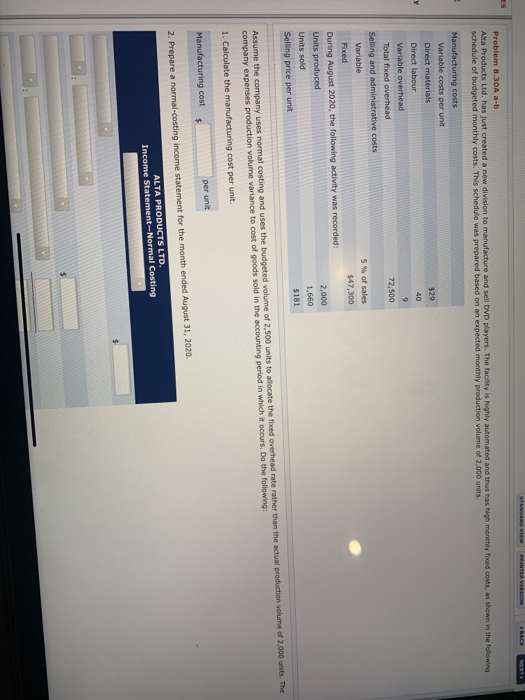

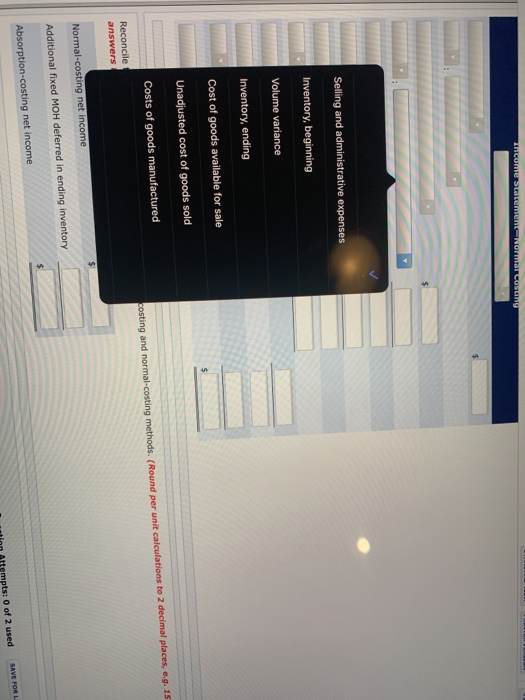

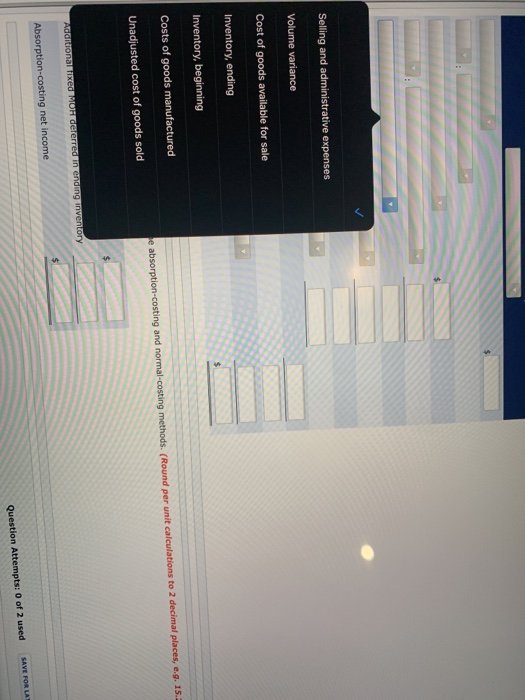

Alta products Ltd has just created a new divisio

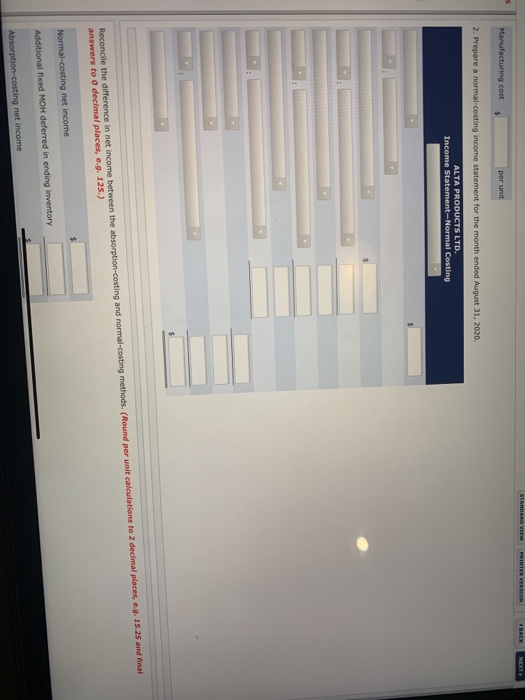

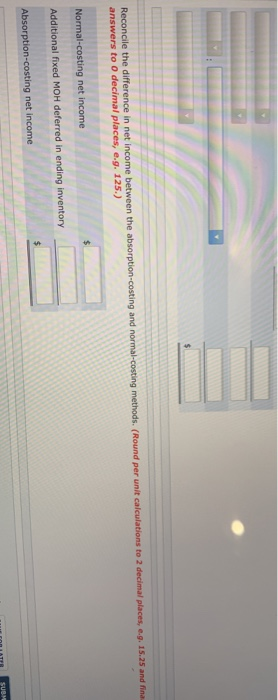

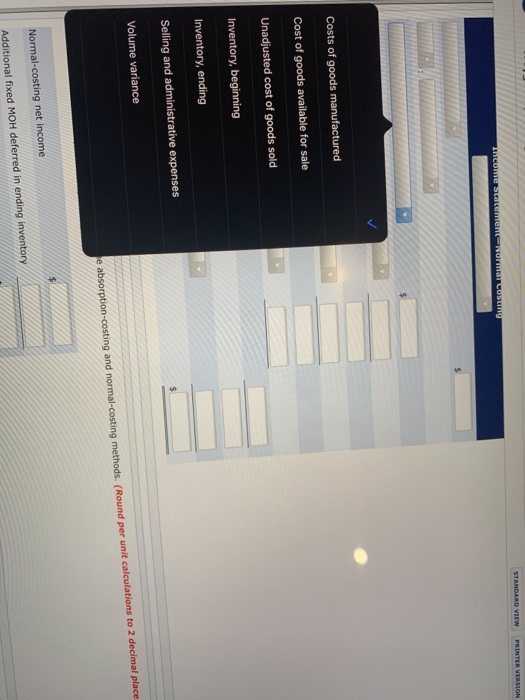

Problem 8.30A a-b Alta Products Ltd. has just created a new division to manufacture and sel DVD players. The fact is highly automated and thus has high monthly feed costs, shown in the following schedule of budgeted monthly costs. This schedule was prepared based on an expected monthly production volume of 2.000 units $29 40 72,500 Manufacturing costs Variable costs per unit Direct materials Direct labour Variable overhead Total fixed overhead Selling and administrative costs Variable Fixed During August 2020, the following activity was recorded: Units produced Units sold Selling price per unit 5% of sales $47,300 2,000 1,660 $181 Assume the company uses normal costing and uses the budgeted volume of 2,500 units to allocate the fixed overhead rate rather than the actual production volume of 2,000 units. The company expenses production volume variance to cost of goods sold in the accounting period in which it occurs. Do the following: 1. Calculate the manufacturing cost per unit. per unit Manufacturing cost $ 2. Prepare a normal-costing income statement for the month ended August 31, 2020. ALTA PRODUCTS LTD. Income Statement - Normal Costing Manufacturing cost per unit 2. Prepare a normal costing income statement for the month ended August 31, 2020. ALTA PRODUCTS LTD. Income Statement-Normal Costing . 