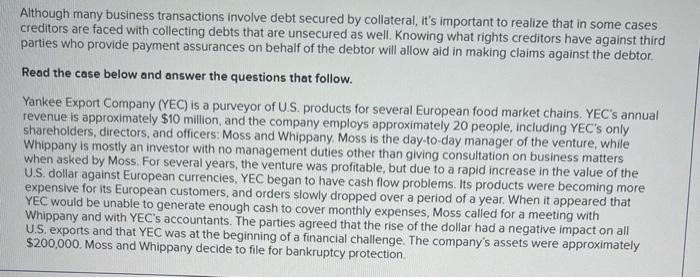

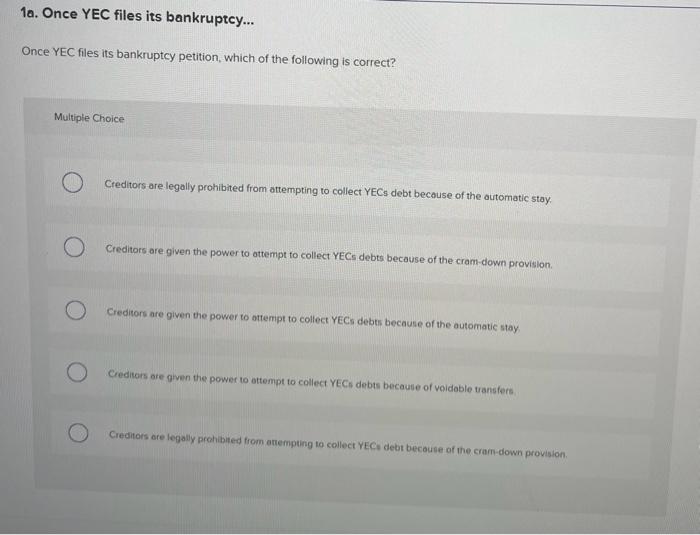

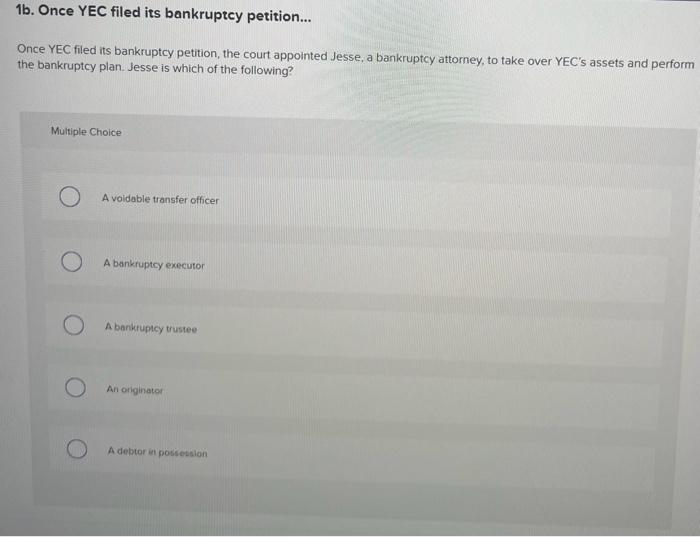

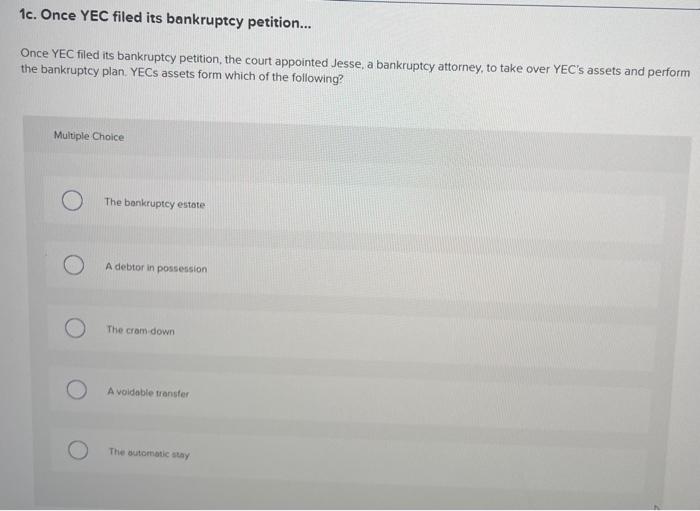

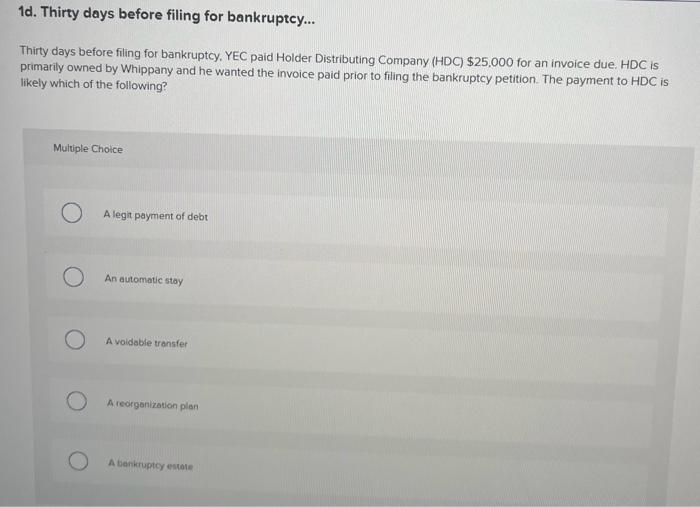

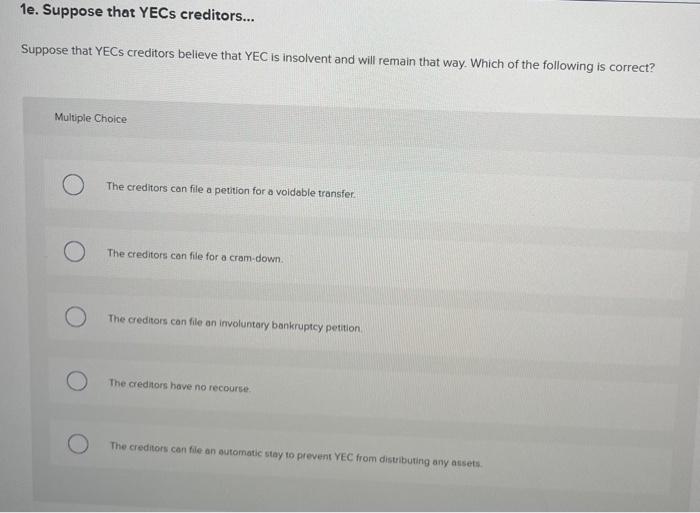

Although many business transactions involve debt secured by collateral, it's important to realize that in some cases creditors are faced with collecting debts that are unsecured as well. Knowing what rights creditors have against third parties who provide payment assurances on behalf of the debtor will allow aid in making claims against the debtor. Read the case below and answer the questions that follow. Yankee Export Company (YEC) is a purveyor of U.S. products for several European food market chains, YEC's annual revenue is approximately $10 million, and the company employs approximately 20 people, including YEC's only shareholders, directors, and officers: Moss and Whippany. Moss is the day-to-day manager of the venture, while Whippany is mostly an investor with no management duties other than giving consultation on business matters when asked by Moss. For several years, the venture was profitable, but due to a rapid increase in the value of the U.S. dollar against European currencies, YEC began to have cash flow problems. Its products were becoming more expensive for its European customers, and orders slowly dropped over a period of a year. When it appeared that YEC would be unable to generate enough cash to cover monthly expenses, Moss called for a meeting with Whippany and with YEC's accountants. The parties agreed that the rise of the dollar had a negative impact on all U.S. exports and that YEC was at the beginning of a financial challenge. The company's assets were approximately $200,000. Moss and Whippany decide to file for bankruptcy protection. 