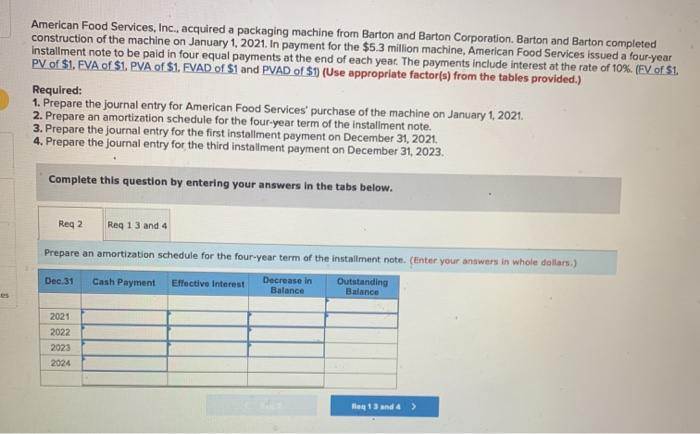

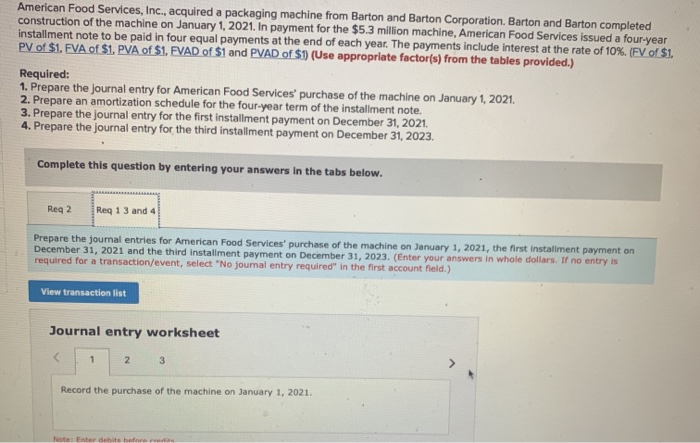

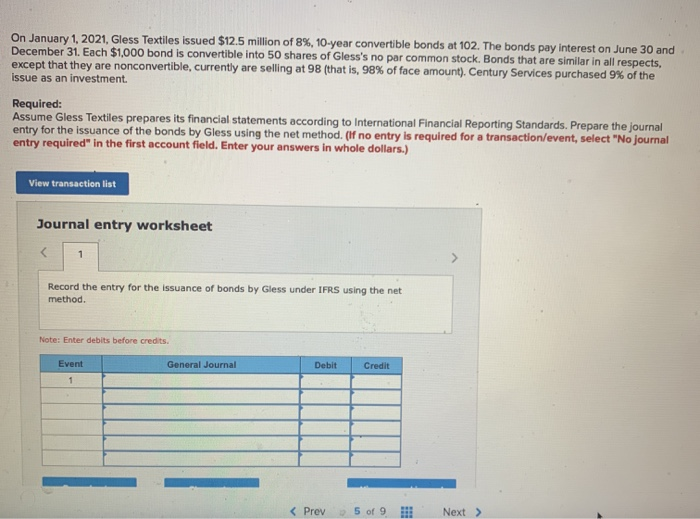

American Food Services, Inc., acquired a packaging machine from Barton and Barton Corporation. Barton and Barton completed construction of the machine on January 1, 2021. In payment for the $5.3 million machine, American Food Services issued a four-year installment note to be paid in four equal payments at the end of each year. The payments include interest at the rate of 10%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare the journal entry for American Food Services' purchase of the machine on January 1, 2021. 2. Prepare an amortization schedule for the four-year term of the installment note. 3. Prepare the journal entry for the first installment payment on December 31, 2021. 4. Prepare the journal entry for the third installment payment on December 31, 2023. Complete this question by entering your answers in the tabs below. Reg 2 Req 1 3 and 4 Prepare an amortization schedule for the four-year term of the installment note. (Enter your answers in whole dollars.) Dec.31 Cash Payment Effective Interest Decrease in Outstanding Balance Balance 2021 2022 2023 2024 Reg 13 and 4 > American Food Services, Inc., acquired a packaging machine from Barton and Barton Corporation. Barton and Barton completed construction of the machine on January 1, 2021. In payment for the $5.3 million machine, American Food Services issued a four-year installment note to be paid in four equal payments at the end of each year. The payments include interest at the rate of 10%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of S1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare the journal entry for American Food Services purchase of the machine on January 1, 2021. 2. Prepare an amortization schedule for the four-year term of the installment note. 3. Prepare the journal entry for the first installment payment on December 31, 2021. 4. Prepare the journal entry for the third installment payment on December 31, 2023. Complete this question by entering your answers in the tabs below. Reg 2 Req 1 3 and 4 Prepare the journal entries for American Food Services' purchase of the machine on January 1, 2021, the first installment payment on December 31, 2021 and the third installment payment on December 31, 2023. (Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 Record the purchase of the machine on January 1, 2021. Note Edi hafi On January 1, 2021, Gless Textiles issued $12.5 million of 8%, 10-year convertible bonds at 102. The bonds pay interest on June 30 and December 31. Each $1,000 bond is convertible into 50 shares of Gless's no par common stock. Bonds that are similar in all respects, except that they are nonconvertible, currently are selling at 98 (that is, 98% of face amount). Century Services purchased 9% of the issue as an investment Required: Assume Gless Textiles prepares its financial statements according to International Financial Reporting Standards. Prepare the journal entry for the issuance of the bonds by Gless using the net method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet Record the entry for the issuance of bonds by Gless under IFRS using the net method. Note: Enter debits before credits. Event General Journal Debit Credit 1