Answered step by step

Verified Expert Solution

Question

1 Approved Answer

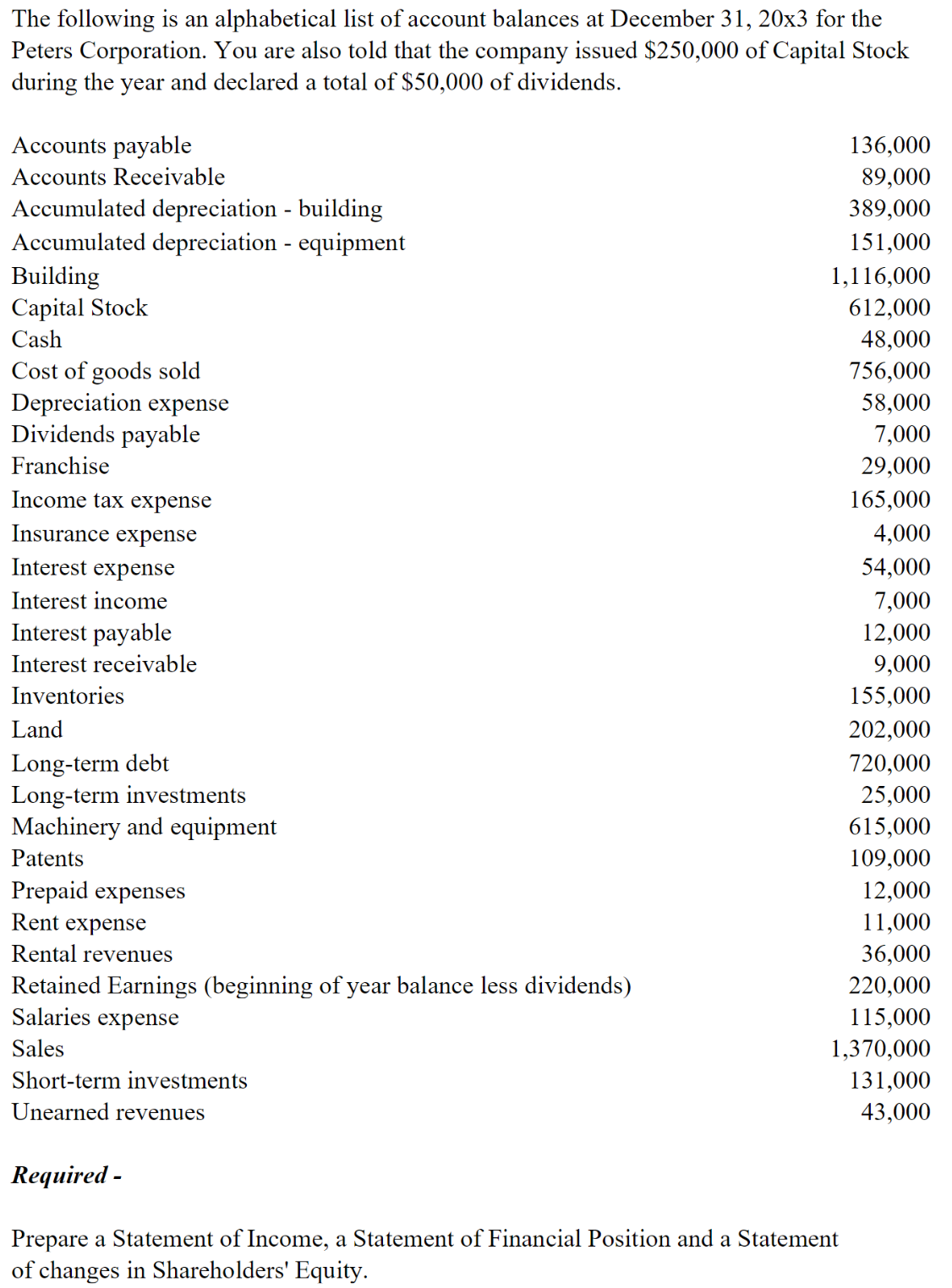

Also please explain why each is either a current/long-term asset, or a current/long-term liability if included in the financial position sheet The following is an

Also please explain why each is either a current/long-term asset, or a current/long-term liability if included in the financial position sheet

The following is an alphabetical list of account balances at December 31,203 for the Peters Corporation. You are also told that the company issued \$250,000 of Capital Stock during the year and declared a total of $50,000 of dividends. \begin{tabular}{lr} Accounts payable & 136,000 \\ Accounts Receivable & 89,000 \\ Accumulated depreciation - building & 389,000 \\ Accumulated depreciation - equipment & 151,000 \\ Building & 1,116,000 \\ Capital Stock & 612,000 \\ Cash & 48,000 \\ Cost of goods sold & 756,000 \\ Depreciation expense & 58,000 \\ Dividends payable & 7,000 \\ Franchise & 29,000 \\ Income tax expense & 165,000 \\ Insurance expense & 4,000 \\ Interest expense & 54,000 \\ Interest income & 7,000 \\ Interest payable & 12,000 \\ Interest receivable & 9,000 \\ Inventories & 155,000 \\ Land & 202,000 \\ Long-term debt & 720,000 \\ Long-term investments & 25,000 \\ Machinery and equipment & 615,000 \\ Patents & 109,000 \\ Prepaid expenses & 12,000 \\ Rent expense & 11,000 \\ Rental revenues & 36,000 \\ Retained Earnings (beginning of year balance less dividends) & 220,000 \\ Salaries expense & 115,000 \\ Sales & 1,370,000 \\ Short-term investments & 131,000 \\ Unearned revenues & 43,000 \\ & \\ \hline \end{tabular} Required - Prepare a Statement of Income, a Statement of Financial Position and a Statement of changes in Shareholders' EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started