Question

Already asked this question once and got it wrong. Hopefully second time is a charm... Simon Companys year-end balance sheets follow. At December 31 Current

Already asked this question once and got it wrong. Hopefully second time is a charm...

Already asked this question once and got it wrong. Hopefully second time is a charm...

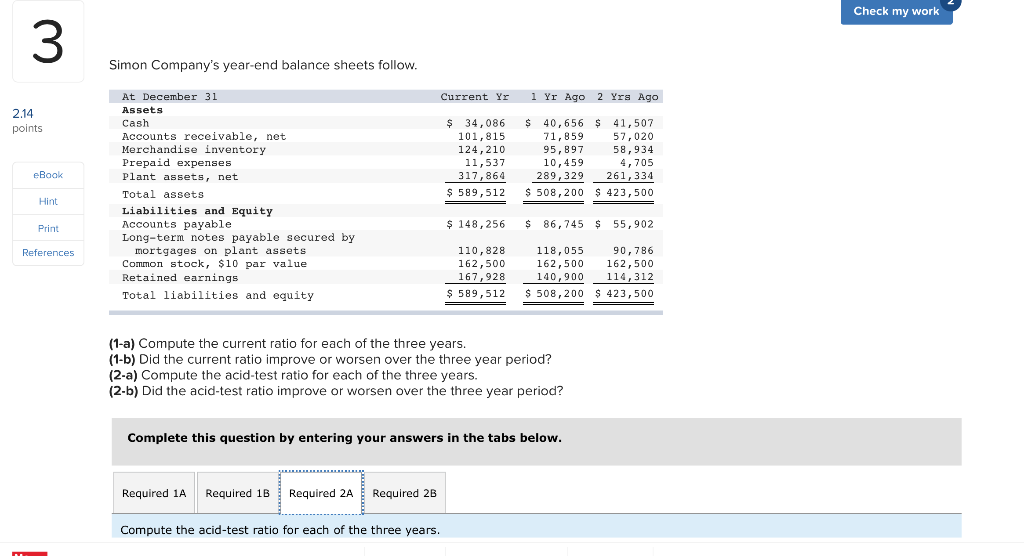

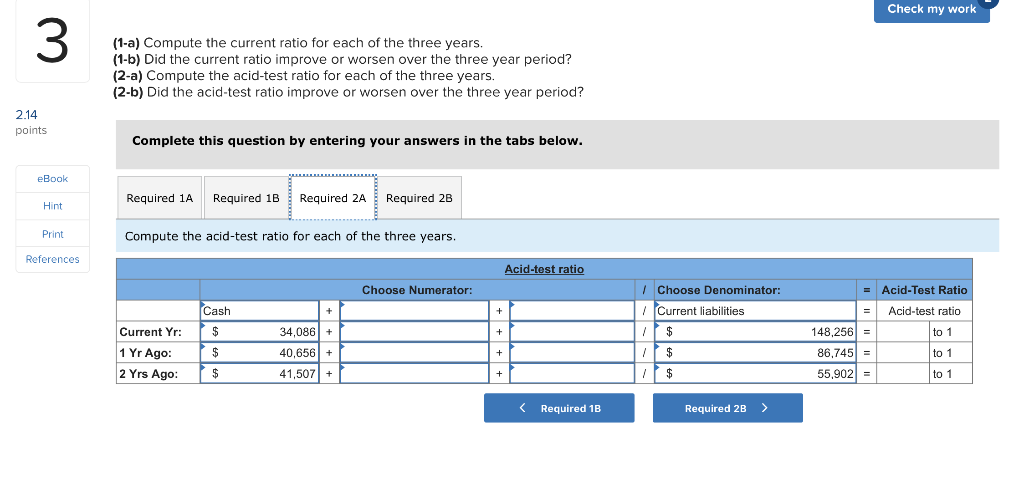

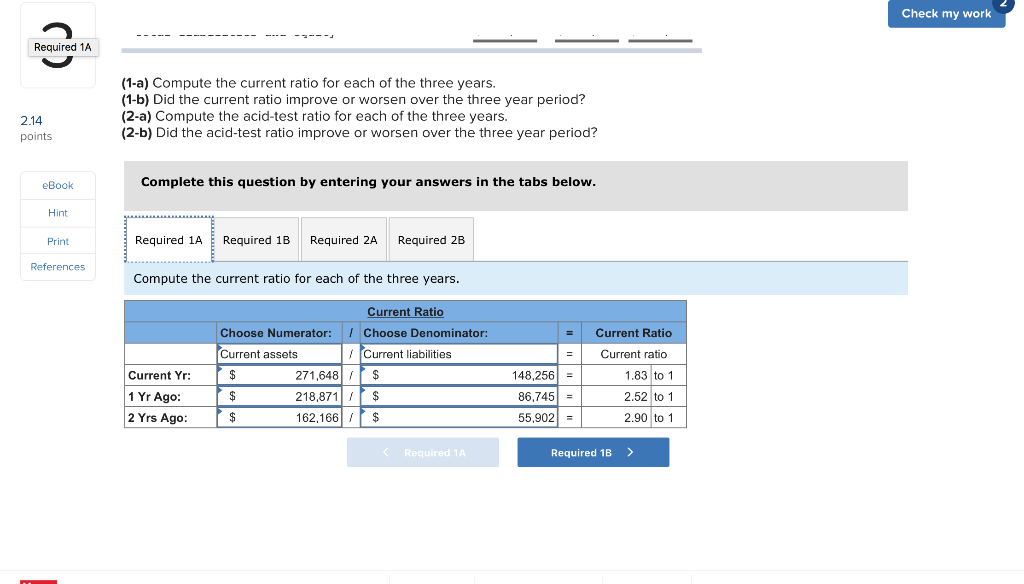

Simon Companys year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2 Yrs Ago Assets Cash $ 34,086 $ 40,656 $ 41,507 Accounts receivable, net 101,815 71,859 57,020 Merchandise inventory 124,210 95,897 58,934 Prepaid expenses 11,537 10,459 4,705 Plant assets, net 317,864 289,329 261,334 Total assets $ 589,512 $ 508,200 $ 423,500 Liabilities and Equity Accounts payable $ 148,256 $ 86,745 $ 55,902 Long-term notes payable secured by mortgages on plant assets 110,828 118,055 90,786 Common stock, $10 par value 162,500 162,500 162,500 Retained earnings 167,928 140,900 114,312 Total liabilities and equity $ 589,512 $ 508,200 $ 423,500 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period?

Check my work Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago 2.14 points $ 34,086 101,815 124,210 11,537 317,864 $ 589,512 $ 40,656 $ 41,507 71,859 57,020 95, 897 58,934 10,459 4,705 289,329 261,334 $ 508,200 $ 423,500 eBook Hint At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity Print $ 148, 256 $ 86,745 $ 55,902 References 110,828 162,500 167,928 $ 589,512 118,055 90,786 162,500 162,500 140,900 114, 312 $ 508,200 $ 423,500 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 26 Compute the acid-test ratio for each of the three years. Check my work (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period? 2.14 points Complete this question by entering your answers in the tabs below. eBook Required 1A Required 1B Required 2A Required 2B Hint Print Compute the acid-test ratio for each of the three years. References Acid-test ratio Choose Numerator: 1 Choose Denominator: 1 Current liabilities Current Yr: 1 Yr Ago: 2 Yrs Ago: Cash $ $ $ 34,086 + 40,656 + 41,507 + | = Acid-Test Ratio Acid-test ratio 148,256 = to 1 86,745 = 55,902 = ( Required 1B Required 2B > Check my work ----- ------------ --- - -- - Required 1A (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period? 2.14 points eBook Complete this question by entering your answers in the tabs below. Hint Print Required 1A Required 1B Required 2A Required 2B References Compute the current ratio for each of the three years. Current Ratio Choose Numerator: I Choose Denominator: Current assets 1 Current liabilities $ 271,6481$ $ 218,871 1 $ $ 162,166/ $ Current Yr: 1 Yr Ago: 2 Yrs Ago: 148,256 = 86,745 = 55,902 = Current Ratio Current ratio 1.83 to 1 2.52 to 1 2.90 to 1 Required 1A Required 1B >Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started