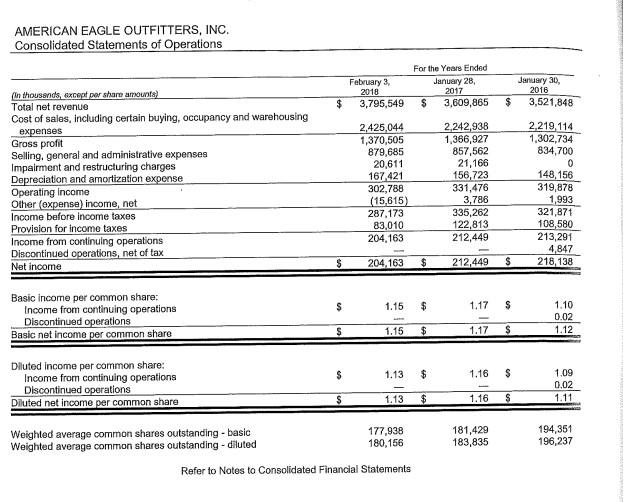

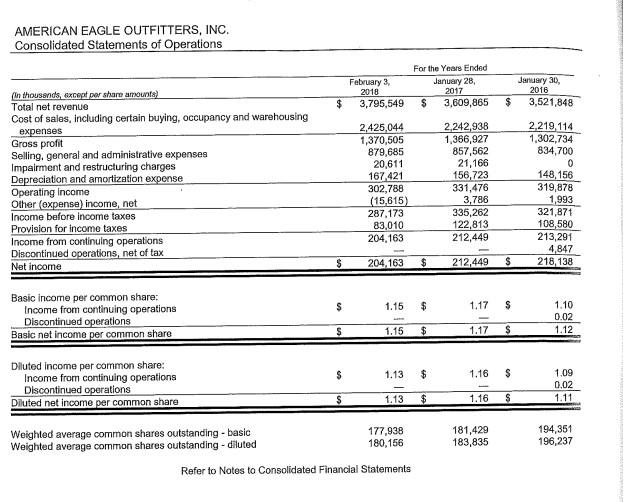

American Eagle:

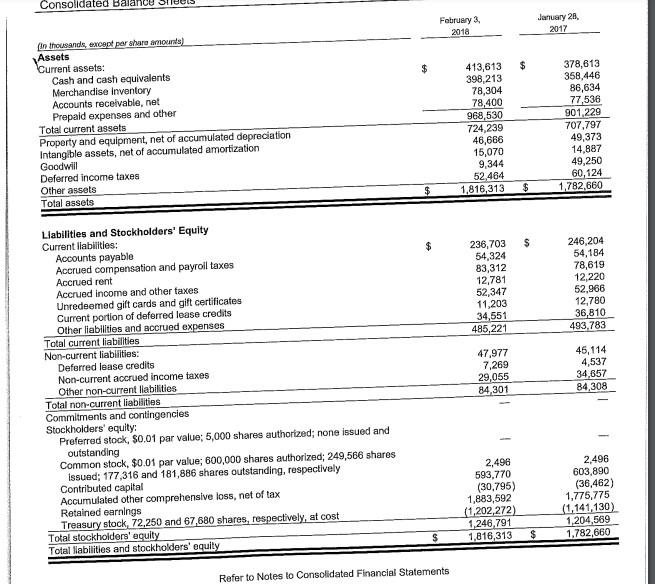

American Eagle:

