Answered step by step

Verified Expert Solution

Question

1 Approved Answer

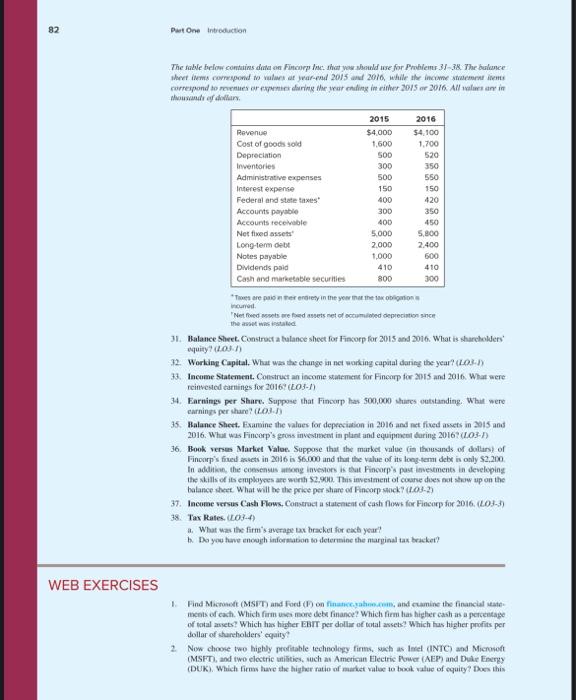

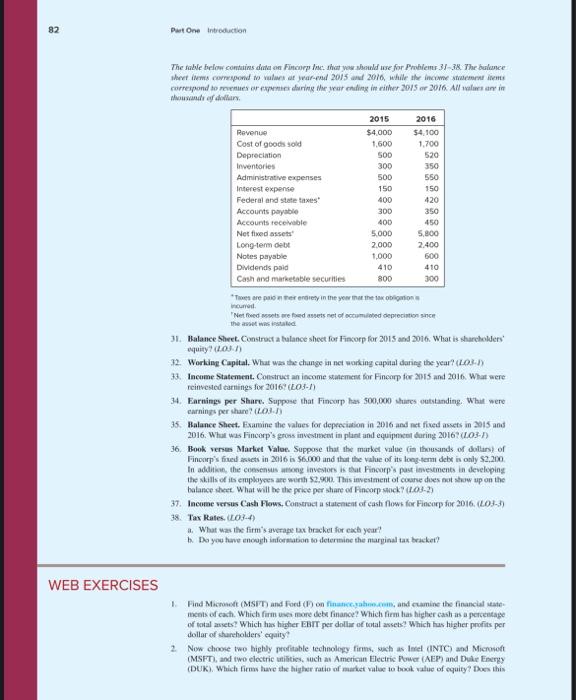

.. Alouwand ef dollan. incumat. 'Net foed nosets are foed assets net of accumalobed depreciation since the ansot was instalied 31. Balance Shert. Construst a

..

Alouwand ef dollan. incumat. 'Net foed nosets are foed assets net of accumalobed depreciation since the ansot was instalied 31. Balance Shert. Construst a tulance shect for Fincorp for 2015 and 2016 . What is sharcholders' equity? (2.05: ) 32. Workine Capital. What was the change in net working capial daring the year? (LOS-1) 33. Incuene Statement. Construct an income statement for Fincorp for 2015 and 2016 . What were reinvesed tarnings for 20169 ( 205l) 34. Earnings per Share. Suppose that Finourp has 500,000 stures outstanding. What were earnings per thane? (203. 5) 35. Balance Sheet. Examine the valoes for depreciasion in 2016 and net fised assets in 2015 and 2016. What was Fincorp's grons investecat in plant and equipnocel daring 2016 ? (LO3H) 36. Book verses Market Valoe. Suppose that the market value (it thousands of dollins of Finoorp's fived asuets in 2016 is $6,000 and that the value of its long-temi debs is only $2,200. In addition, the coesenus ansong investon is that Fincorp's past investments in developing the shills of its emplayes are wint $2.900. This investment of coure dees aot show up on the balance sheet. What will he the price per share of Fincorp suck? (1.03-2) 37. Income versus Cash Flows, Conseract a stateneat of cash flows for Fincorp for 2016. (LOS-3) 38. Tax Rates, (1003-4) a. What was the firm's averape ax bracket for each yeur' b. Do you tave enough informabion so deternine the marginal tax bracket? of sotal ansets? Which has higher EBrT per dollar of total assets? Which has higher poofits per dollar of shureholders' eqaity? 2. Now choose two highly profitable technology firms, wach as Imel (INTC) and Microsoft (MSFT), and two electric unibies, such as American Electric fower (AEP) and Dule Esergy (DUK). Which firms have the higher ratio of market valoe to book. value of equity? Dos this Alouwand ef dollan. incumat. 'Net foed nosets are foed assets net of accumalobed depreciation since the ansot was instalied 31. Balance Shert. Construst a tulance shect for Fincorp for 2015 and 2016 . What is sharcholders' equity? (2.05: ) 32. Workine Capital. What was the change in net working capial daring the year? (LOS-1) 33. Incuene Statement. Construct an income statement for Fincorp for 2015 and 2016 . What were reinvesed tarnings for 20169 ( 205l) 34. Earnings per Share. Suppose that Finourp has 500,000 stures outstanding. What were earnings per thane? (203. 5) 35. Balance Sheet. Examine the valoes for depreciasion in 2016 and net fised assets in 2015 and 2016. What was Fincorp's grons investecat in plant and equipnocel daring 2016 ? (LO3H) 36. Book verses Market Valoe. Suppose that the market value (it thousands of dollins of Finoorp's fived asuets in 2016 is $6,000 and that the value of its long-temi debs is only $2,200. In addition, the coesenus ansong investon is that Fincorp's past investments in developing the shills of its emplayes are wint $2.900. This investment of coure dees aot show up on the balance sheet. What will he the price per share of Fincorp suck? (1.03-2) 37. Income versus Cash Flows, Conseract a stateneat of cash flows for Fincorp for 2016. (LOS-3) 38. Tax Rates, (1003-4) a. What was the firm's averape ax bracket for each yeur' b. Do you tave enough informabion so deternine the marginal tax bracket? of sotal ansets? Which has higher EBrT per dollar of total assets? Which has higher poofits per dollar of shureholders' eqaity? 2. Now choose two highly profitable technology firms, wach as Imel (INTC) and Microsoft (MSFT), and two electric unibies, such as American Electric fower (AEP) and Dule Esergy (DUK). Which firms have the higher ratio of market valoe to book. value of equity? Dos this

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started