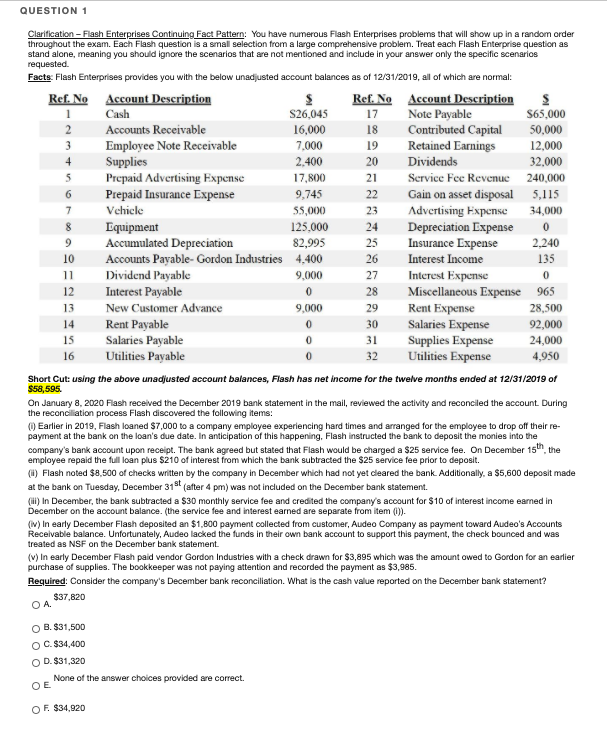

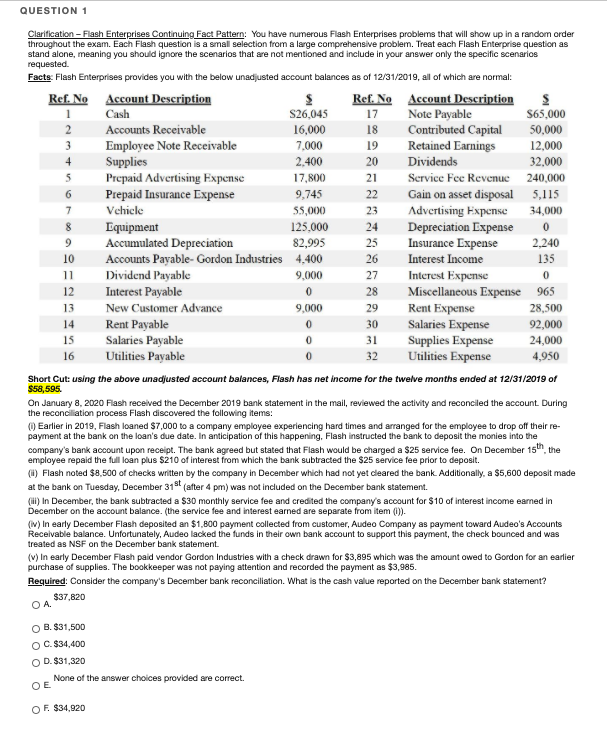

QUESTION 1 Clarification - Flash Enterprises Continuing Fact Pattern: You have numerous Flash Enterprises problems that will show up in a random order throughout the exam. Each Flash question is a small selection from a large comprehensive problem. Treat each Flash Enterprise question as stand alone, meaning you should ignore the scenarios that are not mentioned and include in your answer only the specific scenarios requested. Facts: Flash Enterprises provides you with the below unadjusted account balances as of 12/31/2019, all of which are normal: Ref. No Account Description Ref. No Account Description 1 Cash S26,045 17 Note Payable $65,000 2 Accounts Receivable 16,000 18 Contributed Capital 50,000 3 Employee Note Receivable 7,000 19 Retained Earnings 12,000 4 Supplies 2.400 20 Dividends 32.000 5 Prepaid Advertising Expense 17,800 21 Service Fee Revenue 240,000 6 Prepaid Insurance Expense 9,745 22 Gain on asset disposal 5,115 7 Vehicle 55,000 23 Advertising Expense 34,000 8 Equipment 125,000 24 Depreciation Expense 0 9 Accumulated Depreciation 82,995 25 Insurance Expense 2.240 10 Accounts Payable-Gordon Industries 4,400 26 Interest Income 135 11 Dividend Payable 9,000 27 Interest Expense 0 12 Interest Payable 0 28 Miscellaneous Expense 965 13 New Customer Advance 9,000 29 Rent Expense 28,500 14 Rent Payable 0 30 Salaries Expense 92,000 15 Salaries Payable 0 31 Supplies Expense 24,000 16 Utilities Payable 0 32 Utilities Expense 4,950 Short Cut using the above unadjusted account balances, Flash has net income for the twelve months ended at 12/31/2019 of $58,595. On January 8, 2020 Flash received the December 2019 bank statement in the mail, reviewed the activity and reconciled the account. During the reconciliation process Flash discovered the following items! Earlier in 2019, Flash loaned $7,000 to a company employee experiencing hard times and arranged for the employee to drop off their re- payment at the bank on the loan's due date. In anticipation of this happening, Flash instructed the bank to deposit the monies into the company's bank account upon receipt. The bank agreed but stated that Flash would be charged a $25 service fee. On December 15th the employee repaid the full loan plus $210 of interest from which the bank subtracted the $25 service fee prior to deposit. () Flash noted $8.500 of checks written by the company in December which had not yet cleared the bank. Additionally, a $5,600 deposit made at the bank on Tuesday, December 31st (after 4 pm) was not included on the December bank statement () In December, the bank subtracted a $30 monthly service fee and credited the company's account for $10 of interest income earned in December on the account balance. (the service fee and interest earned are separate from item ()). (iv) In early December Flash deposited an $1,800 payment collected from customer, Audeo Company as payment toward Audeo's Accounts Receivable balance. Unfortunately, Audeo lacked the funds in their own bank account to support this payment, the check bounced and was treated as NSF on the December bank statement (1) In early December Flash paid vendor Gordon Industries with a check drawn for $3,895 which was the amount owed to Gordon for an earlier purchase of supplies. The bookkeeper was not paying attention and recorded the payment as $3,985. Required: Consider the company's December bank reconciliation. What is the cash value reported on the December bank statement? $37,820 OA OB. $31.500 OC. $34,400 OD. $31,320 None of the answer choices provided are correct. OE OF $34.920