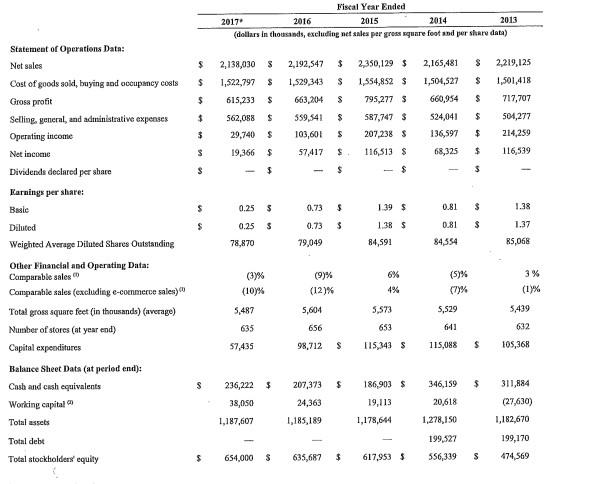

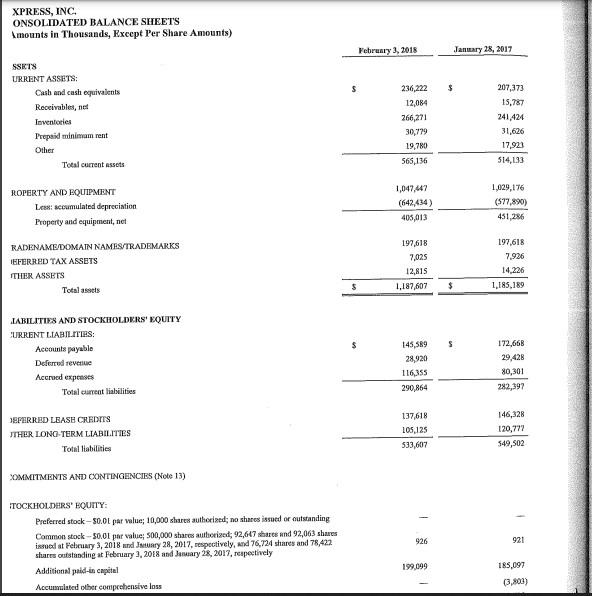

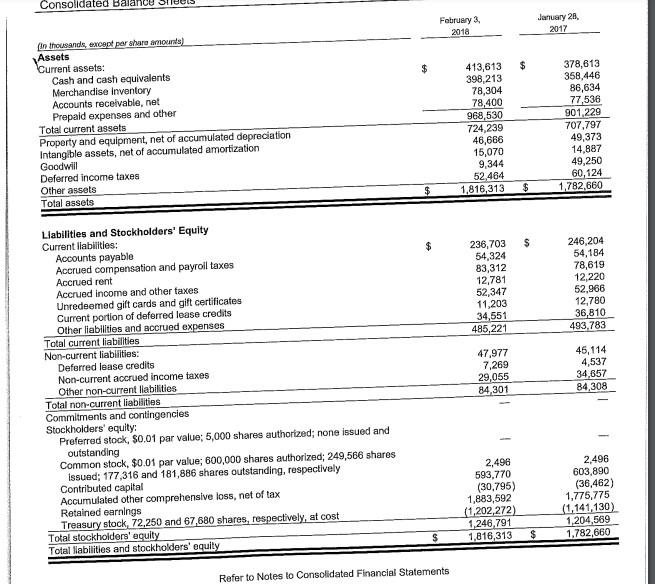

Express:

Express:

