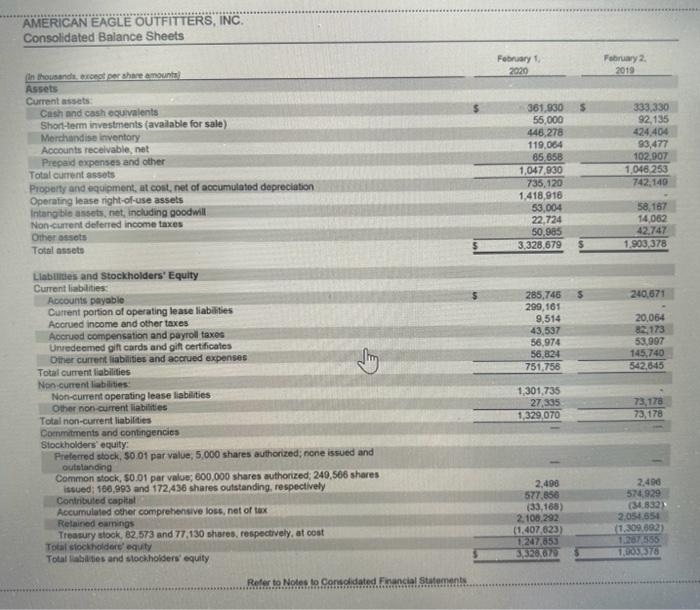

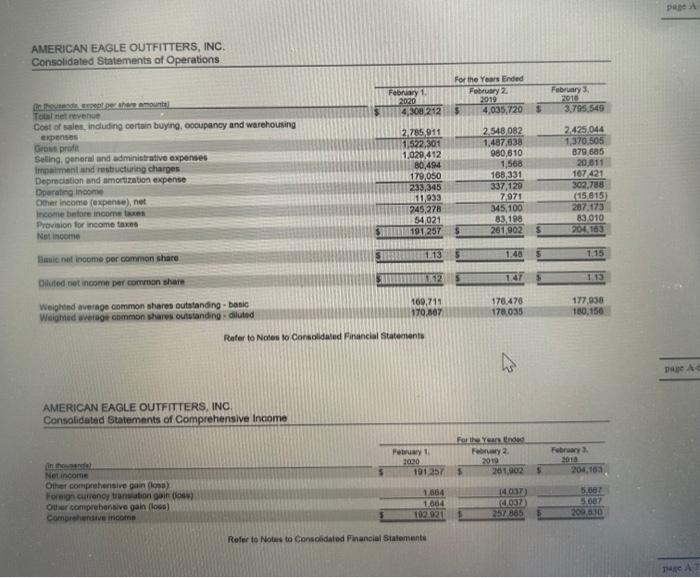

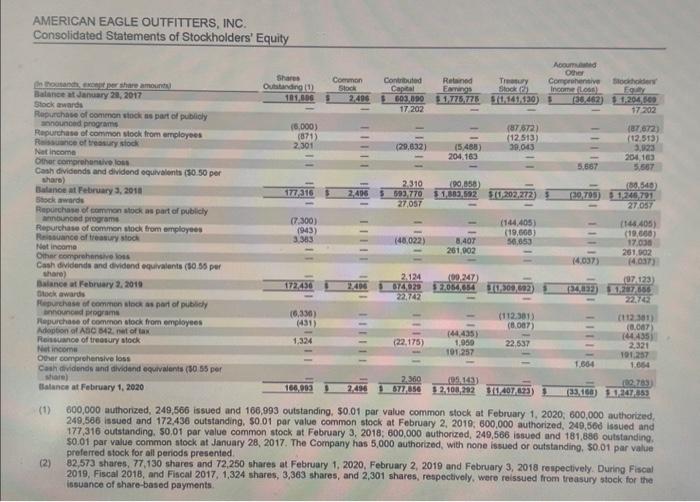

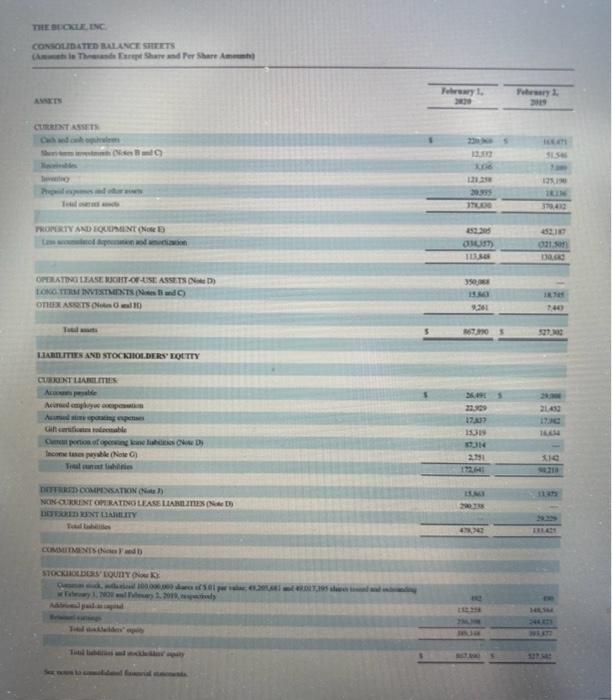

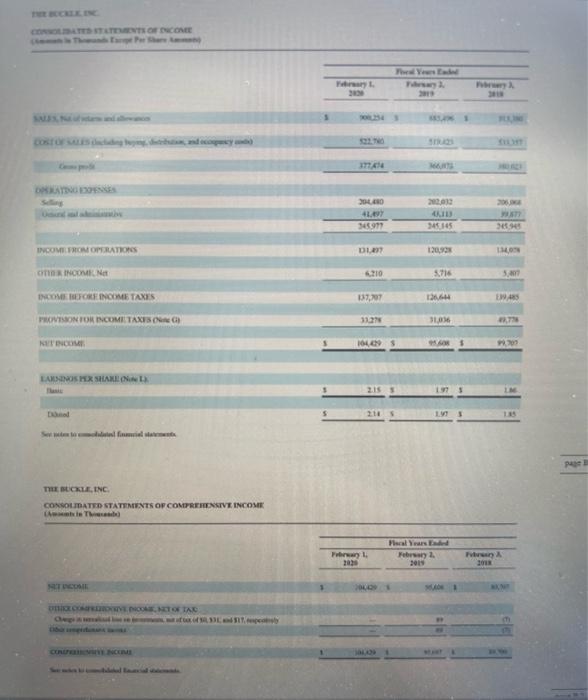

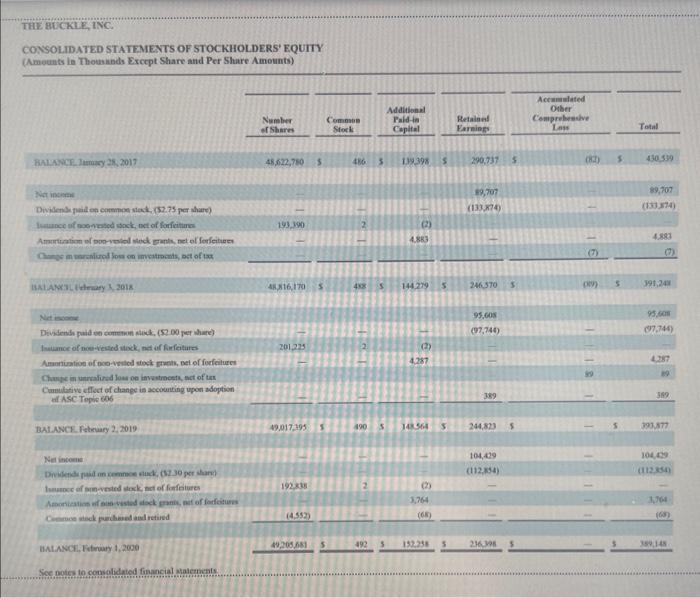

American Eagle Outfitters, Inc. vs. The Buckle, Inc. Comparatlve Analysis Continulng Case RWP3-4. Financial information for American Eagle is presented in G Appendix A at the end of the book, and financial information for Bnckle is presented in Appendix B at the end of the book. Required: 1. Determine which company maintains a higher ratio of current assets to total assets. How might this be an advantage for the company? 2. Determine which comupany maintains a ligher ratio of curreut liabilities to total liabilities. How might this be a disadvantage for the comitinn? 3. The dividend payout ratio equals dividends paid during the year divided by net income. Determine which company las a higher dividend payout ratio. Wliy might this be the case? AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets (n thousandi, brocost per shave amounts) Assets Current assets Cash and cash oquvalents Shontherm investments (avalable for sale) Wiorchandise itventory Accounts recelvable, net Total cument assets Proparty and equipment, at cost, net of accumulated depreciation Operating lease