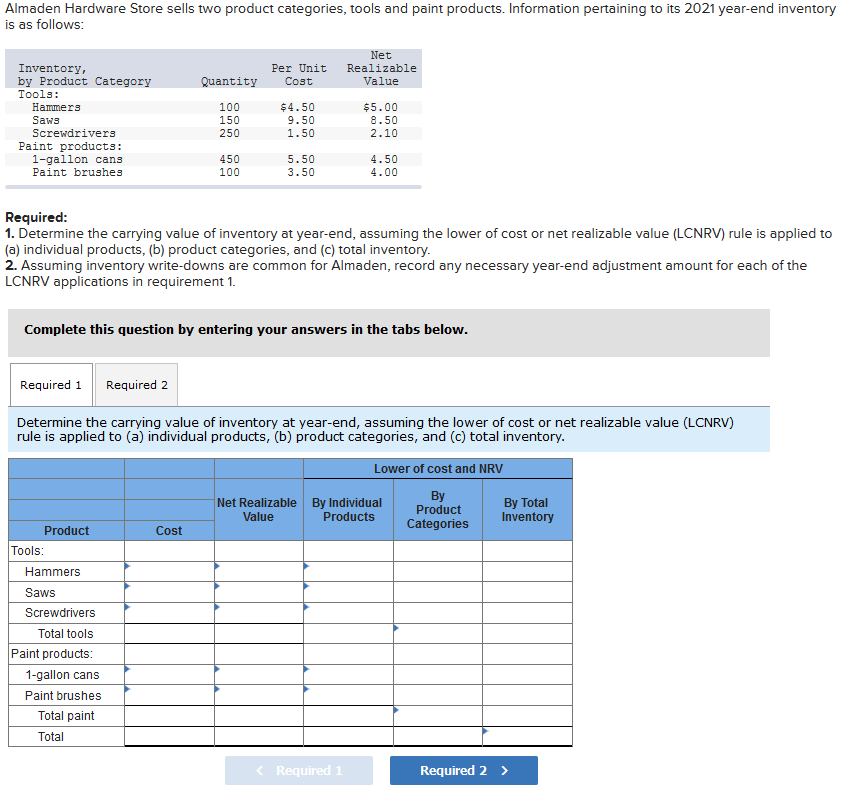

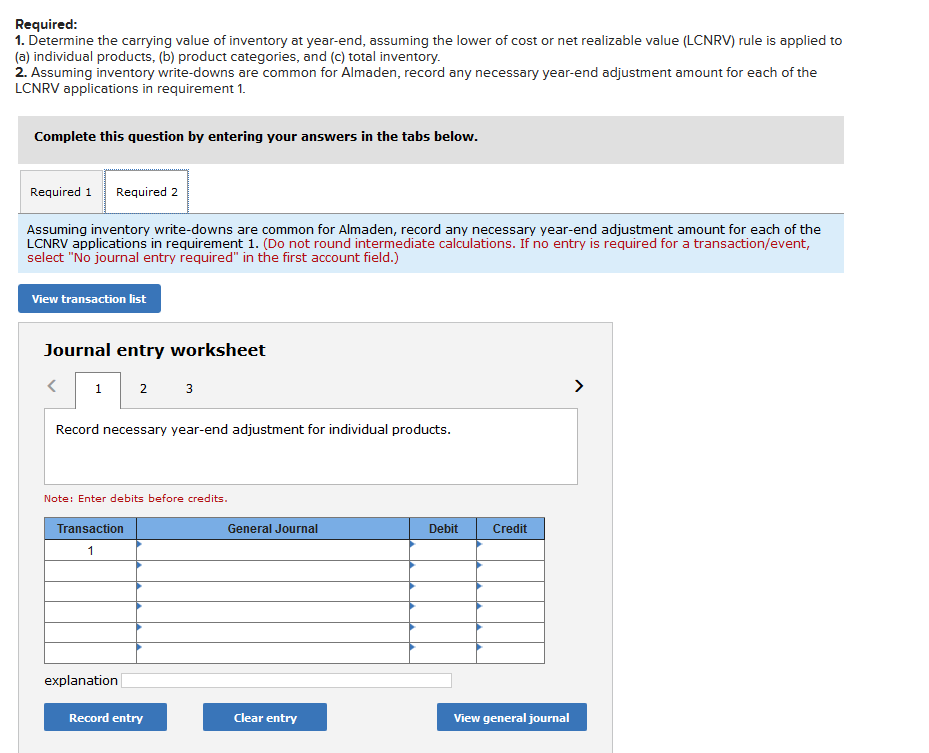

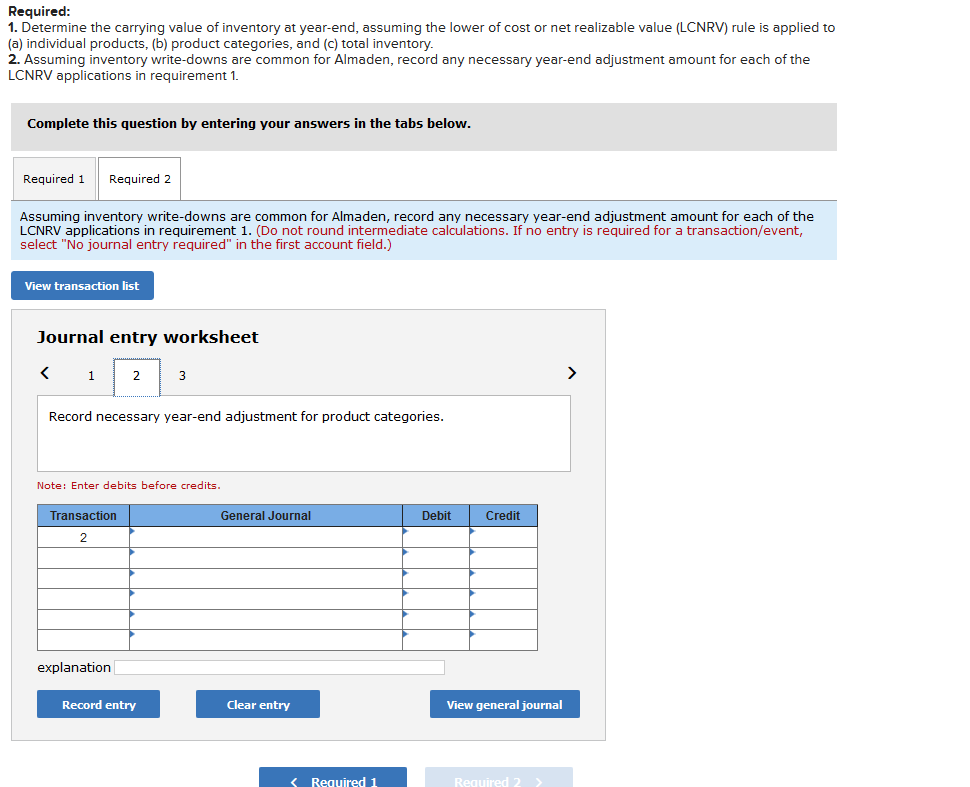

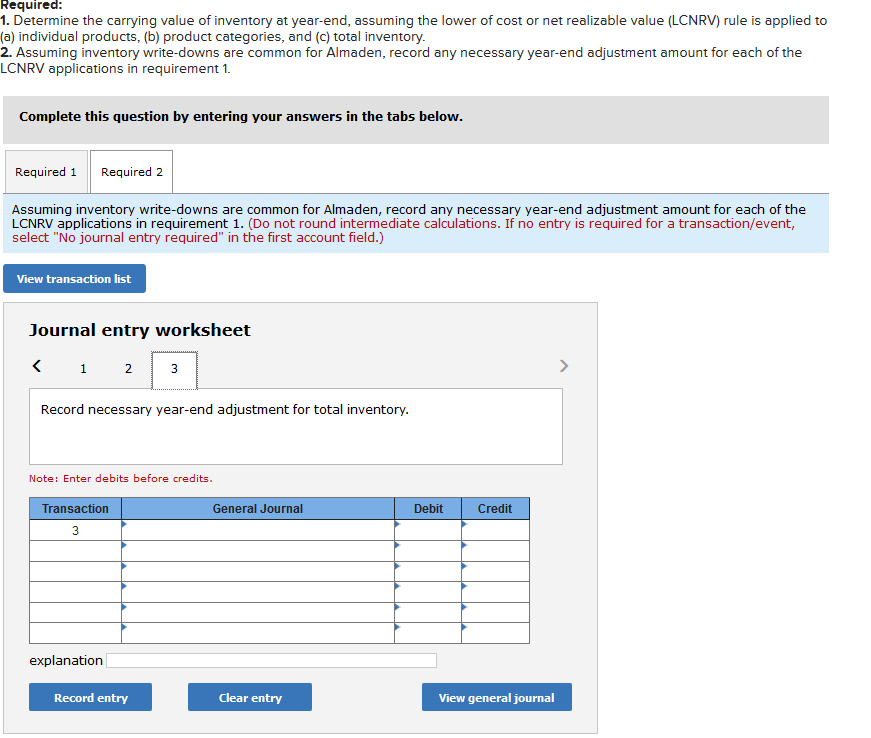

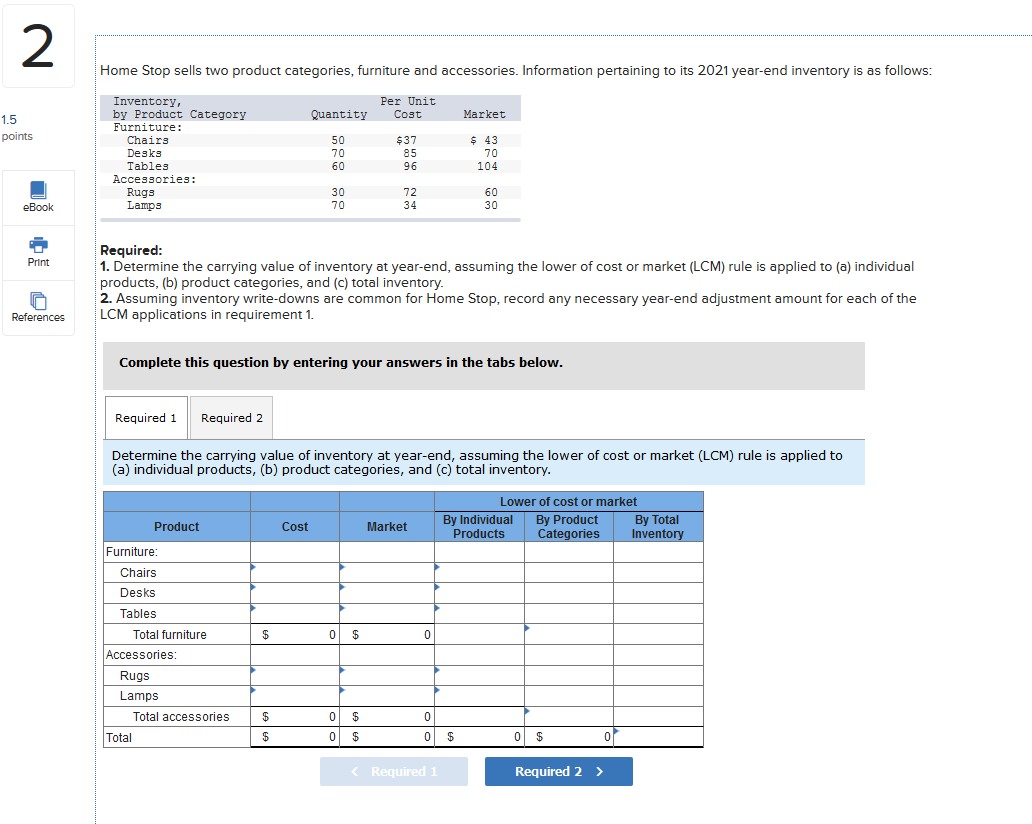

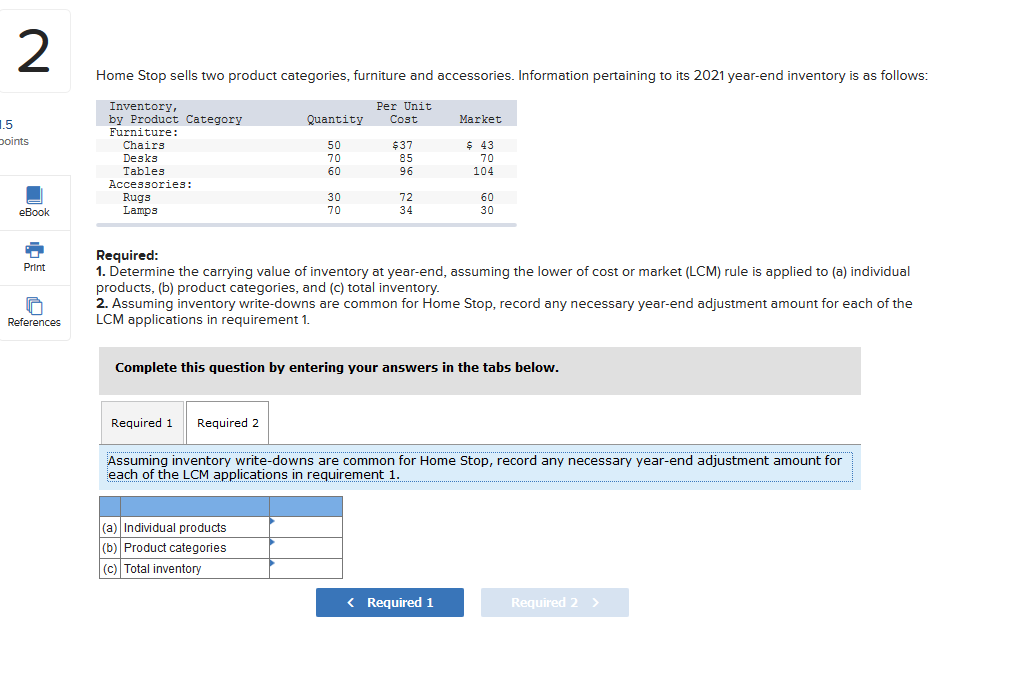

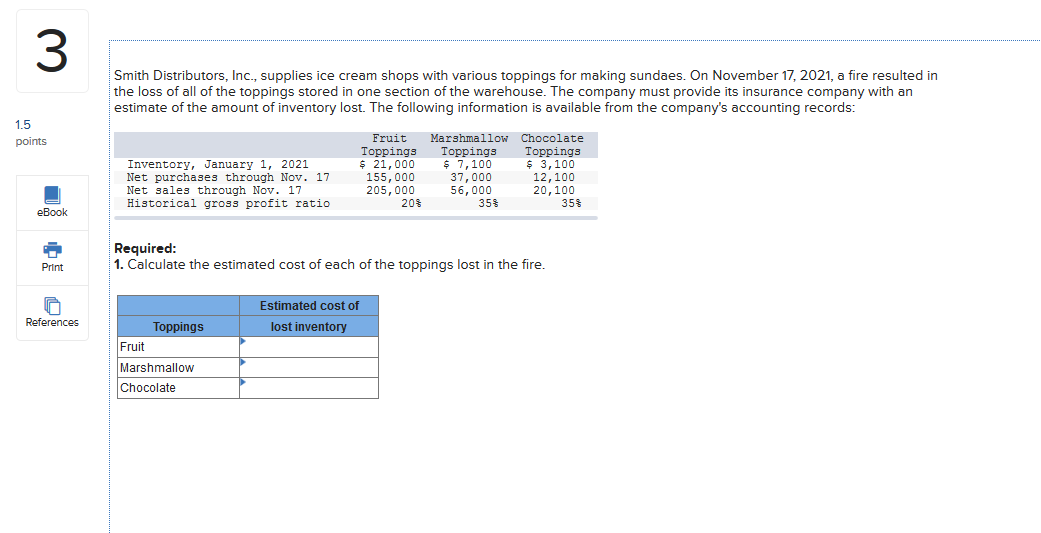

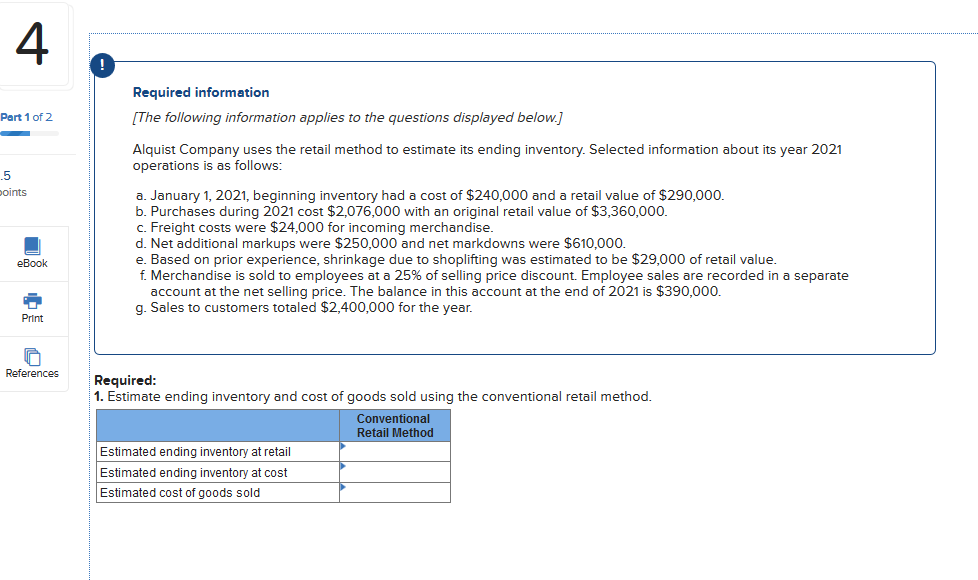

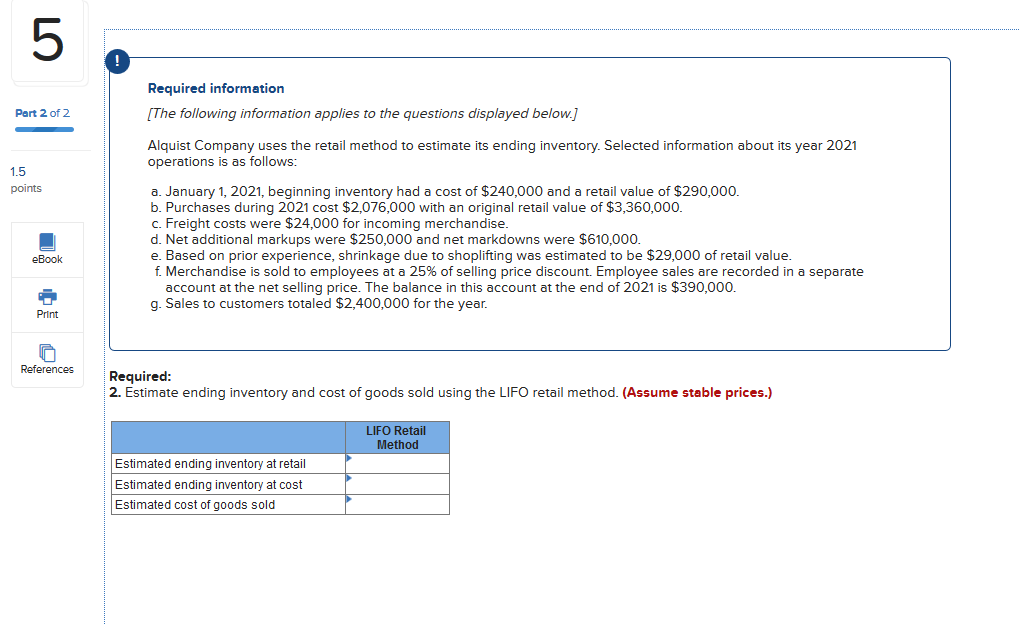

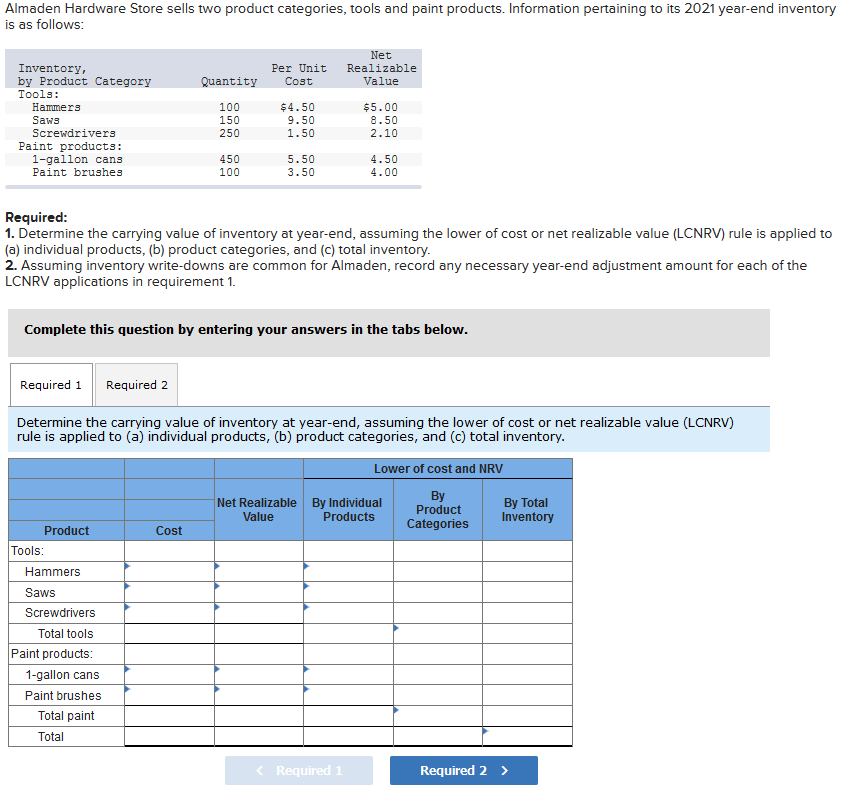

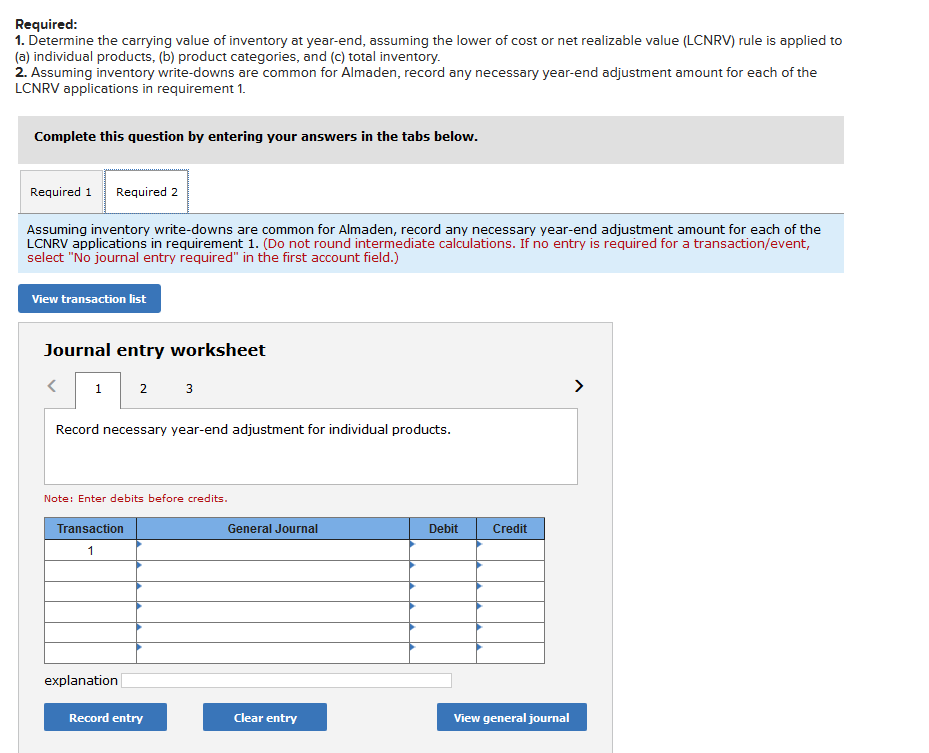

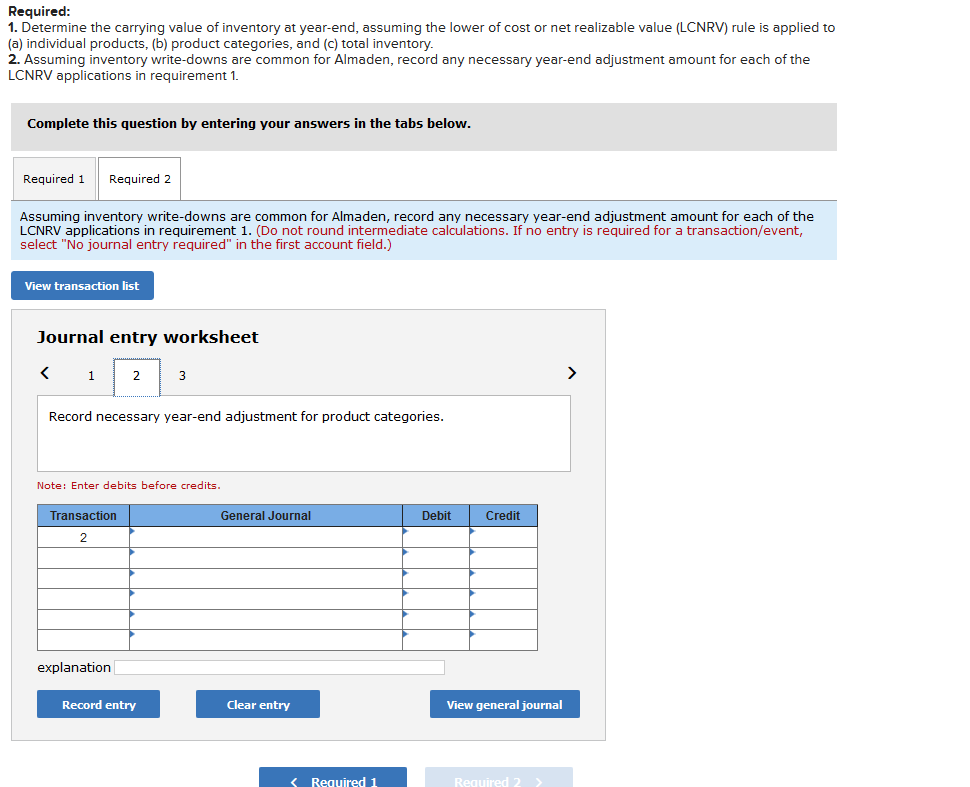

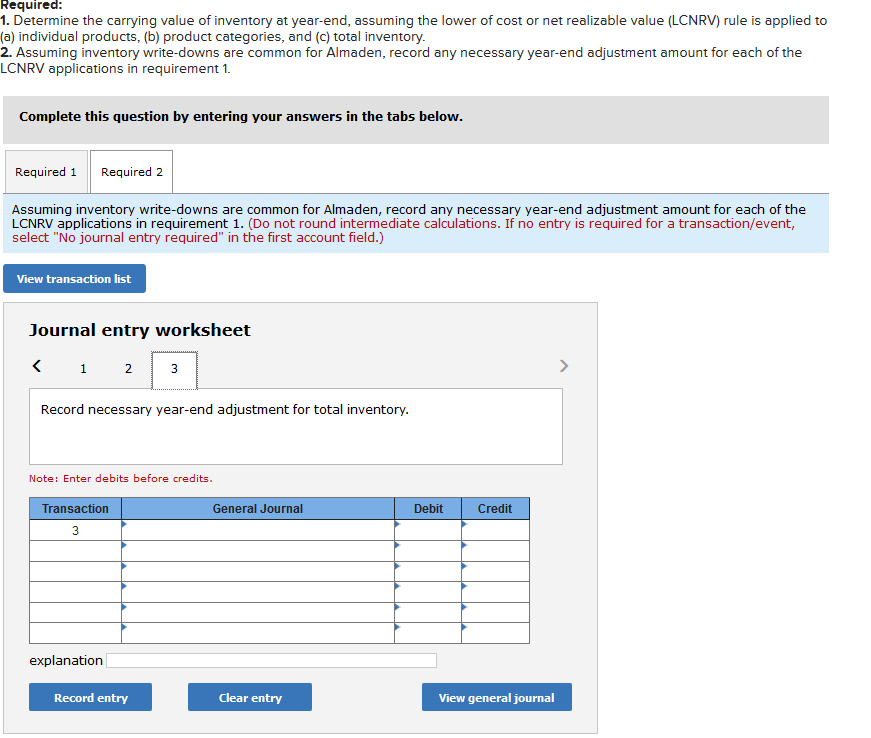

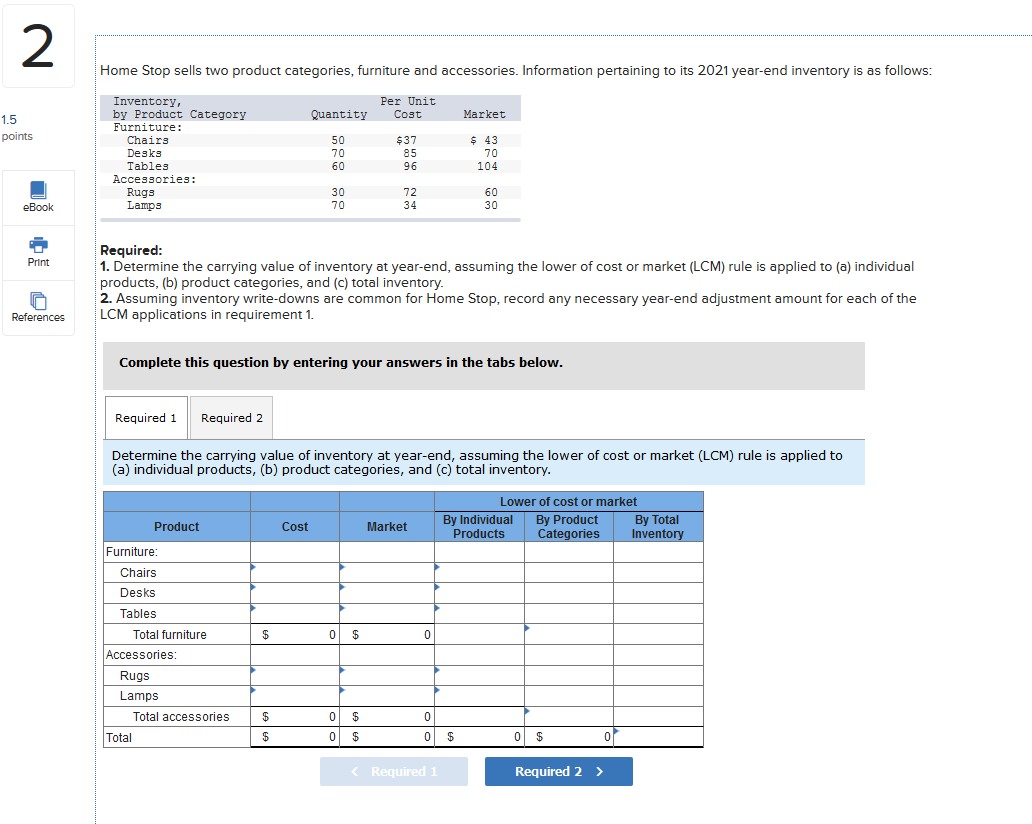

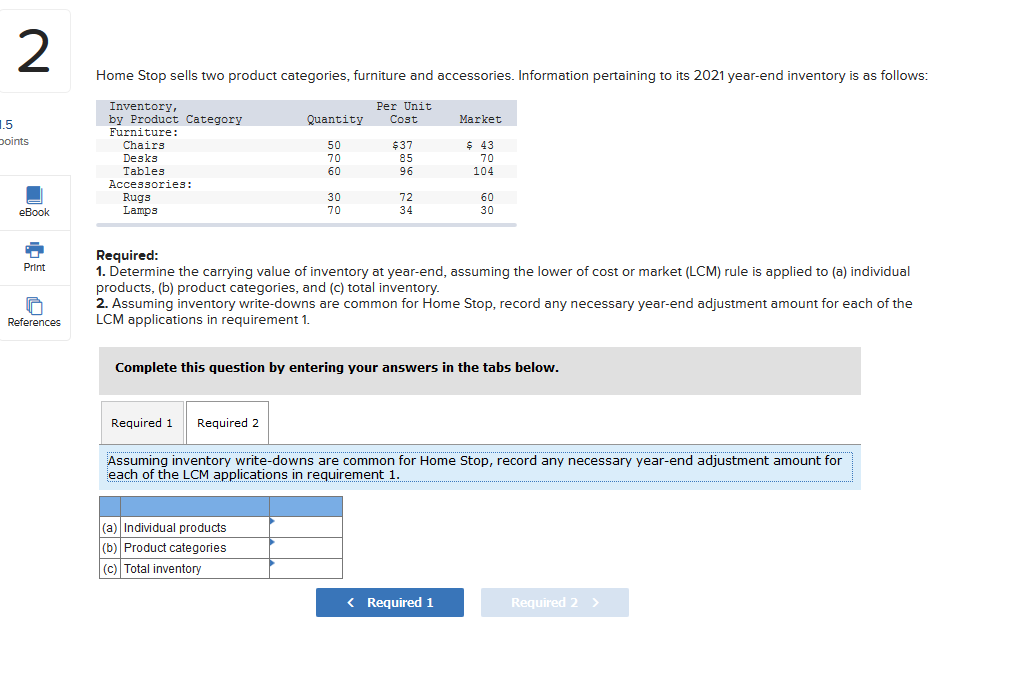

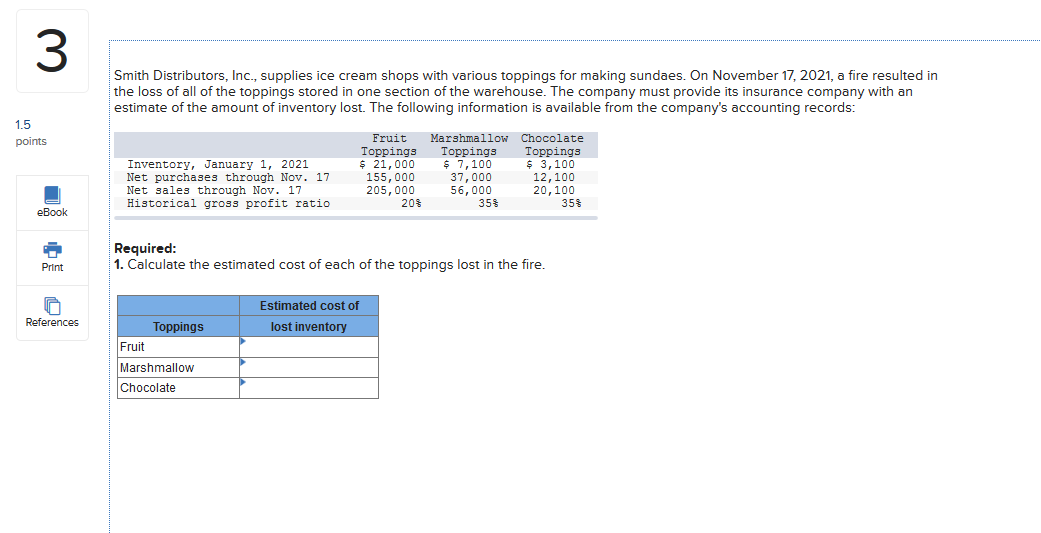

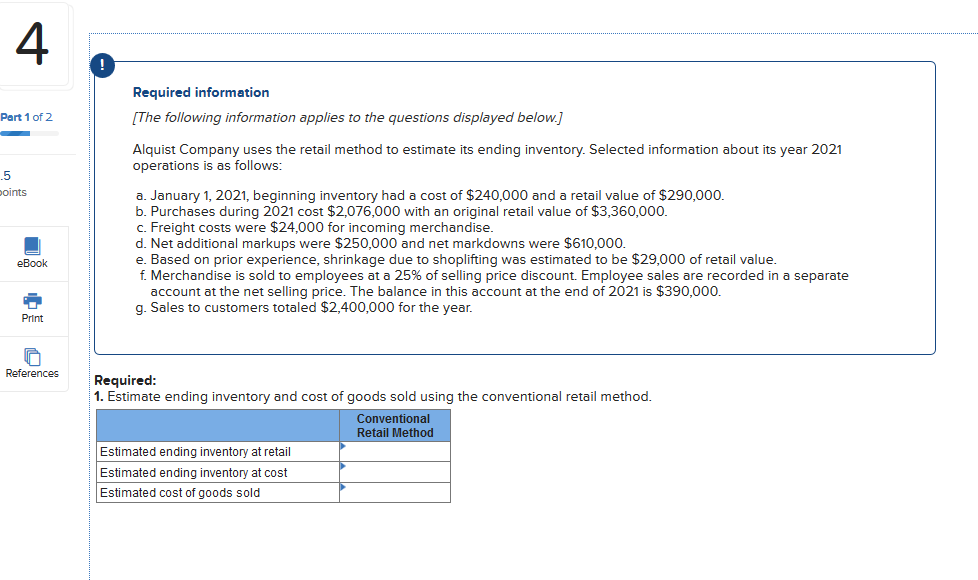

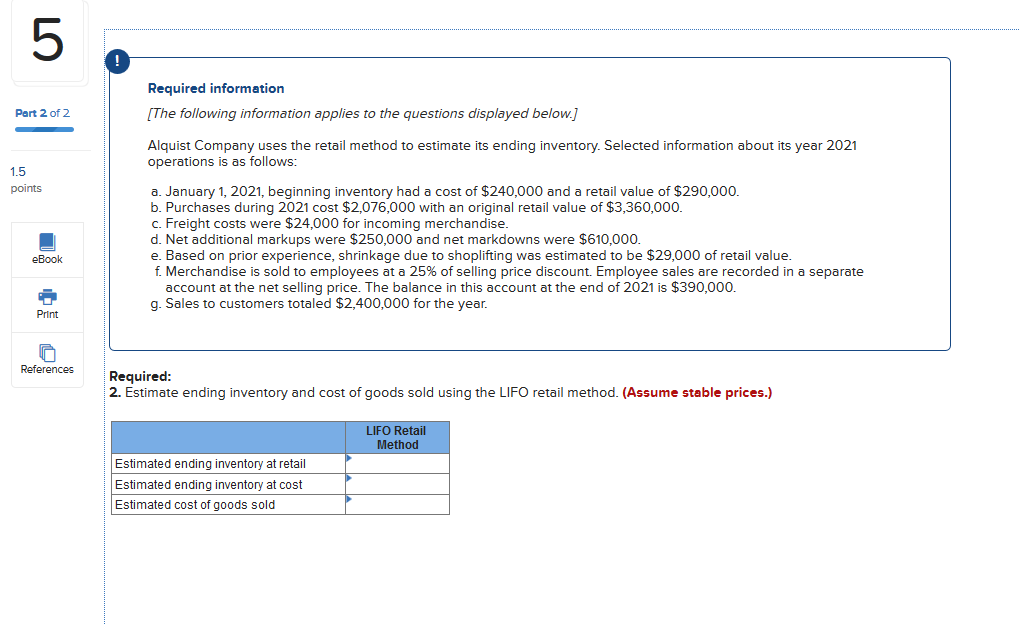

Almaden Hardware Store sells two product categories, tools and paint products. Information pertaining to its 2021 year-end inventory is as follows: Net Realizable Value Per Unit Cost Quantity Inventory, by Product