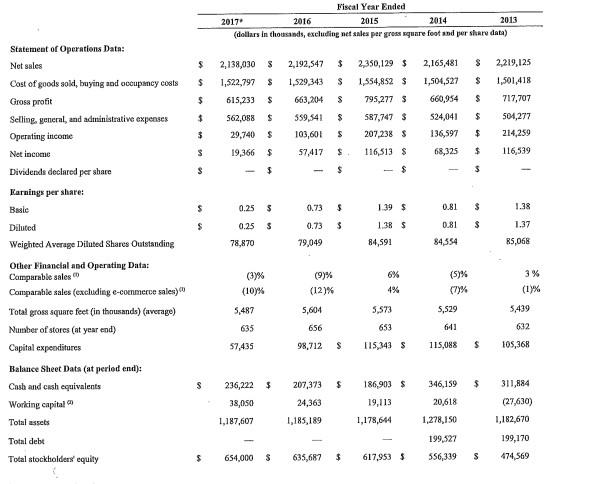

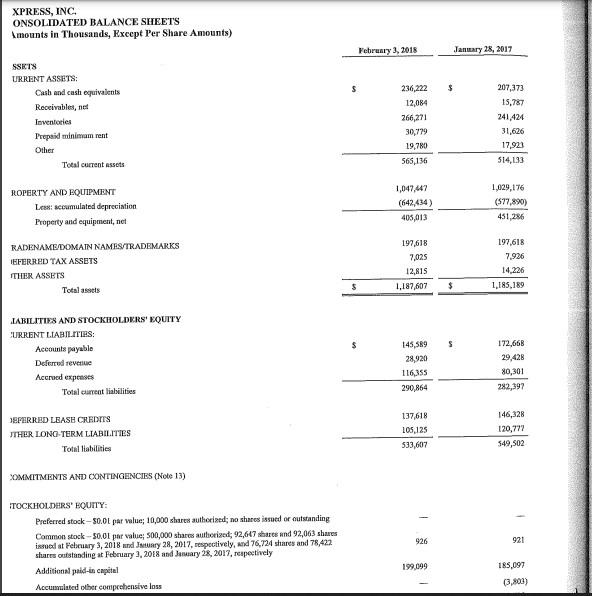

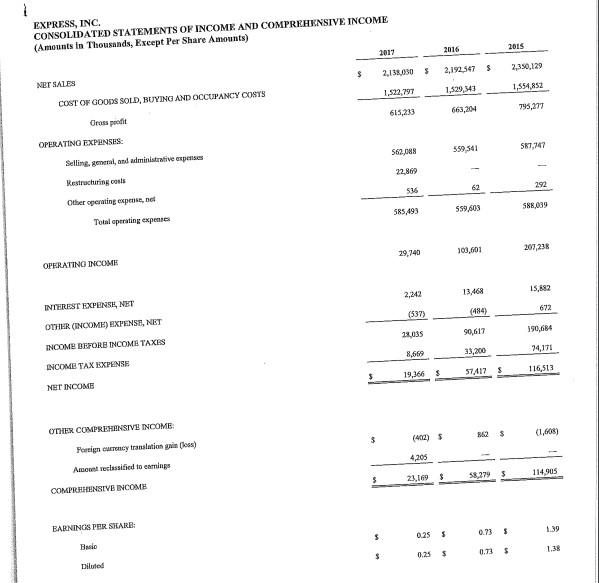

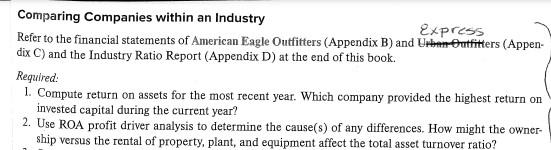

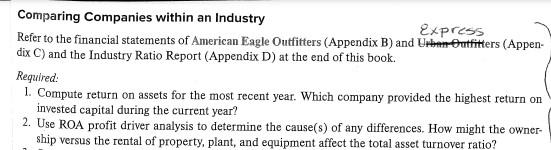

Comparing Companies within an Industry Express Refer to the financial statements of American Eagle Outfitters (Appendix B) and Urban Outfitters (Appen- dix C) and the Industry Ratio Report (Appendix D) at the end of this book. Required 1. Compute return on assets for the most recent year. Which company provided the highest return on invested capital during the current year? 2. Use ROA profit driver analysis to determine the cause(s) of any differences. How might the owner- ship versus the rental of property, plant, and equipment affect the total asset turnover ratio? AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Operations February 3, 2018 3,795,549 For the Year Ended January 28, 2017 $ 3,609,865 January 30, 2016 3,521,848 $ $ In thousands, excepto share amounts) Total net revenue Cost of sales, including certain buying, occupancy and warehousing expenses Gross profit Selling, general and administrative expenses Impairment and restructuring charges Depreciation and amortization expense Operating Income Other (expense) income, net Income before income taxos Provision for Income taxes Income from continuing operations Discontinued operations, net of tax Net income 2.425,044 1,370,505 879,685 20,611 167,421 302,788 (15,615) 287.173 83,010 204,163 2.242,938 1,366,927 857,562 21,166 156,723 331,476 3,786 335,262 122,813 212,449 2,219 114 1,302,734 834,700 0 148, 156 319,878 1,993 321,871 108,580 213,291 4,847 218,138 $ 204 163 $ 212,449 $ OS 1.15 $ 1,17 $ Basic income per common share: Income from continuing operations Discontinued operations Basic net income per common share 1.10 0.02 1.12 $ 1.15 $ 1.17 $ $ 1.13 $ 1.16 $ Diluted Income per common share: Income from continuing operations Discontinued operations Diluted net income per common share 1.09 0.02 1.11 S 1.13 $ 1.16 $ Weighted average common shares outstanding - basic Weighted average common shares outstanding - diluted 177,938 180,156 181,429 183,835 194,351 196,237 Refer to Notes to Consolidated Financial Statements Consolidated Balance January 28 February 3, 2018 2017 $ $ In thousands, except per viure amounts Assets Current assets: Cash and cash equivalents Merchandise Inventory Accounts receivable, net Prepaid expenses and other Total current assets Property and equipment, net of accumulated depreciation Intangible assets, net of accumulated amortization Goodwill Deferred income taxes Other assets Total assets 413,613 398,213 78,304 78,400 968,530 724,239 46,666 15,070 