Answered step by step

Verified Expert Solution

Question

1 Approved Answer

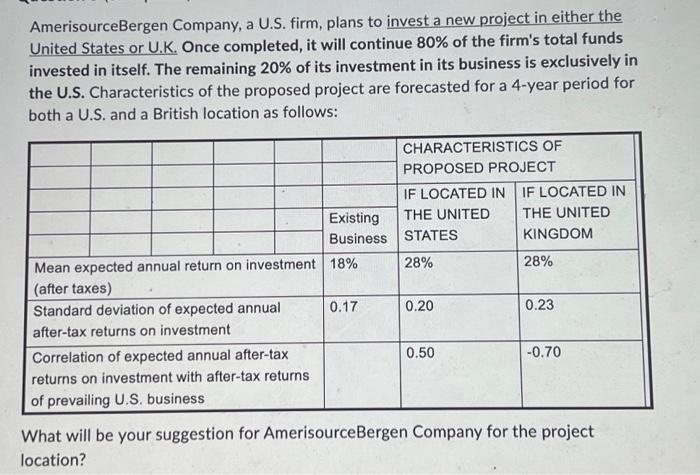

AmerisourceBergen Company, a U.S. firm, plans to invest a new project in either the United States or U.K. Once completed, it will continue 80% of

AmerisourceBergen Company, a U.S. firm, plans to invest a new project in either the United States or U.K. Once completed, it will continue 80% of the firm's total funds invested in itself. The remaining 20% of its investment in its business is exclusively in the U.S. Characteristics of the proposed project are forecasted for a 4-year period for both a U.S. and a British location as follows: Mean expected annual return on investment 18% (after taxes) Standard deviation of expected annual after-tax returns on investment Existing Business Correlation of expected annual after-tax returns on investment with after-tax returns of prevailing U.S. business 0.17 CHARACTERISTICS OF PROPOSED PROJECT IF LOCATED IN IF LOCATED IN THE UNITED THE UNITED STATES KINGDOM 28% 0.20 0.50 28% 0.23 -0.70 What will be your suggestion for AmerisourceBergen Company for the project location?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started