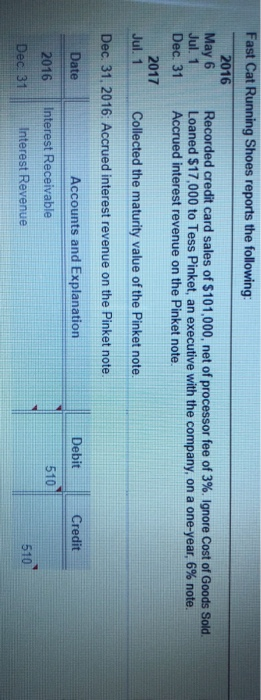

Also, please explain why interest revenue and interest receivable answer is 510.

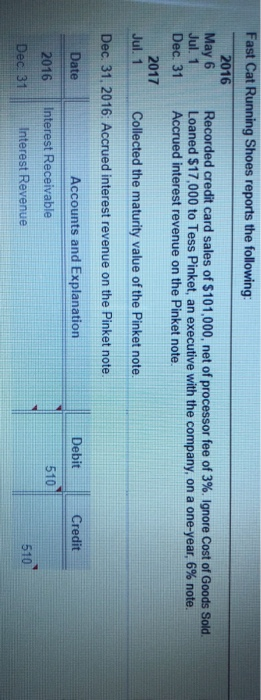

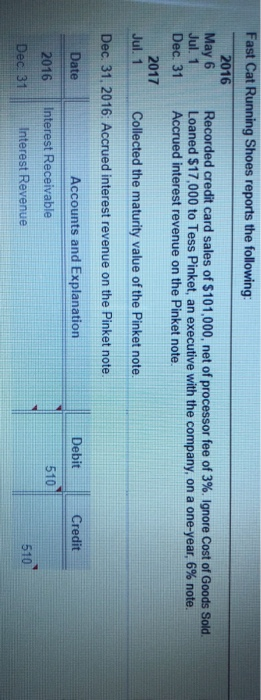

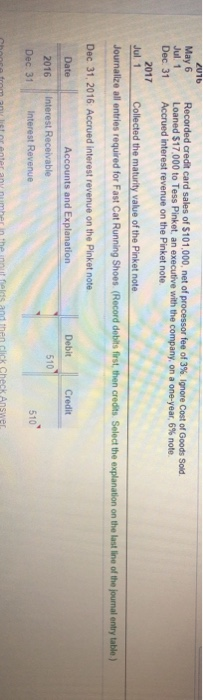

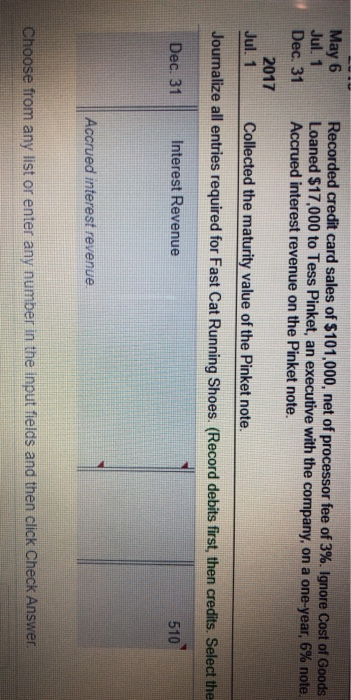

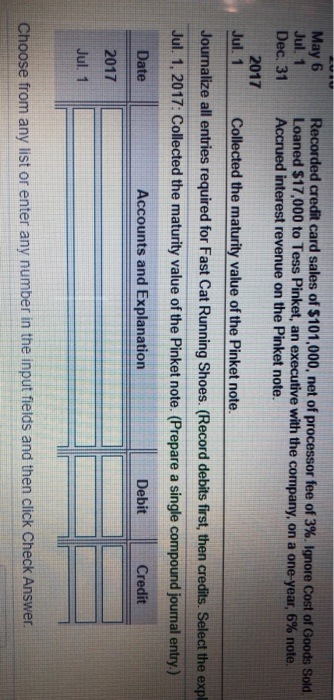

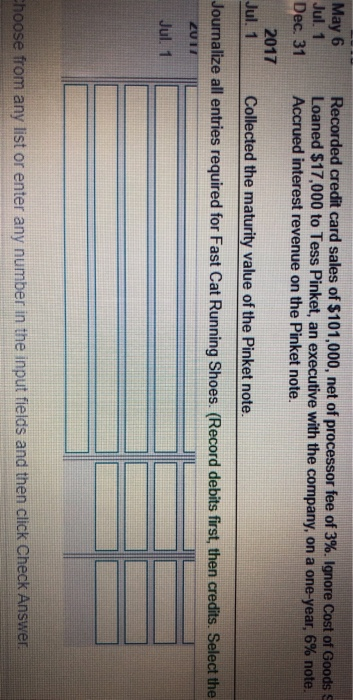

Fast Cat Running Shoes reports the following: 2016 May 6 Recorded credit card sales of $101,000, net of processor fee of 3%. Ignore Cost of Goods Sold Jul. 1 Loaned $17,000 to Tess Pinket, an executive with the company, on a one-year, 6% note. Dec. 31 Accrued interest revenue on the Pinket note. 2017 Jul. 1 Collected the maturity value of the Pinket note. Dec 31, 2016: Accrued interest revenue on the Pinket note Accounts and Explanation Debit Credit Date 2016 Dec 31 510 Interest Receivable Interest Revenue 5109 2016 May 6 Jul 1 Dec 31 2017 Jul 1 Recorded credit card sales of $101.000, net of processor fee of 3%. Ignore Cost of Goods Sold Loaned $17,000 to Tess Pinket, an executive with the company, on a one-year 6% note Accrued interest revenue on the Pinket note Collected the maturity value of the Pinket note Journalize all entries required for Fast Cat Running Shoes (Record debits first, then credits. Select the explanation on the last line of the journal entry table) Dec 31, 2016. Accrued interest revenue on the Pinket note Accounts and Explanation Credit Date 2016 Dec. 31 Debit 510 Interest Receivable Interest Revenue 5109 Chance from a list or enter any number in the innuit fields and then click Check Answer May 6 Recorded credit card sales of $101,000, net of