Answered step by step

Verified Expert Solution

Question

1 Approved Answer

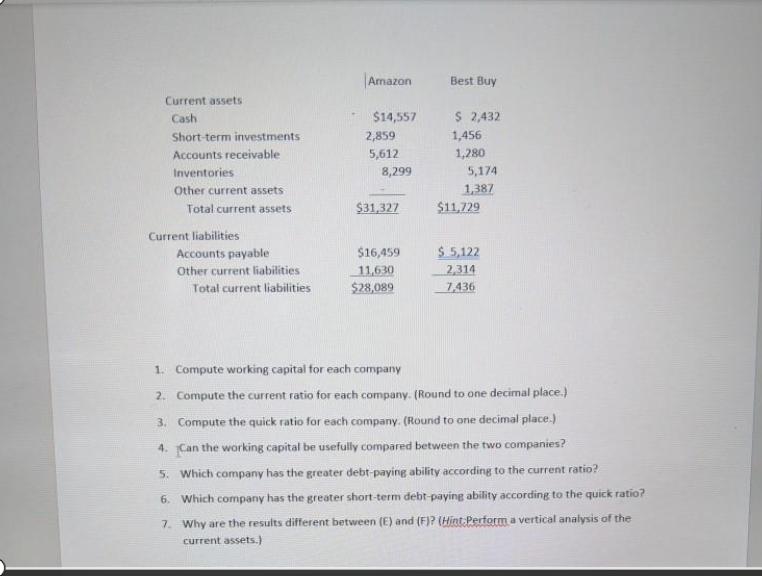

Amazon Current liabilities Current assets Cash Short-term investments Accounts receivable Inventories Other current assets Total current assets $31,327 $11,729 Accounts payable $16,459 $5,122 Other

Amazon Current liabilities Current assets Cash Short-term investments Accounts receivable Inventories Other current assets Total current assets $31,327 $11,729 Accounts payable $16,459 $5,122 Other current liabilities 11,630 2,314 Total current liabilities $28,089 7,436 1. Compute working capital for each company 2. Compute the current ratio for each company. (Round to one decimal place.) 3. Compute the quick ratio for each company. (Round to one decimal place.) 4. Can the working capital be usefully compared between the two companies? 5. Which company has the greater debt-paying ability according to the current ratio? 6. Which company has the greater short-term debt-paying ability according to the quick ratio? 7. Why are the results different between (E) and (F)? (Hint Perform a vertical analysis of the current assets.) $14,557 2,859 5,612 Best Buy $ 2,432 1,456 1,280 8,299 5,174 1,387

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A Amazon 323800 B C Amazon Current ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started