15.25 and final Reconcile the difference in net income between the absorption-costing and normal-costing methods. (Round per unit calculations to 2 decimal places answers to decimal places, e.g. 125.) Normal-costing net income Additional fixed MOH deferred in ending inventory Absorption-costing net income Reconcile the difference in net income between the absorption costing and normal-costing methods. (Round per unit calculations to 2 decimal places, e.g. 15.25 and fina answers to o decimal places, e.g. 125.) Normal-costing net income Additional fixed MOH deferred in ending inventory Absorption-costing net income DIATTI SUBM STANDARD VIEW PRINTER VERSION Costs of goods manufactured Cost of goods available for sale Unadjusted cost of goods sold Inventory, beginning Inventory, ending Selling and administrative expenses Volume variance e absorption costing and normal-costing methods. (Round per unit calculations to 2 decimal place Normal-costing net income Additional fixed MOH deferred in ending inventory Income statement-Norma Costing Selling and administrative expenses Inventory, beginning Volume variance Inventory, ending Cost of goods available for sale Unadjusted cost of goods sold Costs of goods manufactured costing and normal costing methods. (Round per unit calculations to 2 decimal places, ... 15 Reconcile answers Normal-costing net income Additional fixed MOH deferred in ending inventory Absorption-costing net income SAVE FOR tinn Attempts: 0 of 2 used Selling and administrative expenses Volume variance Cost of goods available for sale Inventory, ending Inventory, beginning Costs of goods manufactured e absorption costing and normal costing methods. (Round per unit calculations to 2 decimal places, e.. 15. Unadjusted cost of goods sold itonal Fixed MOF deferred in ending inventory $ Absorption-costing net income SAVE FOR LA Question Attempts: 0 of 2 used