Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alpha Ltd (Alpha) is an Australian resident public company that sells various electronic equipment. The following information relates to the year ended 30 June

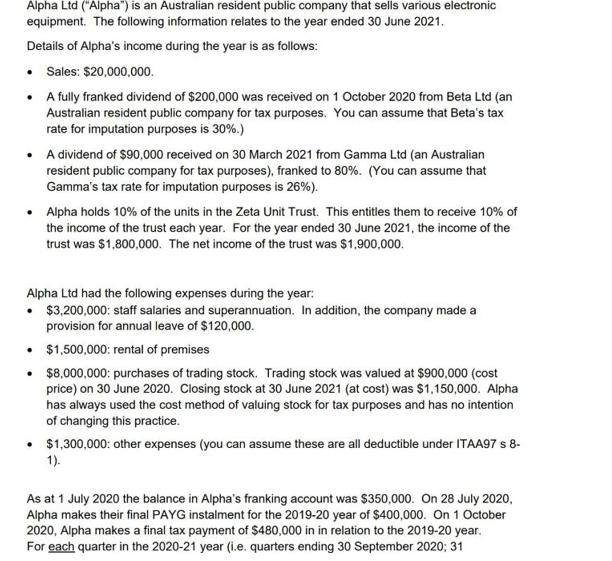

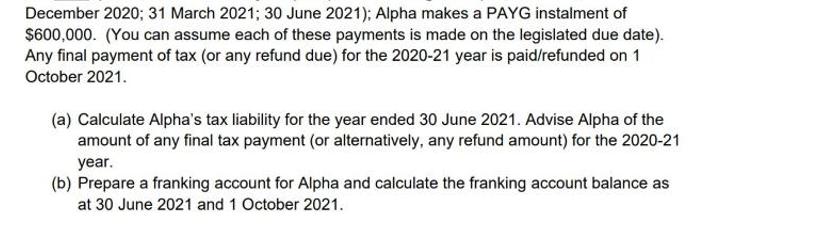

Alpha Ltd ("Alpha") is an Australian resident public company that sells various electronic equipment. The following information relates to the year ended 30 June 2021. Details of Alpha's income during the year is as follows: Sales: $20,000,000. Afully franked dividend of $200,000 was received on 1 October 2020 from Beta Ltd (an Australian resident public company for tax purposes. You can assume that Beta's tax rate for imputation purposes is 30%.) A dividend of $90,000 received on 30 March 2021 from Gamma Ltd (an Australian resident public company for tax purposes), franked to 80%. (You can assume that Gamma's tax rate for imputation purposes is 26%). Alpha holds 10% of the units in the Zeta Unit Trust. This entitles them to receive 10% of the income of the trust each year. For the year ended 30 June 2021, the income of the trust was $1,800,000. The net income of the trust was $1,900,000. Alpha Ltd had the following expenses during the year: $3,200,000: staff salaries and superannuation. In addition, the company made a provision for annual leave of $120,000. $1,500,000: rental of premises $8,000,000: purchases of trading stock. Trading stock was valued at $900,000 (cost price) on 30 June 2020. Closing stock at 30 June 2021 (at cost) was $1,150,000. Alpha has always used the cost method of valuing stock for tax purposes and has no intention of changing this practice. $1,300,000: other expenses (you can assume these are all deductible under ITAA97 s 8- 1). As at 1 July 2020 the balance in Alpha's franking account was $350,000. On 28 July 2020, Alpha makes their final PAYG instalment for the 2019-20 year of $400,000. On 1 October 2020, Alpha makes a final tax payment of $480,000 in in relation to the 2019-20 year. For each quarter in the 2020-21 year (i.e. quarters ending 30 September 2020; 31 December 2020; 31 March 2021; 30 June 2021); Alpha makes a PAYG instalment of $600,000. (You can assume each of these payments is made on the legislated due date). Any final payment of tax (or any refund due) for the 2020-21 year is paid/refunded on 1 October 2021. (a) Calculate Alpha's tax liability for the year ended 30 June 2021. Advise Alpha of the amount of any final tax payment (or alternatively, any refund amount) for the 2020-21 year. (b) Prepare a franking account for Alpha and calculate the franking account balance as at 30 June 2021 and 1 October 2021.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Sales 20000000 x 30 6000000 Dividend recieved from Beta Ltd 200000 x 30 60000 Dividend 90000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started