Question

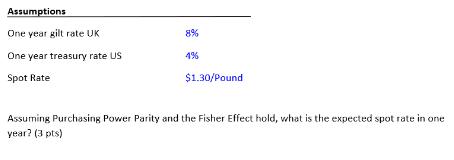

Assumptions One year gilt rate UK One year treasury rate US Spot Ratel 8% 4% $1.30/Pound Assuming Purchasing Power Parity and the Fisher Effect

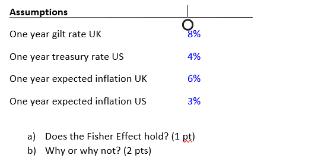

Assumptions One year gilt rate UK One year treasury rate US Spot Ratel 8% 4% $1.30/Pound Assuming Purchasing Power Parity and the Fisher Effect hold, what is the expected spot rate in one year? (3 pts) Assumptions One year gilt rate UK One year treasury rate US One year expected inflation UK One year expected inflation US O 8% 4% 6% 3% a) Does the Fisher Effect hold? (1 pt) b) Why or why not? (2 pts)

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To determine the expected spot rate in one year assuming Purchasing Power Parity PPP and the Fisher Effect we can use the following steps First lets r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Multinational Business Finance

Authors: David K. Eiteman, Arthur I. Stonehill, Michael H. Moffett

14th edition

133879879, 978-0133879872

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App