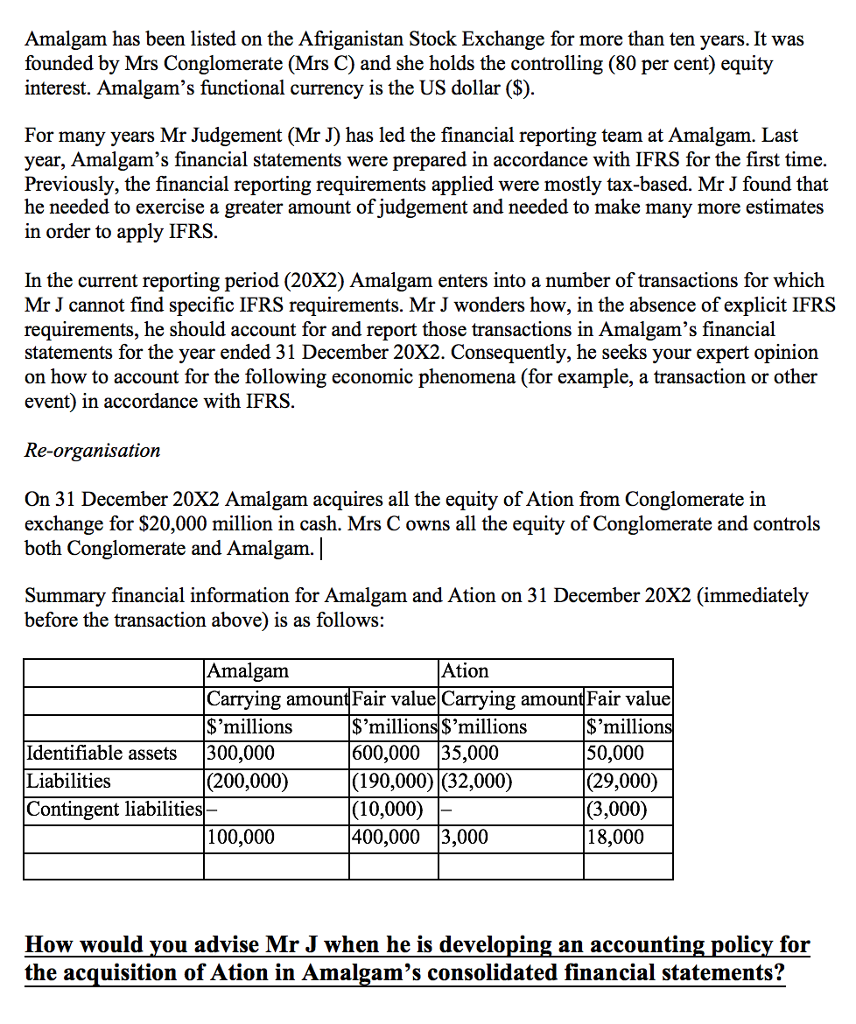

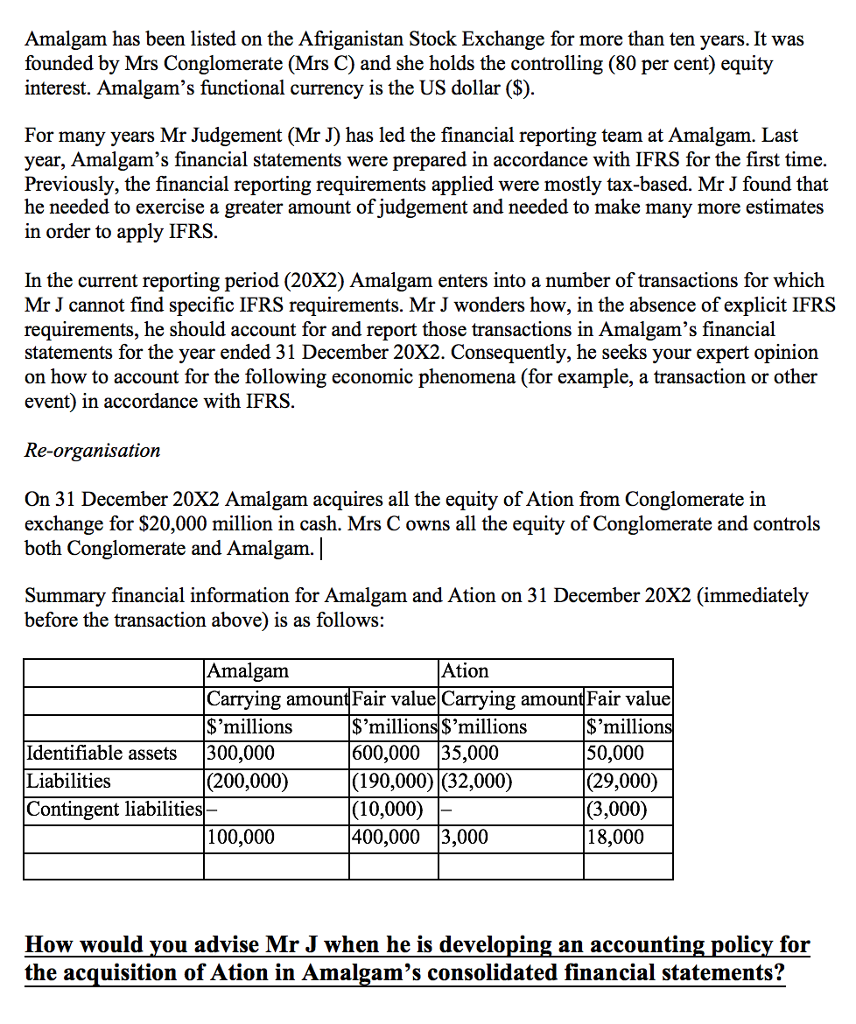

Amalgam has been listed on the Afghanistan Stock Exchange for more than ten years. It was founded by Mrs Conglomerate (Mrs C) and she holds the controlling (80 per cent) equity interest. Amalgam's functional currency is the US dollar ($). For many years Mr Judgement (Mr J) has led the financial reporting team at Amalgam. Last year, Amalgam's financial statements were prepared in accordance with IFRS for the first time. Previously, the financial reporting requirements applied were mostly tax-based. Mr J found that he needed to exercise a greater amount of judgement and needed to make many more estimates in order to apply IFRS. In the current reporting period (20X2) Amalgam enters into a number of transactions for which Mr J cannot find specific IFRS requirements. Mr J wonders how, in the absence of explicit IFRS requirements, he should account for and report those transactions in Amalgam's financial statements for the year ended 31 December 20X2. Consequently, he seeks your expert opinion on how to account for the following economic phenomena (for example, a transaction or other event) in accordance with IFRS. Re-organisation On 31 December 20X2 Amalgam acquires all the equity of Ation from Conglomerate in exchange for $20,000 million in cash. Mrs C owns all the equity of Conglomerate and controls both Conglomerate and Amalgam. | Summary financial information for Amalgam and Ation on 31 December 20X2 (immediately before the transaction above) is as follows: How would you advise Mr J when he is developing an accounting policy for the acquisition of Ation in Amalgam's consolidated financial statements? Amalgam has been listed on the Afghanistan Stock Exchange for more than ten years. It was founded by Mrs Conglomerate (Mrs C) and she holds the controlling (80 per cent) equity interest. Amalgam's functional currency is the US dollar ($). For many years Mr Judgement (Mr J) has led the financial reporting team at Amalgam. Last year, Amalgam's financial statements were prepared in accordance with IFRS for the first time. Previously, the financial reporting requirements applied were mostly tax-based. Mr J found that he needed to exercise a greater amount of judgement and needed to make many more estimates in order to apply IFRS. In the current reporting period (20X2) Amalgam enters into a number of transactions for which Mr J cannot find specific IFRS requirements. Mr J wonders how, in the absence of explicit IFRS requirements, he should account for and report those transactions in Amalgam's financial statements for the year ended 31 December 20X2. Consequently, he seeks your expert opinion on how to account for the following economic phenomena (for example, a transaction or other event) in accordance with IFRS. Re-organisation On 31 December 20X2 Amalgam acquires all the equity of Ation from Conglomerate in exchange for $20,000 million in cash. Mrs C owns all the equity of Conglomerate and controls both Conglomerate and Amalgam. | Summary financial information for Amalgam and Ation on 31 December 20X2 (immediately before the transaction above) is as follows: How would you advise Mr J when he is developing an accounting policy for the acquisition of Ation in Amalgam's consolidated financial statements