Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Also, Calculate the account balance for the Inventory t-account . What is the debit balance total for this account? Calculate the account balance for the

Also,

Also,- Calculate the account balance for the Inventory t-account . What is the debit balance total for this account?

- Calculate the account balance for the Sales Revenue t-account . What is the credit balance total for this account?

- Calculate the account balance for the Transportation Out Expense t-account. What is the debit balance total for this account?

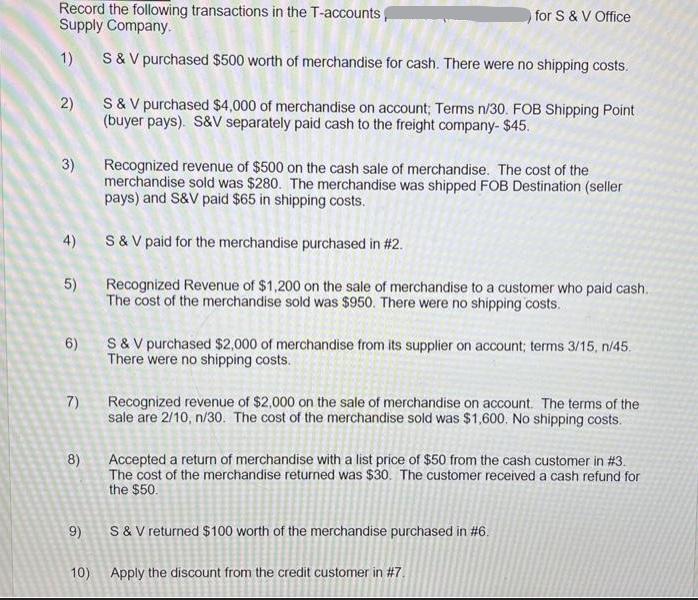

Record the following transactions in the T-accounts, Supply Company. 1) S & V purchased $500 worth of merchandise for cash. There were no shipping costs. 2) S & V purchased $4,000 of merchandise on account; Terms n/30. FOB Shipping Point (buyer pays). S&V separately paid cash to the freight company- $45. 3) 4) 5) 7) 6) S & V purchased $2,000 of merchandise from its supplier on account; terms 3/15, n/45. There were no shipping costs. 8) 9) for S & V Office Recognized revenue of $500 on the cash sale of merchandise. The cost of the merchandise sold was $280. The merchandise was shipped FOB Destination (seller pays) and S&V paid $65 in shipping costs. S & V paid for the merchandise purchased in #2. Recognized Revenue of $1,200 on the sale of merchandise to a customer who paid cash. The cost of the merchandise sold was $950. There were no shipping costs. Recognized revenue of $2,000 on the sale of merchandise on account. The terms of the sale are 2/10, n/30. The cost of the merchandise sold was $1,600. No shipping costs. Accepted a return of merchandise with a list price of $50 from the cash customer in #3. The cost of the merchandise returned was $30. The customer received a cash refund for the $50. S & V returned $100 worth of the merchandise purchased in #6. 10) Apply the discount from the credit customer in #7.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Lets go through each transaction step by step providing full details and solutions for each 1 Purchase of merchandise for cash S V purchased 500 worth of merchandise for cash Debit the Merchandise Inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started