right-of-use assets Intang ble assets, net, including goodwill Non-current delerred income taxes Ohtier assets Total assets Llaburties and Stockholders' Equity Cument liablities: Accounts payable Cutrent portion of operating lease liabilities Accrued income and other taxes Accruod compensation and payroll taxes Unedeemed gif cards and gift certificales Other current fiabilities and accrued expenses Total current fiabilities Non-cument labilities: Non-current operating lease liabilies Othnr noricurrent liabisties Tolal non-current liabilties Cocnmitments and contingencies Slockholders' equity: Preferred stock, 50.01 par value, 5,000 shares authorized; none issued and outstanding Common stock, 50.01 par value; 600,000 shares authorized; 240,506 shares Contributed capitsl Accumulated other comprehensive loss, net of tax Retained camings Tressury stook, 82,573 and 77,130 shares, respectrvely, at oost Total slockholdere' equity Total labities and stockholders' equity Refer to Noles is Consolidated Financial Statements. Refer to Notes to Consoidated Financial Stalemunte AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Stockholders' Equity (1) 600,000 authorized, 249,566 issued and 166,993 outstanding, 50.01 par value common stock at Fobruary 1,2020 ; 600,000 authorized 249,586 issued and 172,436 outstanding, 50.01 par value common stock at February 2, 2019, 600,000 authorized, 249,560 issued and 177,316 outstanding, 50,01 par value common stock at February 3,2018;600,000 authorzed, 249,566 issued and 181,886 outstanding. 50.01 par value common atock at January 28, 2017. The Cornpany has 5,000 authorized, with none issued or outstanding, 50.01 par value preferred stock for all periods presented. (2) 82,573 shares, 77,130 shares and 72,250 shares at February 1, 2020, February 2, 2019 and February 3,2018 roapectively. During Fiscal 2019, Fiscal 2018, and Fiscal 2017, 1,324 shares, 3,363 shares, and 2,301 shares, respectivoly, were reissued from treasury stock for the issuance of share-besod payments Tht aticktritic: xverts ctoment assts C.KaNT 13hm rmes:- stockase bosy LoumY okse 8 : Tat stcatr, WNC. (Geaentrie Thesemete? THE 8CCKl INC. CONSOLID ATED STATEMENTS OF STOCKHOLDERS' EQUTY (Amounts in Thousinds Excopt Share and Per Share Ameunts) BALANC? Iamacy 2s,2017 48,622,760$4865193985290,7375 (BI) 5.430 .439 Wict intintae Dovidenbu fuill en cormmen sieat, (32.75 per ahare? lutunce of noonested sock, oxt of forficiture: IAkt.ANTLitraty 3, 2018 43x+6,170 i 488 is 144279 5 246370 i (an) 5(391,243 BAT.ANCL. Fithacy 2.2019 Net incene (4.552) (65) (63) BALANChifitruary 1,2000 4006,4815 4923 152385216395 Soe notes to comsolidntod financial katements