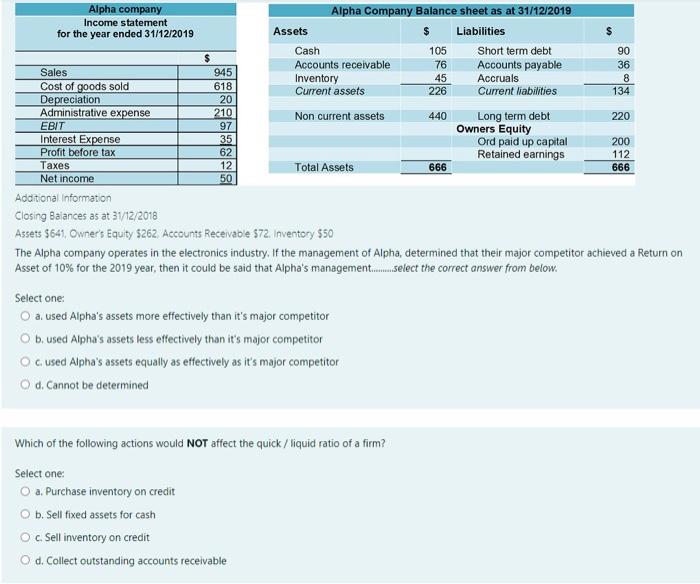

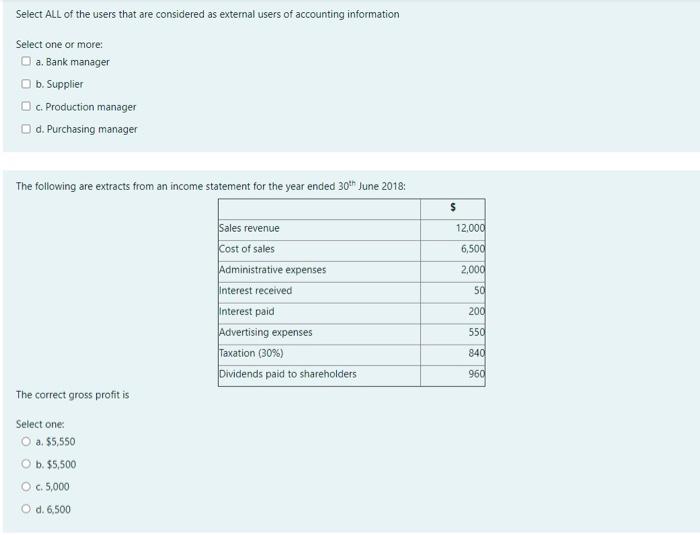

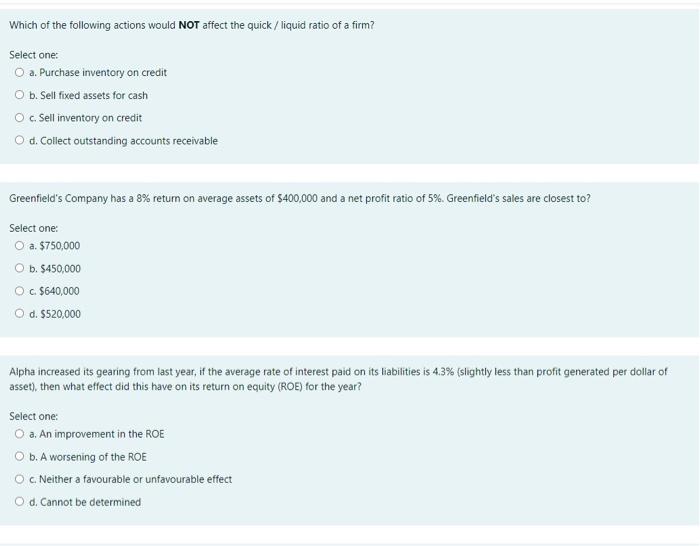

$ Alpha company Alpha Company Balance sheet as at 31/12/2019 Income statement for the year ended 31/12/2019 Assets $ Liabilities Cash 105 Short term debt 90 $ Accounts receivable 76 Accounts payable 36 Sales 945 Inventory 45 Cost of goods sold Accruals 8 618 Current assets 226 Current liabilities 134 Depreciation 20 Administrative expense 210 Non current assets 440 Long term debt 220 EBIT 97 Owners Equity Interest Expense 35 Ord paid up capital 200 Profit before tax 62 Retained earnings 112 Taxes 12 Total Assets 666 666 Net income 50 Additional Information Closing Balances as at 31/12/2018 Assets $641. Owner's Equity $262. Accounts Receivable $72. Inventory $50 The Alpha company operates in the electronics industry. If the management of Alpha, determined that their major competitor achieved a Return on Asset of 10% for the 2019 year, then it could be said that Alpha's management.....select the correct answer from below. Select one: O a used Alpha's assets more effectively than it's major competitor O bused Alpha's assets less effectively than it's major competitor ocused Alpha's assets equally as effectively as it's major competitor Od. Cannot be determined Which of the following actions would NOT affect the quick / liquid ratio of a firm? Select one: O a. Purchase inventory on credit b. Sell fixed assets for cash O c Sell inventory on credit Od. Collect outstanding accounts receivable Select ALL of the users that are considered as external users of accounting information Select one or more a. Bank manager b. Supplier c. Production manager d. Purchasing manager The following are extracts from an income statement for the year ended 30th June 2018: $ 12,000 6,500 Sales revenue Kost of sales Administrative expenses Interest received 2.000 50 200 550 Interest paid Advertising expenses Taxation (30%) Dividends paid to shareholders 840 960 The correct gross profit is Select one: O a. 55,550 b. $5,500 O c. 5,000 O d. 6,500 Which of the following actions would NOT affect the quick / liquid ratio of a firm? Select one: O a. Purchase inventory on credit O b. Sell fixed assets for cash Oc Sell inventory on credit d. Collect outstanding accounts receivable Greenfield's Company has a 8% return on average assets of $400,000 and a net profit ratio of 5%. Greenfield's sales are closest to? Select one: O a $750,000 O b. $450,000 O c $640,000 d. $520,000 Alpha increased its gearing from last year, if the average rate of interest paid on its liabilities is 4.3% (slightly less than profit generated per dollar of asset), then what effect did this have on its return on equity (ROE) for the year? Select one: O a. An improvement in the ROE O b. A worsening of the ROE O c. Neither a favourable or unfavourable effect d. Cannot be determined