Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Amelia purchased 500 shares of Xienna stock at RM50 per share. She owns RM15,000 to invest and the minimum initial margin requirement is 50%. She

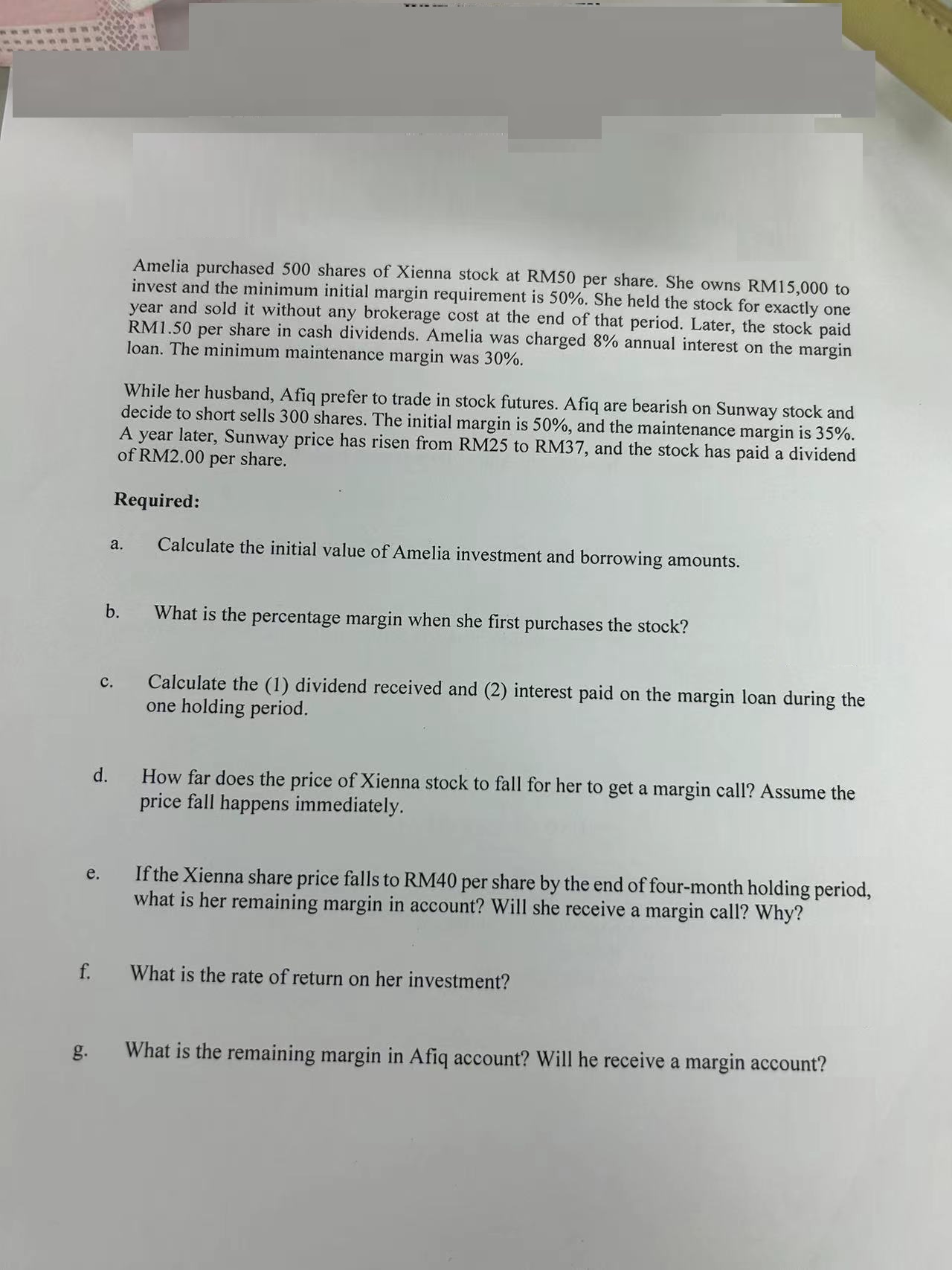

Amelia purchased 500 shares of Xienna stock at RM50 per share. She owns RM15,000 to invest and the minimum initial margin requirement is 50%. She held the stock for exactly one year and sold it without any brokerage cost at the end of that period. Later, the stock paid RM1.50 per share in cash dividends. Amelia was charged 8% annual interest on the margin loan. The minimum maintenance margin was 30%. While her husband, Afiq prefer to trade in stock futures. Afiq are bearish on Sunway stock and decide to short sells 300 shares. The initial margin is 50\%, and the maintenance margin is 35%. A year later, Sunway price has risen from RM25 to RM37, and the stock has paid a dividend of RM2.00 per share. Required: a. Calculate the initial value of Amelia investment and borrowing amounts. b. What is the percentage margin when she first purchases the stock? c. Calculate the (1) dividend received and (2) interest paid on the margin loan during the one holding period. d. How far does the price of Xienna stock to fall for her to get a margin call? Assume the price fall happens immediately. e. If the Xienna share price falls to RM40 per share by the end of four-month holding period, what is her remaining margin in account? Will she receive a margin call? Why? f. What is the rate of return on her investment? g. What is the remaining margin in Afiq account? Will he receive a margin account

Amelia purchased 500 shares of Xienna stock at RM50 per share. She owns RM15,000 to invest and the minimum initial margin requirement is 50%. She held the stock for exactly one year and sold it without any brokerage cost at the end of that period. Later, the stock paid RM1.50 per share in cash dividends. Amelia was charged 8% annual interest on the margin loan. The minimum maintenance margin was 30%. While her husband, Afiq prefer to trade in stock futures. Afiq are bearish on Sunway stock and decide to short sells 300 shares. The initial margin is 50\%, and the maintenance margin is 35%. A year later, Sunway price has risen from RM25 to RM37, and the stock has paid a dividend of RM2.00 per share. Required: a. Calculate the initial value of Amelia investment and borrowing amounts. b. What is the percentage margin when she first purchases the stock? c. Calculate the (1) dividend received and (2) interest paid on the margin loan during the one holding period. d. How far does the price of Xienna stock to fall for her to get a margin call? Assume the price fall happens immediately. e. If the Xienna share price falls to RM40 per share by the end of four-month holding period, what is her remaining margin in account? Will she receive a margin call? Why? f. What is the rate of return on her investment? g. What is the remaining margin in Afiq account? Will he receive a margin account Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started