processor fee of 3%. Ignore Cost of Goods Jul. 1 Loaned $17,000 to Tess Pinket, an executive with the company, on a one-year, 6% note Dec. 31 Accrued interest revenue on the Pinket note. 2017 Jul. 1 Collected the maturity value of the Pinket note. Journalize all entries required for Fast Cat Running Shoes (Record debits first, then credits. Select the Dec. 31 Interest Revenue 510 Accrued interest revenue Choose from any list or enter any number in the input fields and then click Check Answer. May 6 Recorded credit card sales of $101,000, net of processor fee of 3%. Ignore Cost of Goods Sold Jul. 1 Loaned $17,000 to Tess Pinket, an executive with the company, on a one-year, 6% note Dec. 31 Accrued interest revenue on the Pinket note. 2017 Jul. 1 Collected the maturity value of the Pinket note. Journalize all entries required for Fast Cat Running Shoes. (Record debits first, then credits. Select the exp Jul 1, 2017: Collected the maturity value of the Pinket note. (Prepare a single compound journal entry) Date Accounts and Explanation Debit Credit 2017 Jul. 1 Choose from any list or enter any number in the input fields and then click Check Answer. May 6 Jul. 1 Dec. 31 2017 Jul. 1 Recorded credit card sales of $101,000, net of processor fee of 3%. Ignore Cost of Goods Loaned $17,000 to Tess Pinket, an executive with the company, on a one-year, 6% note. Accrued interest revenue on the Pinket note. Collected the maturity value of the Pinket note. Journalize all entries required for Fast Cat Running Shoes (Record debits first, then credits. Select the 2017 Jul. 1 Choose from any list or enter any number in the input fields and then click Check