Category Tools: Hammers Saws Screwdrivers Paint products: 1-gallon cans Paint brushes 100 150 250 $4.50 9.50 1.50 $5.00 8.50 2.10 450 100 5.50 3.50 4.50 4.00 Required: 1. Determine the carrying value of inventory at year-end, assuming the lower of cost or net realizable value (LCNRV) rule is applied to (a) individual products, (b) product categories, and (c) total inventory. 2. Assuming inventory write-downs are common for Almaden, record any necessary year-end adjustment amount for each of the LCNRV applications in requirement 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the carrying value of inventory at year-end, assuming the lower of cost or net realizable value (LCNRV) rule is applied to (a) individual products, (b) product categories, and (c) total inventory. Lower of cost and NRV By Net Realizable By Individual Product By Total Value Products Inventory Product Cost Categories Tools: Hammers Saws Screwdrivers Total tools Paint products: 1-gallon cans Paint brushes Total paint Total Required: 1. Determine the carrying value of inventory at year-end, assuming the lower of cost or net realizable value (LCNRV) rule is applied to (a) individual products, (b) product categories, and (c) total inventory. 2. Assuming inventory write-downs are common for Almaden, record any necessary year-end adjustment amount for each of the LCNRV applications in requirement 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assuming inventory write-downs are common for Almaden, record any necessary year-end adjustment amount for each of the LCNRV applications in requirement 1. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record necessary year-end adjustment for individual products. Note: Enter debits before credits. General Journal Debit Credit Transaction 1 explanation Record entry Clear entry View general journal Required: 1. Determine the carrying value of inventory at year-end, assuming the lower of cost or net realizable value (LCNRV) rule is applied to (a) individual products, (b) product categories, and (c) total inventory. 