9,344 52.464 1,816,313 378,613 358,446 86,634 77,536 901 229 707,797 49,373 14,887 49,250 60,124 1,782,660 $ $ $ 236,703 54,324 83,312 12,781 52,347 11,203 34,551 485,221 246,204 54,184 78,619 12,220 52,966 12,780 36,810 493,783 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued compensation and payroll taxes Accrued rent Accrued Income and other taxes Unredeemed gift cards and gift certificates Current portion of deferred loase credits Other liabilities and accrued expenses Total current liabilities Non-current liabilities: Deferred lease credits Non-current accrued income taxes Other non-current liabilities Total non-current liabilities Commitments and contingencies Stockholders' equity: Preferred stock, S0.01 par value: 5,000 shares authorized: none issued and outstanding Common stock, $0.01 par value; 600,000 shares authorized; 249,566 shares Issued: 177,316 and 181,886 shares outstanding, respectively Contributed capital Accumulated other comprehensive loss, net of tax Retained earnings Treasury stock, 72,250 and 67,680 shares, respectively, at cost Total stockholders' equity Total liabilities and stockholders' equity 47,977 7,269 29,055 84,301 45,114 4,537 34,657 84,308 2,498 593,770 (30,795) 1,883,592 (1,202,272) 1,246 791 1,816,313 2,496 603,890 (36,462) 1,775,775 (1,141,130 1,204,569 1,782,660 $ Refer to Notes to Consolidated Financial Statements Fiscal Year Ended 2017 2016 2015 2014 2013 (dollars in thousands, excluding net sales per press quare foot and pershare data) $ S 2,192,547 $ $ $ $ 2,350,129 $ 1,554,852 $ 795,277 $ $ $ 2,165,481 1,504,527 660,954 $ $ S $ 2,138,030 1,522,797 615,233 562,088 29,740 19,366 2,219,125 1,501,418 717,707 504,277 214,259 $ 1,529,343 663,204 559,541 103,601 57,417 $ $ $ 3 $ 587,747 $ 207,238 $ 116,513 $ 524,041 136,597 68,325 $ S $ $ $ 116,539 $ $ $ - $ $ $ 0.25 $ 0.73 $ 1.39 $ 0.81 $ 1.38 $ 0.25 $ $ 1.38 $ 0.81 $ 1.37 0.73 79,049 78,870 84,591 84,354 85,068 Statement of Operations Data: Net sales Cost of goods sold buying and occupancy costs Gross profit Selling, general, and administrative expenses Operating income Net income Dividenda declared per share Earnings per share: Basic Diluted Weighted Average Diluted Shares Outstanding Other Financial and Operating Data: Comparable sales Comparable sales (excluding e-commerce sales) Total gross square feet (in thousands) (average) Number of stores (at year end) Capital expenditures Balance Sheet Data (at period end): Cash and cash equivalents Working capital Total assets Total debt Total stockholders' equity (5)% (3% (109% 5,487 (9)% (12)% 5,604 6% 4% 3% (17% (7)% 5.573 5,529 5,439 635 656 653 641 632 108,368 57,435 98,712 S 115,343 S 115,088 $ S $ 207,373 $ 346,159 $ 236,222 38,050 1,187,607 186,903 $ 19,113 24,363 1,185,189 20,618 1,278,150 311,884 (27,630) 1,182,670 1,178,644 199,527 199,170 474,569 $ 654,000 $ 635,687 $ 617,953 $ 556,339 S XPRESS, INC ONSOLIDATED BALANCE SHEETS Amounts in Thousands, Except Per Share Amounts) February 3, 2018 January 28, 2017 $ SSETS URRENT ASSETS: Cash and cash equivalents Receivables, et Inventoles Prepaid minimum rent Other Total current assets 236,222 12,084 266,271 30,779 19,780 565,136 207,373 15,787 241,424 31,626 17,923 514,133 ROPERTY AND EQUIPMENT Les accumulated depreciation Property and equipment, niet 1,047,447 (642,434) 405,013 1,029,176 (577,890) 451,286 RADENAME/DOMAIN NAMES/TRADEMARKS EFERRED TAX ASSETS THER ASSETS Total assets 197,618 7,025 12,818 1,187,607 197,618 7,926 14.226 1,185,189 $ $ S LABILITIES AND STOCKHOLDERS' EQUITY URRENT LIABILITIES: Accounts payable Deferred revenue Accrued expenses Total current liabilities 145,589 28,920 116.355 290,864 172,668 29,428 80,301 282,397 EFERRED LEASE CREDITS JTHER LONG-TERM LIABILITIES Total liabilities 137,618 105,125 146,328 120,772 549,502 533,607 OMMITMENTS AND CONTINGENCIES (Note 13) 926 921 TOCKHOLDERS' EQUITY: Preferred stock - 50.01 par value; 10,000 share authorized; no share issued or outstanding Common stock - 50.01 par value: 500,000 shares authorized: 92,647 bars and 92,063 shoes issued at February 3, 2018 und Juary 28, 2017, respectively, and 76,724 shares and 78,422 shares outstanding at February 3, 2018 and Juary 28, 2017, respectively Additional paid-in capital Accumulated other comprehensive loss 199,099 185,097 (3,801) EXPRESS, INC. CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (Amounts in Thousands, Except Per Share Amounts) 2016 2015 2017 $ 2,350,129 2,138,030 2,192_5475 1,522,797 1,529343 1,554,852 615,233 663,204 795,277 NET SALES COST OF GOODS SOLD, BUYING AND OCCUPANCY COSYS Crosspolit OPERATING EXPENSES Selling. geral, and administrative expenses 562,088 559541 567,447 22,869 Restructuring costs 536 62 292 Other operating expense, nel 585,493 SRE,039 559,603 Total operating expenses 29,740 103,601 207,238 OPERATING INCOME 2,242 13,468 15,182 (484) 672 INTEREST EXPENSE, NET OTHER (INCOME) EXPENSE, NET (537) 190,684 28.035 90,617 INCOME BEFORE INCOME TAXRS 14,171 8,669 33,200 INCOME TAX EXPENSE 116,513 19,166 $ 574175 NET INCOME OTHER COMPREHENSIVE INCOME $ 1625 (160) 4,205 Foreign ceny translation gainos) Amount classified to carings COMPREHENSIVE INCOME 21.169 $ SR2795 114,905 EARNINCS PER SHARE: 1.39 5 0.25 0.73S 5 Bando $ 0.72 1.38 0.25 $ $ Diluted

American Eagle:

American Eagle:

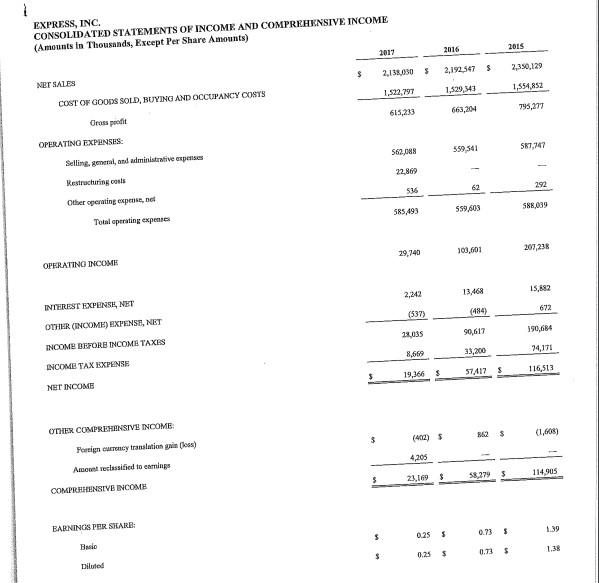

Express:

Express: