Answered step by step

Verified Expert Solution

Question

1 Approved Answer

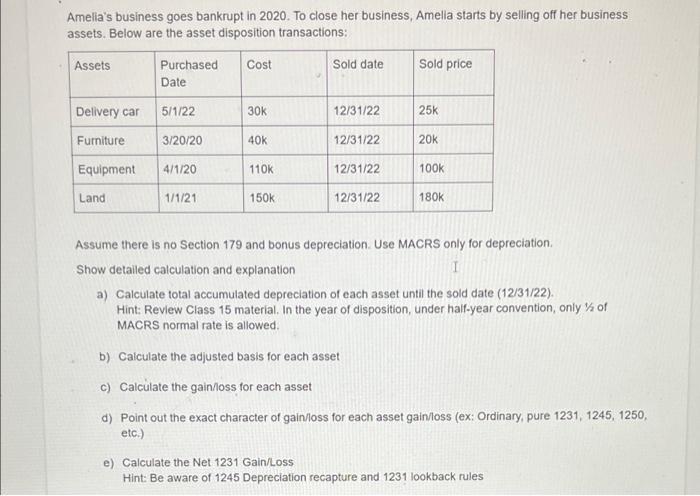

Amelia's business goes bankrupt in 2020. To close her business, Amelia starts by selling off her business assets. Below are the asset disposition transactions:

Amelia's business goes bankrupt in 2020. To close her business, Amelia starts by selling off her business assets. Below are the asset disposition transactions: Purchased Date 5/1/22 3/20/20 Equipment 4/1/20 1/1/21 Assets Delivery car Furniture Land Cost 30k 40k 110k 150k Sold date 12/31/22 12/31/22 12/31/22 12/31/22 Sold price 25k 20k 100k 180k Assume there is no Section 179 and bonus depreciation. Use MACRS only for depreciation. Show detailed calculation and explanation I a) Calculate total accumulated depreciation of each asset until the sold date (12/31/22). Hint: Review Class 15 material. In the year of disposition, under half-year convention, only % of MACRS normal rate is allowed. b) Calculate the adjusted basis for each asset c) Calculate the gain/loss for each asset d) Point out the exact character of gain/loss for each asset gain/loss (ex: Ordinary, pure 1231, 1245, 1250, etc.) e) Calculate the Net 1231 Gain/Loss Hint: Be aware of 1245 Depreciation recapture and 1231 lookback rules

Step by Step Solution

★★★★★

3.35 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Delivery Car The Delivery Car was purchased on 5122 and sold on 32020 This means that the car was held for less than a year so the halfyear convention applies This means that for the year of disposi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started