10. Once YEC files its bankruptcy... Once YEC files its bankruptcy petition, which of the following is correct? Multiple Choice Creditors are legally prohibited from attempting to collect YECs debt becouse of the automatic stay. Creditors are given the power to attempt to collect YECs debts because of the cram-down provision. Creditors are given the power to oftempt to collect YECr debts because of the automatic stay. Cieditors ore given the power to attempt to collect YECs debts becaute of voldable transfers Creditors are legally prahibited from attempting to collect YEC, debt becaute of the cram-down provision. 1b. Once YEC filed its bankruptcy petition... Once YEC filed its bankruptcy petition, the court appointed Jesse, a bankruptcy attorney, to take over YEC's assets and perform the bankruptcy plan. Jesse is which of the following? Multiple Choice A voidable transfer officer A bankruptcy executor A bankrupicy trustee An originator A deptor in posisebsion 1c. Once YEC filed its bankruptcy petition... Once YEC filed its bankruptcy petition, the court appointed Jesse, a bankruptcy attorney, to take over YEC's assets and perform the bankruptcy plan. YECs assets form which of the following? Multiple Choice The bankruptcy estote A debtor in possession The cram-down A voidable transter Thie astomatic stay 1d. Thirty days before filing for bankruptcy... Thirty days before filing for bankruptcy. YEC paid Holder Distributing Company (HDC) $25,000 for an invoice due. HDC is primarily owned by Whippany and he wanted the invoice paid prior to filing the bankruptcy petition. The payment to HDC is likely which of the following? Multiple Chotce A legit payment of debt An automatic stay A voidable tronsfer A reorganization plan A benkruptcy estote that YECs creditors... Suppose that YECs creditors believe that YEC is insolvent and will remain that way. Which of the following is correct? Multiple Choice The creditors can file a petition for a voidable transfer. The creditors con file for a cram-down. The creditors can file an involuntary bankruptcy petition The creditors have no recourse The creditors cen file an automatic stay to prevent YEC from distributing any atsets