Answered step by step

Verified Expert Solution

Question

1 Approved Answer

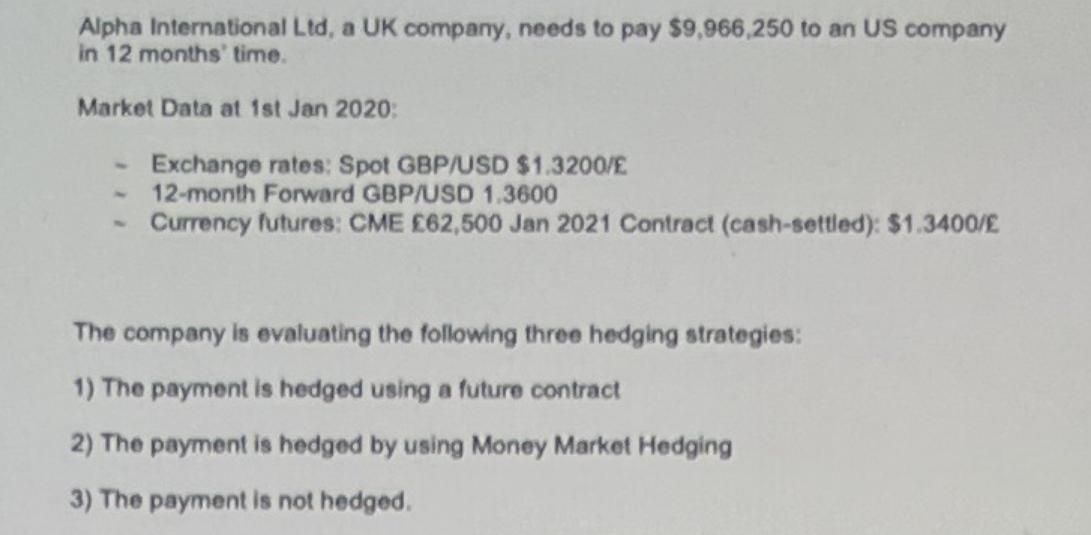

Alpha International Ltd, a UK company, needs to pay $9,966,250 to an US company in 12 months' time. Market Data at 1st Jan 2020:

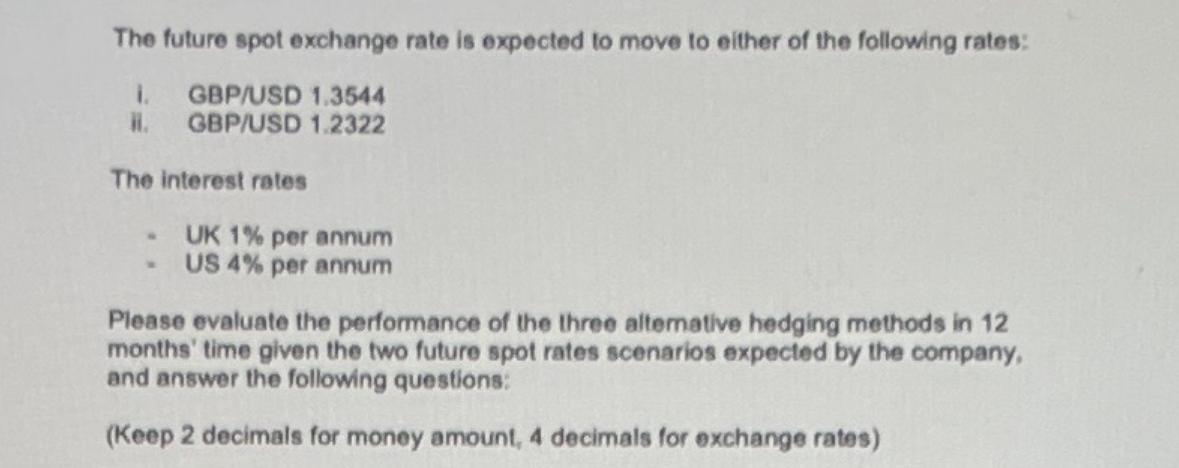

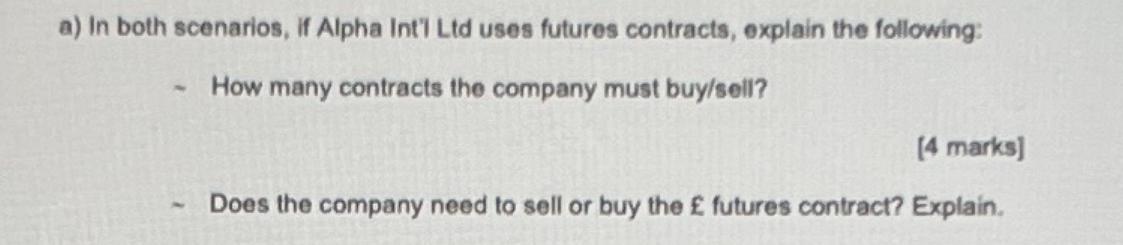

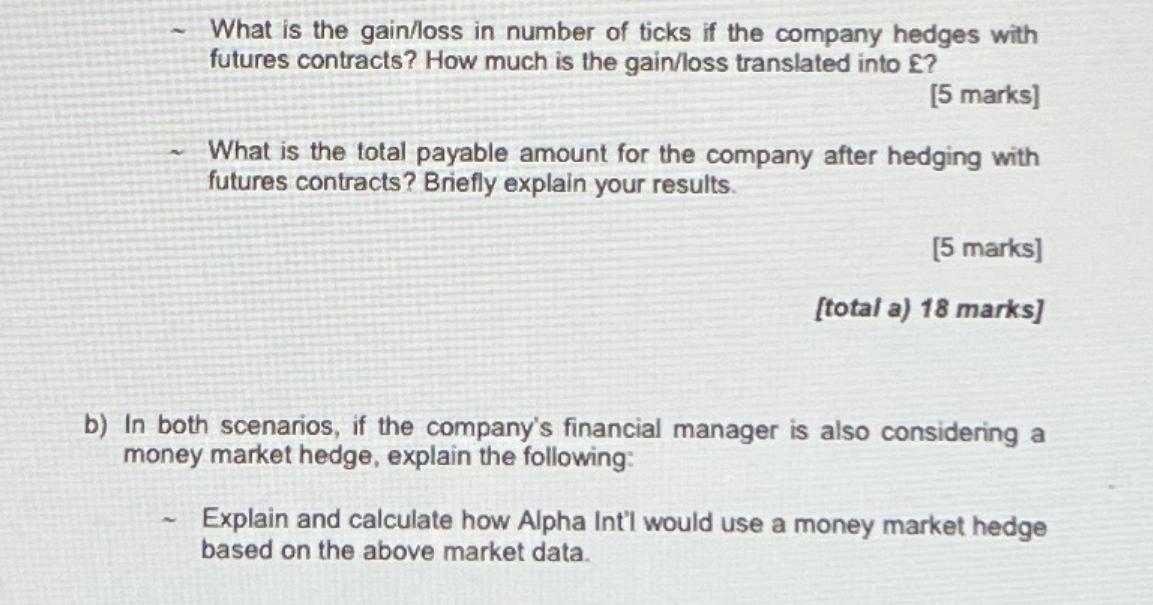

Alpha International Ltd, a UK company, needs to pay $9,966,250 to an US company in 12 months' time. Market Data at 1st Jan 2020: Exchange rates: Spot GBP/USD $1.3200/E 12-month Forward GBP/USD 1.3600 Currency futures: CME 62,500 Jan 2021 Contract (cash-settled): $1.3400/ The company is evaluating the following three hedging strategies: 1) The payment is hedged using a future contract 2) The payment is hedged by using Money Market Hedging 3) The payment is not hedged. The future spot exchange rate is expected to move to either of the following rates: i. GBP/USD 1.3544 ii. GBP/USD 1.2322 The interest rates UK 1% per annum US 4% per annum Please evaluate the performance of the three alternative hedging methods in 12 months' time given the two future spot rates scenarios expected by the company, and answer the following questions: (Keep 2 decimals for money amount, 4 decimals for exchange rates) a) In both scenarios, if Alpha Int'l Ltd uses futures contracts, explain the following: How many contracts the company must buy/sell? [4 marks] Does the company need to sell or buy the futures contract? Explain. What is the gain/loss in number of ticks if the company hedges with futures contracts? How much is the gain/loss translated into ? [5 marks] What is the total payable amount for the company after hedging with futures contracts? Briefly explain your results. [5 marks] [total a) 18 marks] b) In both scenarios, if the company's financial manager is also considering a money market hedge, explain the following: Explain and calculate how Alpha Int'l would use a money market hedge based on the above market data. N Calculate the effective exchange rate for Alpha Int'l in 12 months' time if the company uses a money market hedge strategy. Briefly explain when the firm should apply the MMH strategy or using Forward. Calculations are required to complete your explanation.

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

The question appears to have multiple parts to it regarding the hedging alternatives Alpha International Ltd a UK company can use to hedge a payment of 9966250 to a US company in 12 months time The co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started