2. Assuming inventory write-downs are common for Almaden, record any necessary year-end adjustment amount for each of the LCNRV applications in requirement 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assuming inventory write-downs are common for Almaden, record any necessary year-end adjustment amount for each of the LCNRV applications in requirement 1. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record necessary year-end adjustment for product categories. Note: Enter debits before credits. Transaction General Journal Debit Credit 2 explanation Record entry Clear entry View general journal 2 Home Stop sells two product categories, furniture and accessories. Information pertaining to its 2021 year-end inventory is as follows: Per Unit Cost Market 1.5 points Inventory, by Product Category Furniture: Chairs Desks Tables Accessories: Rugs Lamps Quantity 50 70 60 $37 $ 43 70 104 96 30 70 72 34 60 30 eBook Print Required: 1. Determine the carrying value of inventory at year-end, assuming the lower of cost or market (LCM) rule is applied to (a) individual products, (b) product categories, and (c) total inventory. 2. Assuming inventory write-downs are common for Home Stop, record any necessary year-end adjustment amount for each of the LCM applications in requirement 1. References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assuming inventory write-downs are common for Home Stop, record any necessary year-end adjustment amount for each of the LCM applications in requirement 1. (a) Individual products (0) Product categories (c) Total inventory m. Smith Distributors, Inc., supplies ice cream shops with various toppings for making sundaes. On November 17, 2021, a fire resulted in the loss of all of the toppings stored in one section of the warehouse. The