Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alpha Ltd acquired 30% of the voting shares of Beta Ltd on 1 July 2021 for $200 000. This acquisition resulted in Alpha Ltd

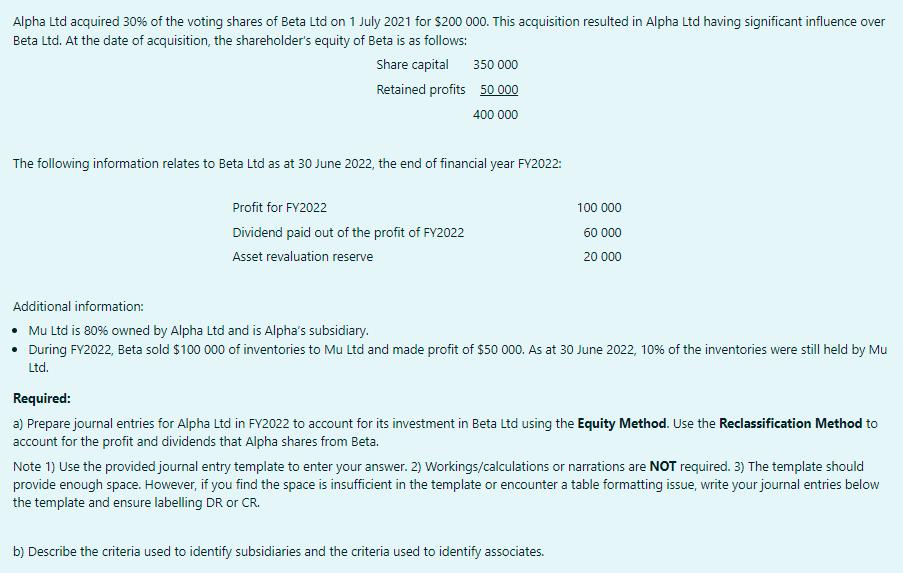

Alpha Ltd acquired 30% of the voting shares of Beta Ltd on 1 July 2021 for $200 000. This acquisition resulted in Alpha Ltd having significant influence over Beta Ltd. At the date of acquisition, the shareholder's equity of Beta is as follows: Share capital 350 000 Retained profits 50 000 400 000 The following information relates to Beta Ltd as at 30 June 2022, the end of financial year FY2022: Profit for FY2022 100 000 60 000 Dividend paid out of the profit of FY2022 Asset revaluation reserve 20 000 Additional information: Mu Ltd is 80% owned by Alpha Ltd and is Alpha's subsidiary. During FY2022, Beta sold $100 000 of inventories to Mu Ltd and made profit of $50 000. As at 30 June 2022, 10% of the inventories were still held by Mu Ltd. Required: a) Prepare journal entries for Alpha Ltd in FY2022 to account for its investment in Beta Ltd using the Equity Method. Use the Reclassification Method to account for the profit and dividends that Alpha shares from Beta. Note 1) Use the provided journal entry template to enter your answer. 2) Workings/calculations or narrations are NOT required. 3) The template should provide enough space. However, if you find the space is insufficient in the template or encounter a table formatting issue, write your journal entries below the template and ensure labelling DR or CR. b) Describe the criteria used to identify subsidiaries and the criteria used to identify associates.

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The inclusion of an investment journal by Alpha Ltd under the Equity Method Carrying Value Date Details Amt Dr Amt Cr Equity Investment Method Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started