company must provide its insurance company with an estimate of the amount of inventory lost. The following information is available from the company's accounting records: 1.5 points Inventory, January 1, 2021 Net purchases through Nov. 17 Net sales through Nov. 17 Historical gross profit ratio Fruit Toppings $ 21,000 155,000 205,000 20% Marshmallow Chocolate Toppings Toppings $ 7,100 $ 3,100 37,000 12,100 56,000 20, 100 35% 35% eBook Required: 1. Calculate the estimated cost of each of the toppings lost in the fire. Print References Estimated cost of lost inventory Toppings Fruit Marshmallow Chocolate 4 Part 1 of 2 Required information (The following information applies to the questions displayed below.) Alquist Company uses the retail method to estimate its ending inventory. Selected information about its year 2021 operations is as follows: .5 oints a. January 1, 2021, beginning inventory had a cost of $240,000 and a retail value of $290,000. b. Purchases during 2021 cost $2,076,000 with an original retail value of $3,360,000. c. Freight costs were $24,000 for incoming merchandise. d. Net additional markups were $250,000 and net markdowns were $610,000. e. Based on prior experience, shrinkage due to shoplifting was estimated to be $29,000 of retail value. f. Merchandise is sold to employees at a 25% of selling price discount. Employee sales are recorded in a separate account at the net selling price. The balance in this account at the end of 2021 is $390,000. g. Sales to customers totaled $2,400,000 for the year. eBook Print References Required: 1. Estimate ending inventory and cost of goods sold using the conventional retail method. Conventional Retail Method Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 5 Part 2 of 2 Part 2 of 2 Required information (The following information applies to the questions displayed below.) Alquist Company uses the retail method to estimate its ending inventory. Selected information about its year 2021 operations is as follows: 1.5 points a. January 1, 2021, beginning inventory had a cost of $240,000 and a retail value of $290,000. b. Purchases during 2021 cost $2,076,000 with an original retail value of $3,360,000. C. Freight costs were $24,000 for incoming merchandise. d. Net additional markups were $250,000 and net markdowns were $610,000. e. Based on prior experience, shrinkage due to shoplifting was estimated to be $29,000 of retail value. f. Merchandise is sold to employees at a 25% of selling price discount. Employee sales are recorded in a separate account at the net selling price. The balance in this account at the end of 2021 is $390,000. g. Sales to customers totaled $2,400,000 for the year. eBook Print Roger References Required: 2. Estimate ending inventory and cost of goods sold using the LIFO retail method. (Assume stable prices.) LIFO Retail Method Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold